Table of Contents

Every action reacts, and so is true even for the investment arena. Talking about macroeconomics here, the spending done by individuals affects the overall balance side of the economy.

Investment spending is an essential factor in the economic growth of a country. It is the money spent on new capital goods and assets, such as buildings, vehicles, machines, land, etc. Investment spending stimulates economic growth because it leads to more efficient production, which increases productivity and raises living standards. Calculating investment spending can help inform financial policy decisions and provide a better understanding of the economy’s performance.

What is investment spending?

Investment spending represents money spent on capital goods used to produce other goods, capital, or services. It is a way of increasing output by utilizing or purchasing capital goods. Investment spending may include buying machinery, inputs, infrastructure, land, etc.

Investment spending is a broad category that includes many different expenditures, such as purchases of new equipment or factories, additions to inventories, and investments in new housing. The critical feature of investment spending is that it represents a commitment of resources today to generate benefits in the future.

There are many different reasons why businesses might choose to invest in new equipment or facilities. One common motivation is to increase production capacity to meet expected future demand for the company’s products or services. Another is to improve efficiency and productivity by using newer or more advanced technology. And still another reason might be to take advantage of economies of scale – that is, by increasing the size of its operation, a business can lower its per-unit costs.

Whatever the specific reason for investing, businesses typically expect their investment expenditures to generate future economic benefits through higher sales revenues and lower costs. To continue our earlier example, a company might expect that its new production facility will enable it to sell more products or charge higher prices and that it will be able to produce its products at a lower cost per unit.

It should be noted that not all investment spending results in an increase in productive capacity. Some investments are made to replace worn-out or obsolete equipment. In such cases, there may not be any increase in output due to the acquisition; instead, the goal is to maintain existing production levels.

The expenditure done on capital equipment for economic activities is called investment spending. It is also written as S = I. The question now is what is the investment spending formula and how to calculate investment spending. Well, let’s get into it without any wait.

How to Calculate Investment Spending?

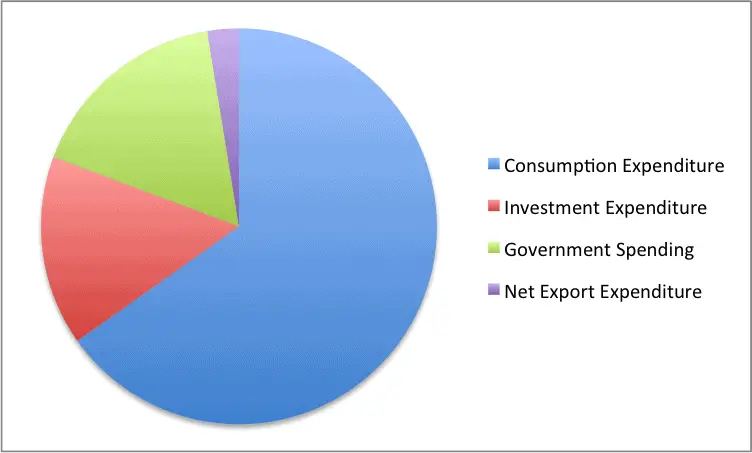

To calculate investment spending, you need to subtract from GDP consumption, investment, government spending, and net export. Therefore in macroeconomics, to calculate investment spending, you need to use the following investing spending formula:

Investment Spending (IS) = Gross Domestic Product (GDP) – Consumption (C) – Government Spending (G) – Net Exports (NX).

The formula for calculating investment spending is Gross Domestic Product (GDP) minus Consumption (C), Government Spending (G), and Net Exports (NX). GDP represents all final goods and services produced within an economy over a specific period. Consumption (C) is the total amount households spend on goods and services during a particular period; this does not include expenditures made by businesses or governments. Government Spending (G) refers to any expenditure that takes place as part of the activities carried out by government bodies. Finally, net exports (NX) represent the difference between countries’ total exports and imports over a given period; if exports exceed imports, NX will be positive.

By subtracting C, G, and NX from GDP, we are left with only investment expenditures, which gives us a better understanding of how much money is being used to acquire new capital goods and assets to increase economic productivity. This calculation also allows us to measure how these investments impact economic growth over time to make informed policy decisions.

In addition to calculating investment spending through GDP minus CGNX, economists may also use other measures such as gross national product (GNP) or gross national income (GNI). GNP measures the production of an economy’s citizens regardless of where they are located in the world, while GNI measures income earned by citizens irrespective of their location. By using one or both of these indicators alongside GDP minus CGNX, we can gain further insight into how much money is being spent on new capital goods and assets around the globe.

There are a few formulas that we need to know of before knowing the formula of investment spending. The first one is the formula of the Gross Domestic Product (GDP).

Using the investment spending formula, economists usually calculate the GDP

The investing spending formula can be calculated using the Gross Domestic Product (GDP) formula, where total output equals the sum of the consumption, investment, government spending, and net exports.

GDP = C + IS + G + NX.

NX = X – M

Example of Investment Spending Formula

A country’s GDP is $20,000 billion; tax is 2,000 billion; government spending is 5,000 billion; and consumption is 6,000 billion. Find Investment Spending.

Investment Spending (IS) = Gross Domestic Product (GDP) – Consumption (C) – Government Spending (G) – Net Exports (NX).

IS = 20,000 – 6,000 – 5,000

IS = 9,000 billion

Conclusion

In my opinion, you as a forex trader should know basic knowledge about investment spending because investment spending and GDP calculation are essential as one of the best fundamental indicators of a country’s economic health.

Calculating investment spending can help us understand how productive investments impact economic growth over time. By breaking GDP down into its components, we can gain insight into what kind of investments are taking place and identify areas that need additional attention or support to improve existing conditions. By studying investment spending trends across countries, we can better grasp international trade patterns and identify potential opportunities for collaboration among nations that could lead to stronger global economies overall.