Table of Contents

Our Xm.com broker review described this famous forex broker’s basic features and offers. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders invest large amounts of money in forex trading. Therefore, they would like to determine the XM deposit and withdrawal methods to decide accordingly. One factor affecting the choice of deposit or withdrawal method is the country where the trader resides. Some payment/withdrawal methods are prevalent in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, and AUD.

XM Deposit and Withdrawal Methods

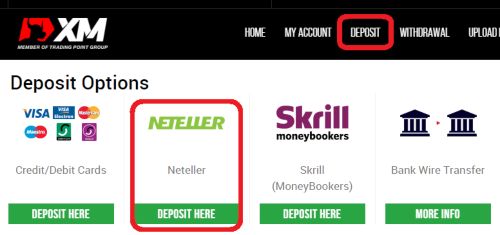

For traders, XM.com deposit and withdrawal methods are Credit card, Debit card, Neteller, Skrill, UnionPay, Web money, and Bank Wire. XM withdrawal options for XM partners are Skrill, Neteller, Sticpay, and Bank Wire.

XM deposit methods are:

- VISA

- VISA Electron

- Mastercard

- Maestro

- Diners Club International

- UnionPay

- XM Card

- Skrill

- Neteller

- Web Money

- Bank Wire

- Sticpay

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, and $ 10,000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000.

The minimum deposit value and minimum withdrawal value for the XM account are related to the order type, not the payment method. Skrill withdrawal is one of the most used payment methods, and the minimum deposit (and withdrawal, too) is based on account type.

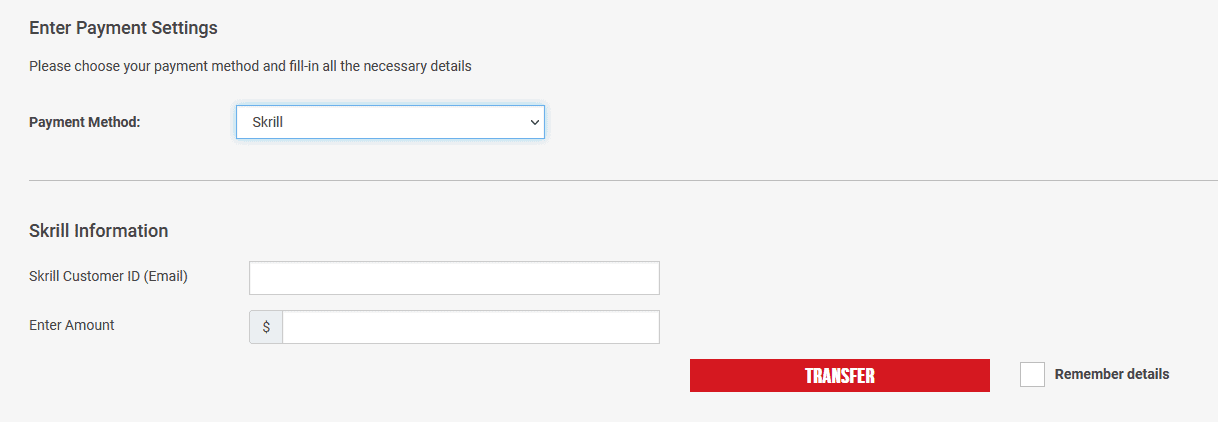

How do you deposit money on XM Broker?

- Login to the XM Member account.

- Select the deposit method, such as credit card, bank wire, or other wallet method.

- Type in the cell the deposit amount.

- Confirm the account number and deposit amount.

- Make payment.

XM deposit and withdrawal methods

How do you deposit the XM account? There are several XM deposit options:

- XM PayPal

XM Forex broker doesn’t accept PayPal as a deposit and withdrawal option.

- XM Credit/debit card

XM accepts deposits using credit and debit cards from Visa, Visa Electron, Mastercard, and Maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s Forex account. There are no fees for using this deposit method. This deposit method is widely preferred since most people have a debit or credit card. However, most credit and debit cards have a limit, so the amount deposited is also limited.

- XM Mastercard

XM Company offers XM Mastercard in dollars and euros. Traders can get XM MasterCard from this broker and use it at ATMs, stores, and online. In less than seven days, XM will send you a credit card, which you can use as a deposit and withdrawal option.

- XM Electronic payment: All electronic payment methods have no fees and a minimum deposit of $5. Neteller, Skrill, and Unionpay are some of the electronic payment methods. For Neteller and Skrill, the amount is immediately credited to the Forex account, while the deposit will be processed within 24 hours for Union pays. Cash only accepts USD deposits, and Przelewy24 accepts PLN deposits, and the amount is instantly credited to the Forex account. For Bitcoin, deposits in only three currencies, USD, EUR, and JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM Banking

For Sofort Banking, deposits are only accepted in Eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For a conventional Bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank which is used. The amount deposited in the bank account will be credited to the Forex account within two to five business days.

The trading bonus can be used only by non-European Union residents. Therefore, potential EU clients can not use forex or any CFD bonus. However, other broker promotions are usually available for all clients.

XM Withdrawal Review

If a user wishes to withdraw his money from the XM account, they will have to provide the Know Your Customer (KYC) documents, which are specified. According to the requirements of various regulatory bodies in different countries, these documents are necessary to prevent money laundering. In addition, XM has an online and offline form where the customer’s personal information and background details must be provided. This information will help XM in providing better service to their customers.

There are fewer withdrawal methods than deposits, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are proof of identity and proof of address of the trader. However, the amount will only be credited to the linked bank account after three to five business days.

XM Credit cards and electronic payment

Visa, Visa electron credit and debit cards, Maestro, and Mastercard credit cards can be used to withdraw funds. UnionPay is another option for fund withdrawal. Similarly, Skrill ( earlier called Moneybookers) and Neteller are electronic payment methods for fund withdrawal. Bitcoin can also be used to withdraw money in the XM account, though funds can only be removed in USD, EUR, and JPY. XM gives credit/debit cards top priority by XM, followed by Bitcoin withdrawals and Neteller/Skrill (e-wallet) withdrawals.

XM Bank wire transfer

XM money transfer via bank wire can be done using the following steps:

- Log in to the “Members Area”

- Go to “Deposit” and select the deposit method “Bank Wire.”

- The bank account details will appear.

Many forex traders trade large amounts and prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for withdrawing to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request. XM may process the bank withdrawal requests more slowly. The longest XM bank wire transfer withdrawal period was five days in my last eight years.

XM fees

XM fees for all deposit methods and most withdrawal methods do not exist. However, wire transfer withdrawal fees exist, which are different for each bank. Usually, the wire transfer withdrawal fee is between $20 and $30.

XM deposit request failed.

“XM deposit request failed” represents the XM.com error when the depositing transaction can not be realized. To solve this problem, check your internet connection or ensure you have enough money in your deposit option balance. If errors still exist, contact live support for help.

This error usually occurs when you pay using a credit or debit card and set the balance too high. Always set the balance a few dollars less than your card’s available balance.

XM Fund safety

To keep their client’s funds and forex traders safe, XM takes all measures to prevent unauthorized access to their information system. Clients’ funds are segregated and kept with the most reputed banks worldwide. Additionally, XM also offers negative balance protection to its clients. XM has implemented a risk management system, which means that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet lack the money to take the risk. However, getting forex trading experience is still possible without depositing.

XM No deposit bonus

To encourage people to become curious about forex trading, XM offers a $30 no-deposit bonus to those who create a new account with XM. This bonus allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM Demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. For each account made, the trader will be given $50,000 in virtual money, which he can use to trade, familiarize himself with the features, and test strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for an extended period, it will be deleted immediately.