When it comes to saving for their retirement, people have several options. Two commonly compared options are the Roth TSP and the Roth IRA. Though they may sound similar, the two have some key differences.

Is Roth TSP the Same as Roth IRA?

No, ROTH TSP and Roth IRA are not the same investment opportunity. The major difference between a Roth TSP and a Roth IRA is that the Roth TSP is only available to federal employees and members of the uniformed services, while a Roth IRA is available to anyone with earned income up to a specific income limit. Additionally, the contribution limits and investment options differ between the two accounts.

Firstly, a Roth IRA is an individual retirement account funded directly by the account holder. The account holder can open and fund the account through a bank, brokerage, or other financial institution. The contributions to a Roth IRA are funded with after-tax dollars, and the account grows tax-free throughout the account’s lifetime. Once the account holder reaches retirement age and begins withdrawing funds, they will not be charged any taxes on those withdrawals, including earnings from the account.

On the other hand, the Roth TSP (Thrift Savings Plan) is the U.S. government’s version of a Roth 401(k). Contributions to the Roth TSP are made through payroll deductions, with money taken directly from the account holder’s paycheck before taxes are withheld. This means that the contributions are made with pre-tax dollars. However, once the account holder reaches retirement age and begins withdrawing funds, they will be taxed on both the contributions and the earnings.

One of the most significant differences between the two is the annual contribution limit. The IRS sets the limits for both accounts, which can change yearly. As of 2023, the contribution limit for a Roth IRA is $6,500 per year ($7,500 if the account holder is over 50). The limit for a Roth TSP is much higher – $22,500 per year.

Another difference between the two is the availability of the accounts. Roth IRAs are available to anyone with earned income, regardless of their employer. Anyone can open and contribute to a Roth IRA if they meet the earnings requirements. On the other hand, the Roth TSP is only available to federal employees and members of the uniformed services.

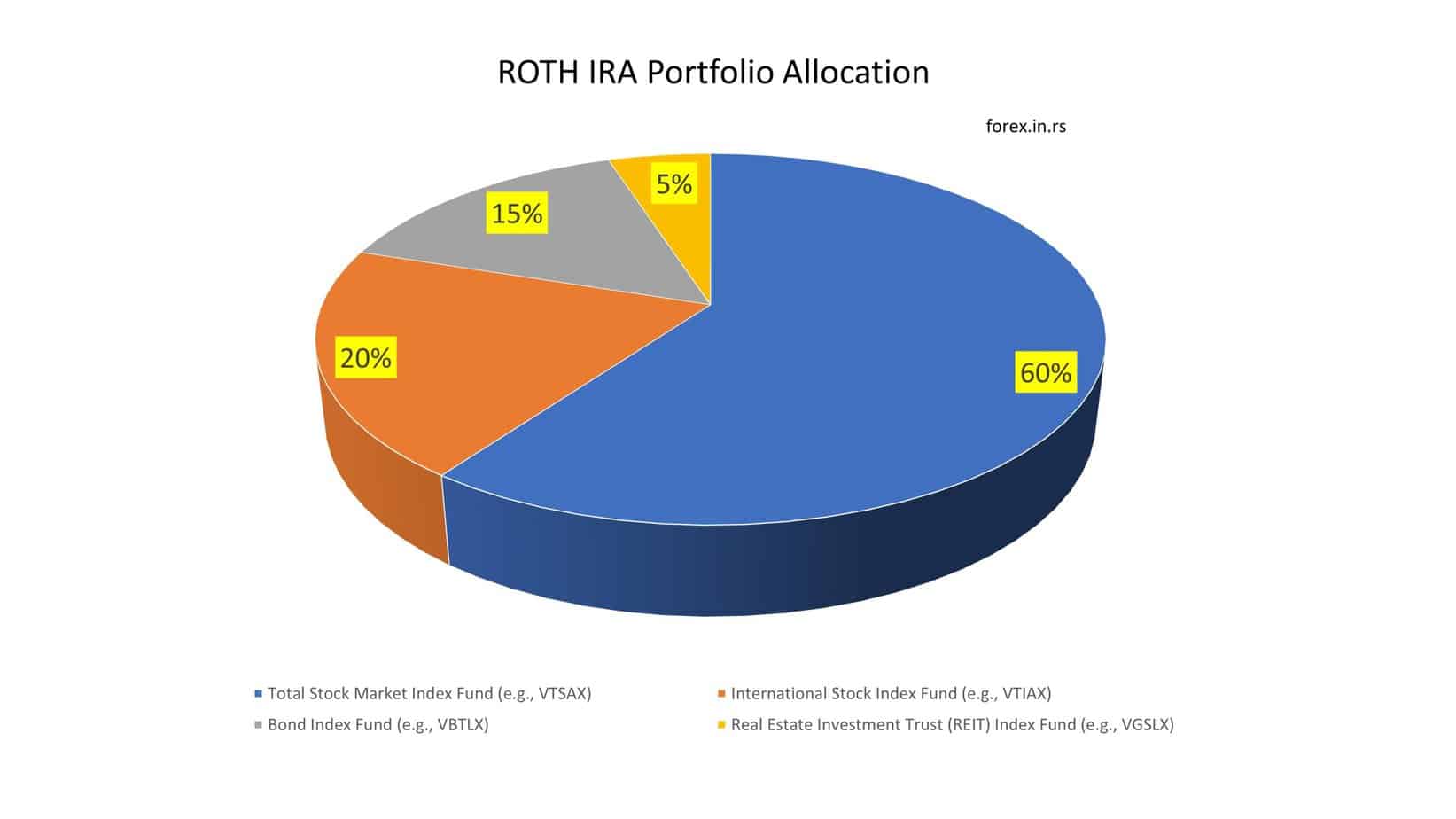

Regarding investment options, the Roth IRA offers more flexibility than the Roth TSP. With a Roth IRA, the account holder can invest in individual stocks, mutual funds, exchange-traded funds (ETFs), bonds, and more. On the other hand, the Roth TSP offers limited investment options, which the Thrift Savings Plan Investment Board manages.

Lastly, it’s worth noting that some unique features of the Roth TSP could make it an attractive investment option for some federal employees. For example, the Roth TSP has a unique “Roth matching” feature, allowing the employer to match the employee’s contributions. However, this is not a feature of the Roth IRA.

Roth TSP characteristics

- Offered through the federal government’s Thrift Savings Plan (TSP)

- Only available to federal employees and members of the uniformed services

- Contribution limits are much higher than a Roth IRA ($22,500 in 2023, with an additional $6,500 catch-up contribution for those 50 and over)

- Employer matching contributions can be made to a Roth TSP (although the matching contributions will be pre-tax and go into a traditional TSP account)

- Withdrawals are subject to the same rules as traditional TSP accounts (including required minimum distributions after age 72)

- There are limited investment options (only ten funds to choose from)

Roth IRA characteristics

- Offered through various financial institutions (banks, brokerages, etc.)

- Available to anyone with earned income up to a specific income limit

- Contribution limits are lower than a Roth TSP ($6,500 in 2023, with an additional $1,000 catch-up contribution for those 50 and over)

- No employer-matching contributions can be made to a Roth IRA

- Withdrawals are subject to different rules than a Roth TSP (no required minimum distributions, more flexible withdrawal options)

- There are many investment options available (depending on the financial institution)

In conclusion, while the Roth TSP and the Roth IRA offer tax-free growth of investments, they differ in their contribution limits, investment options, and availability. Ultimately, the best fit for your financial situation will depend on your circumstances, financial goals, and the investment you must make; it’s essential to consult with a financial advisor who can help you assess your options and make an informed decision.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE