Table of Contents

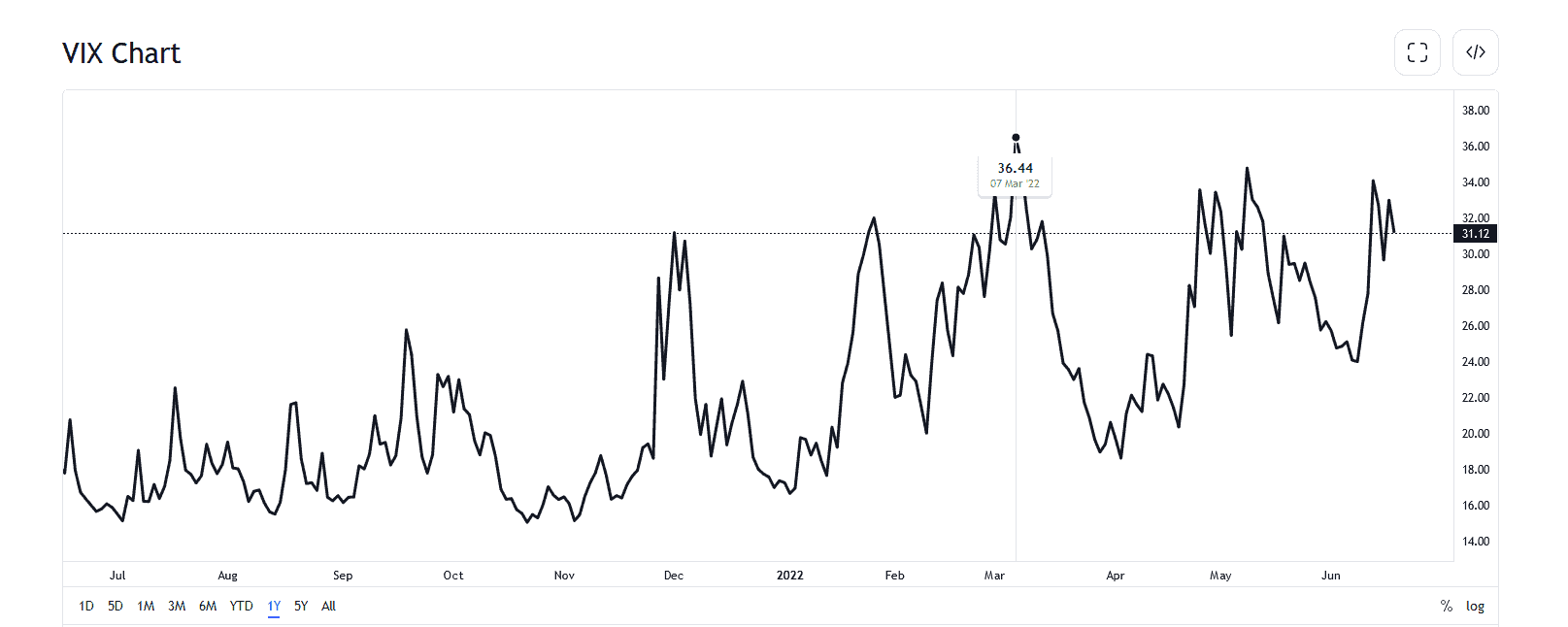

The Volatility Index (VIX), often called the market’s “fear gauge,” is a crucial indicator for traders and investors in understanding market sentiment. It measures the stock market’s expectation of volatility based on S&P 500 index options. A high VIX value indicates increased fear or uncertainty among investors, often coinciding with market downturns, while a low VIX suggests confidence and is typically seen in rising markets.

Interpreting Market Sentiment with the Put-Call Ratio

The Put-Call ratio (PCR) is another vital tool in assessing market mood. This ratio compares Put options or open interest volume against Call options. A PCR greater than one generally indicates a bearish market sentiment, suggesting that investors hedge against or bet on a market decline. Conversely, a PCR below 1 reflects a bullish bias, indicating that more traders are betting on a market rise. This ratio can effectively confirm or contrast the signals from the VIX, providing a more nuanced understanding of market sentiment.

Synergizing VIX and PCR for Market Analysis

Combining the VIX with the PCR can offer a more definitive picture of prevailing market conditions. For instance, a high VIX reading paired with a PCR below one could signal a bullish sentiment, potentially indicating a market rebound or resilience. In contrast, a low VIX reading alongside a PCR more significant than one might suggest that bears are gaining control, pointing to a possible market downturn.

The VXXB: A Tradable Reflection of Market Volatility

While the VIX itself is not directly tradable, the VXXB (S&P 500 VIX Short-Term Futures ETN) offers a way for investors to trade on volatility expectations. The VXXB tracks VIX futures, not the VIX index itself, and tends to move inversely to the stock market. When stocks decline, the VXXB usually rises, reflecting an increase in short-term volatility. This relationship makes the VXXB a valuable instrument for investors looking to capitalize on or hedge against market volatility.

The VXXB, or the S&P 500 VIX Short-Term Futures Exchange-Traded Note, is a pivotal financial instrument in market volatility. Unlike traditional stocks or ETFs, the VXXB operates as an Exchange-Traded Note (ETN), making it a unique vehicle for investors and traders. As an ETN, it represents an unsecured debt security issued by financial institutions, differentiating itself from ETFs, typically holding underlying assets.

Tracking Market Volatility

At its core, the VXXB is designed to track the S&P 500 VIX Short-Term Futures Index. This index measures the returns from a portfolio of monthly VIX futures contracts, explicitly focusing on the first and second-month contracts. These futures are rolled periodically, allowing the VXXB to maintain a consistent position relative to market volatility.

A Tool for Hedging and Speculation

The primary appeal of the VXXB lies in its ability to act as a hedge against market downturns. In times of increased market turbulence, the value of VXXB tends to rise, providing a counterbalance to declining stock prices. This feature makes it an attractive option for those looking to mitigate risk. Its sensitivity to market volatility also renders it a popular instrument among speculative traders who aim to capitalize on swift market movements.

Pricing Influences and Trading Considerations

A myriad of factors influence the value of VXXB. These include the current level of the VIX, prevailing conditions in the futures market, and the roll yield incurred from transitioning between futures contracts. This complex interplay of elements dictates the price movements of VXXB, making it a sophisticated tool for market participants.

Simplifying Exposure to Volatility

For investors seeking exposure to market volatility without delving into the complexities of futures trading, VXXB offers a streamlined alternative. It provides a more accessible avenue for engaging with volatility, bypassing the intricacies often associated with direct futures trading.

Suitability and Risks

However, the VXXB is not without its risks and caveats. Primarily suited for short-term trading strategies, it may not be the best fit for long-term investment plans. Investors need to be particularly cautious of periods characterized by low volatility, where the potential for significant losses is heightened. Additionally, the phenomenon of contango in the VIX futures market can adversely impact the performance of VXXB, a critical consideration for any potential investor.

VXXB’s Unique Behavior in Different Market Conditions

Interestingly, the VXXB often tends to overshoot the movements in VIX futures and, consequently, the broader market trends, particularly during bullish periods. This characteristic can be advantageous for traders who understand how to interpret these movements about the VIX and PCR. In times of market uncertainty, when forecasting the overall direction is challenging, tracking the VIX and the VXXB can reveal significant opportunities for capitalizing on market volatility.

Conclusion

Understanding the correlations and relationships between the VIX, PCR, and VXXB is crucial for traders and investors aiming to navigate market sentiment and volatility. Each of these indicators, alone and in combination, offers insights into the prevailing mood of the market, helping to inform investment decisions and risk management strategies. As the financial markets evolve, interpreting these correlations becomes ever more critical in pursuing successful trading and investment outcomes.