Table of Contents

Long-term investors often analyze currency pairs’ positions, net long or net short positions, looking for market reversal or trend continuation.

One of the reports that professional traders use is the COT report. The COT report shows how committed the large institutional traders are and presents long or short positions for each currency pair or other asset.

Please read all info and instructions in my video from the Fxigor youtube channel:

What is the COT report?

The COT report, or the Commitments of Traders report, represents a weekly report published by the U.S. Commodity Futures Trading Commission (CFTC) that provides valuable information about the positions held by various traders in the futures markets. The report is based on data collected from futures contracts traded on regulated exchanges in the United States.

You can download the COT reports on the CFTC website.

The COT report offers insights into the trading activities and sentiments of three main groups of traders:

- Commercial Traders: These traders use futures contracts to hedge their commercial activities. They are typically involved in producing, processing, or using the underlying commodity. Commercial traders often have in-depth knowledge and experience in the specific market, and their positions can provide insights into fundamental supply and demand factors.

- Non-Commercial Traders: Also known as speculative traders or large speculators, this group includes hedge funds, investment firms, and individual traders who enter futures positions for speculative purposes. Non-commercial traders often have significant trading capital, and their roles can reflect market sentiment and trends.

- Non-Reportable Traders: This category comprises small traders or traders whose positions do not meet the reporting thresholds set by the CFTC. Their positions are aggregated together and reported as a single group.

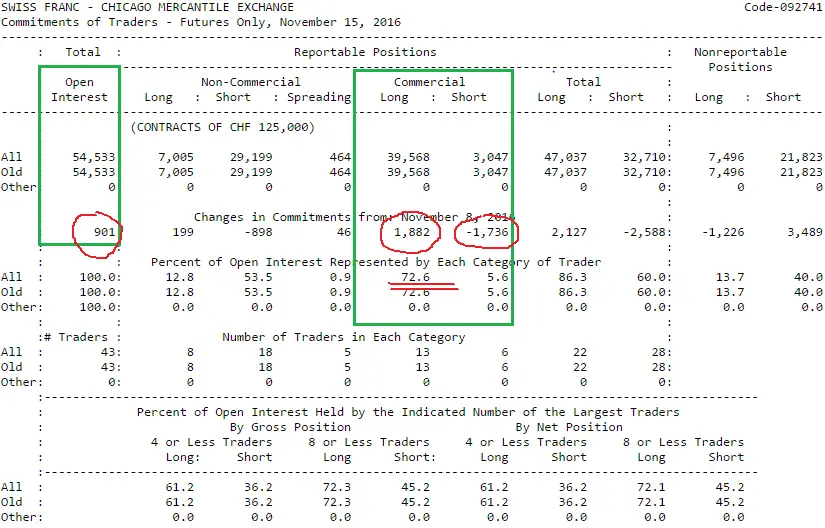

The COT report provides the following information for each category of traders:

- Open interest: The total number of outstanding contracts held by each group.

- Long positions: The number of contracts held by traders who have a bullish outlook and expect prices to rise.

- Short positions: The number of contracts held by traders who have a bearish outlook and expect prices to fall.

- Changes in positions: The net changes in long and short positions compared to the previous report.

The COT details open interest for each commodity on the market, explicitly containing 20 or more traders. This report’s primary purpose is to provide traders transparency regarding available interests in various markets effectively. This report is also used to determine the size of particular positions for different groups of traders. This report also provides the total number of open interests for each day. This is very helpful for traders because this information is critical to continue with investments. This source type is highly reliable for getting insight into all the different types of trades and how this can increase or decrease over time.

But when is the earnings report for COT:

When is the COT report released?

The COT report is released every Friday at 3:30 p.m. Eastern time. However, the data within COT reports reflect positions as of the previous Tuesday. This lag allows for proper compilation and analysis before dissemination to the public.

How to use the COT report in forex trading?

COT report should be used for swing or long-term position trades in forex trading, analyzing Commercial Traders’ (big institutional traders) behavior. We should expect a market reversal when the spread between commercial traders and large investors is big. When large traders start to reverse their positions (i.e., prominent large investor’s line’s trend starts reversing), we can expect a market reversal most of the time.

Using the COT report in forex trading can provide insights into market sentiment and potential reversals. Here’s a general approach to incorporating the COT report into your analysis:

- Identify the Commercial Traders’ Behavior: Focus on Commercial Traders’ positions, as they often represent large institutional traders with significant market knowledge. Analyze their net positions, particularly the spread between Commercial Traders and other large investors (such as non-commercial traders).

- Assess Extreme Positions: Look for instances where the spread between Commercial Traders and large investors is large, indicating a potential market reversal. Extreme divergences between these groups can signal a change in market sentiment and suggest an impending reversal. Pay attention to the net position changes of Commercial Traders.

- Monitor Reversal Signals: Keep an eye on the trend of the large investor’s line in the COT report. When large traders start reversing their positions, it may indicate an upcoming market reversal. So look for a shift in the large investor’s line trend as a potential signal for a change in market direction.

- Combine with Other Analysis: While the COT report can provide valuable insights, it should be used with other technical and fundamental analysis tools. For example, consider incorporating other indicators, chart patterns, support/resistance levels, and economic news to validate and strengthen your trading decisions.

- Determine Trading Strategy: Based on your analysis of the COT report and other factors, develop a strategy that aligns with your risk tolerance and trading style. For example, this could involve taking swing or long-term position trades based on the expected market reversals indicated by the COT report.

- Risk Management: Implement proper risk management techniques, such as setting stop-loss orders and managing position sizes, to protect your capital if the market moves against your anticipated reversal.

How to Read the COT Report?

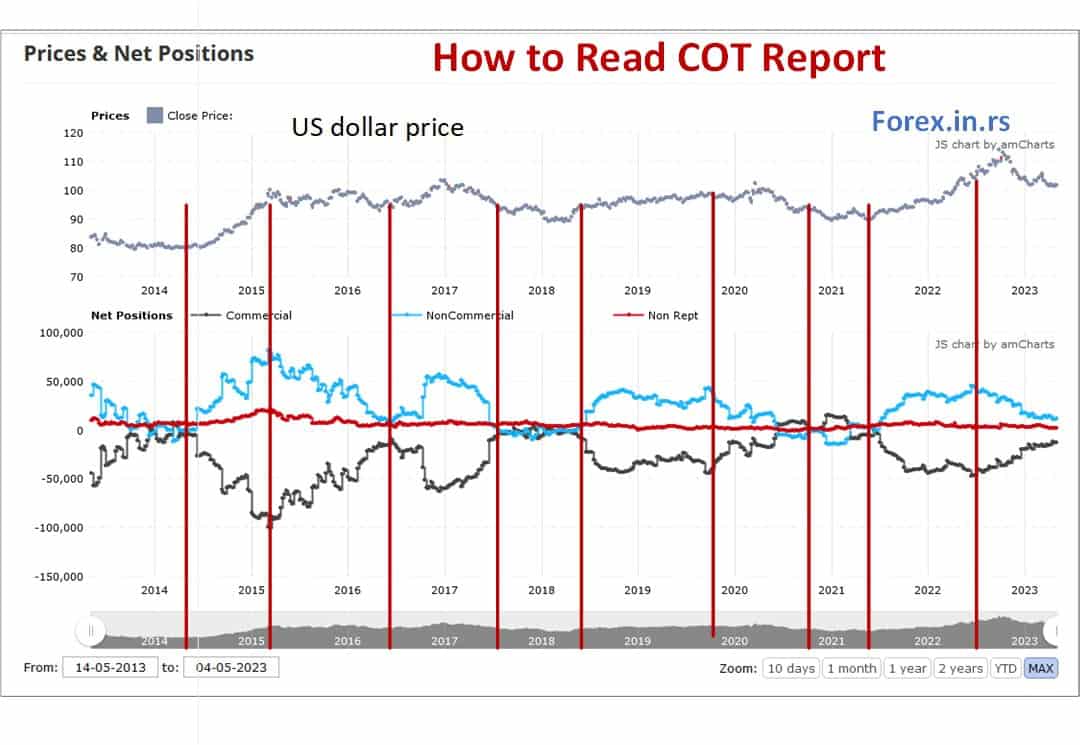

You can read and analyze the COT report by looking for the maximum or minimum difference between Commercial Traders’ and Non-Commercial Traders’ position values. Usually, when values are too close or at a maximum distance, asset price trends will change (reverse) drastically in the long run.

In my personal opinion, the best way to use the COT report is to try to predict the subsequent reversal based on the COT report chart. For example, you can see in the image above how the US dollar price change after the extremum position difference between Non-commercial and Commercial values. After the red vertical line, you can see on the chart how the price of the US dollar changes in the opposite direction!

Download the COT report from the CFTC website. You will see that the report presents data in a tabular format, including the number of long contracts, short contracts, and open interest for each trader category. It also includes net position changes from the previous report.

You can read the COT report and analyze pieces of information:

- First, analyze Net Positions in COT Report: Focus on the net positions of Commercial and Non-Commercial Traders, as these groups often indicate market sentiment. The net position is calculated by subtracting short contracts from long contracts. Favorable net positions indicate a bullish sentiment, while negative net positions suggest a bearish sentiment.

- Monitor Changes in Positions: Look for changes in net positions compared to the previous report. Significant changes can provide insights into shifts in market sentiment and potential price reversals. In addition, please pay attention to the net position changes of Commercial Traders, as they are often considered more informed market participants.

- Compare Commercial and Non-Commercial Positions: Assess the spread or difference between the net positions of Commercial and Non-Commercial Traders. Significant divergences can signal potential market reversals. Conversely, when the spread is large, it suggests a disagreement between these two groups, indicating a possible shift in market direction.

- Consider Historical Context: Analyze the COT report data within a historical context to identify patterns and trends. For example, look for instances where extreme net positions or large spreads have preceded market reversals in the past.

- Combine with Other Analysis: Use the COT report with other technical and fundamental analysis techniques. For example, consider incorporating chart patterns, support/resistance levels, indicators, and economic news to validate and strengthen your trading decisions.

How to Read the COT Report Practical Example

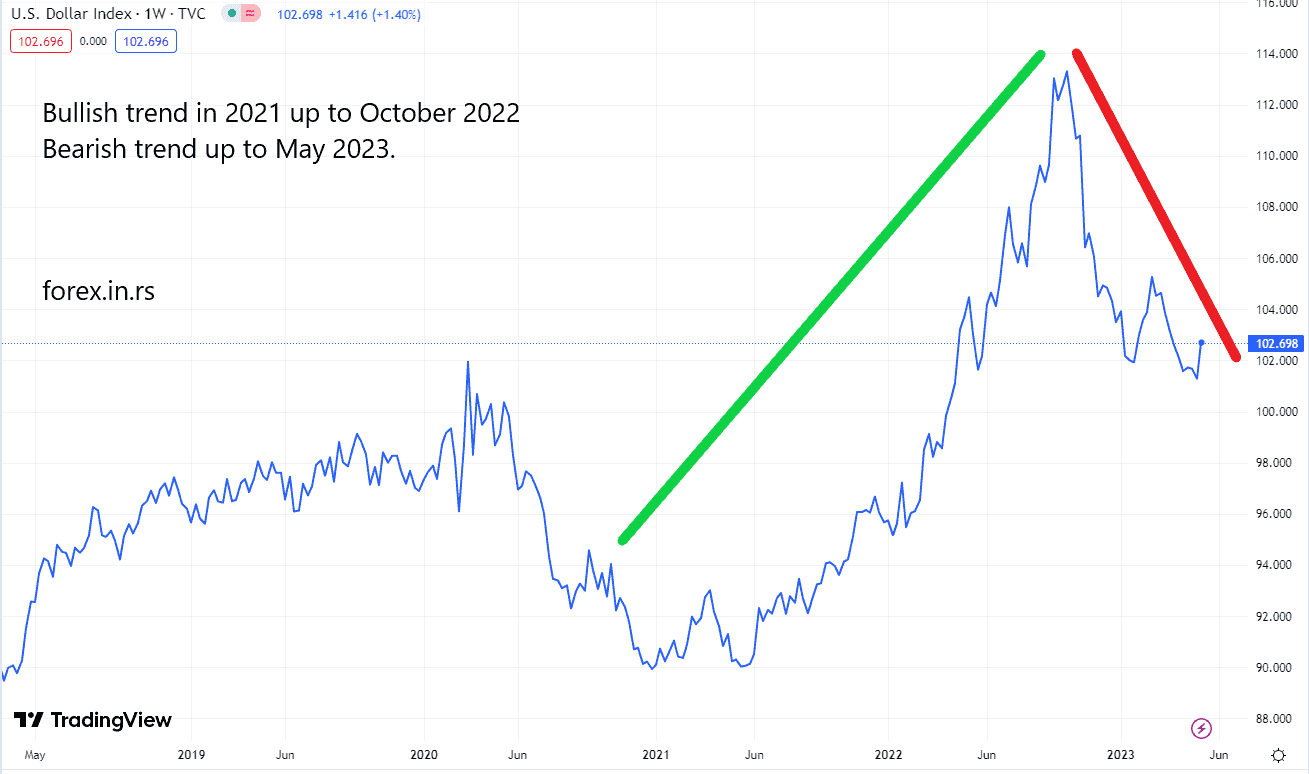

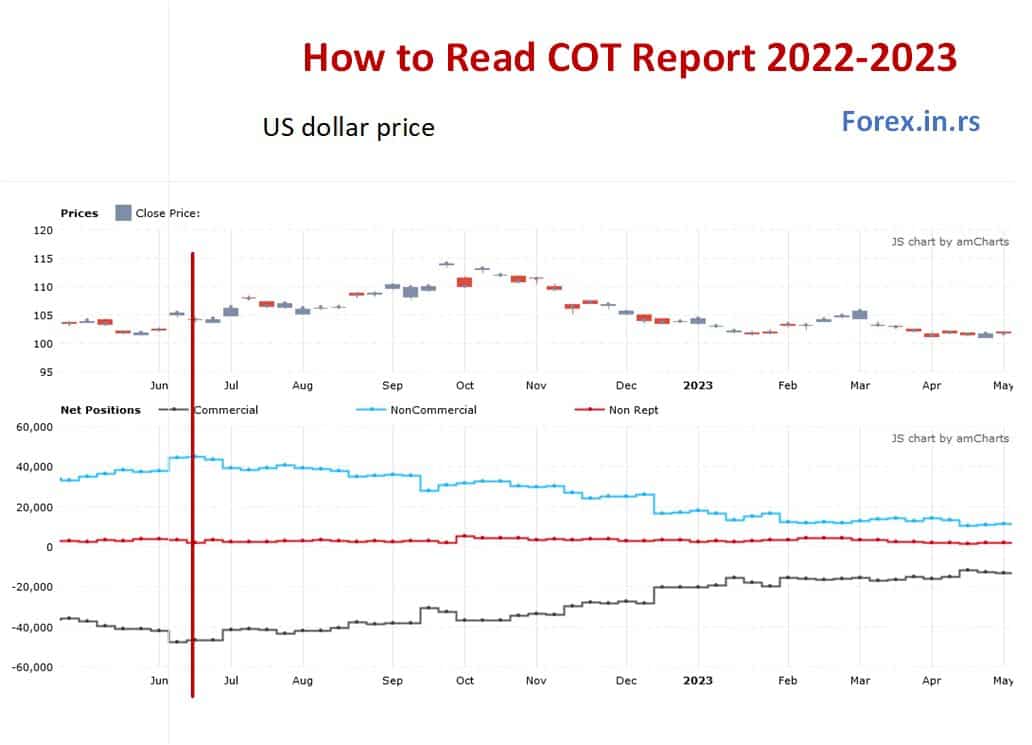

Below you can see one example of the US dollar in 2022-2023 and how the COT report sha ows a trend shift :

As we can see in COT Report on June 14. 2022, it was the most significant guest difference between values of Commercial and Non-Commercial position values:

A couple of months later, the US dollar price started to decline. US dollar price declines from October 2022. and currently, in May 2023. the bearish trend is valid.

Therefore, the COT report can forecast trend reversal in the interval from 3-6 months. COT report you should not use to interpret next week’s results.

How to read the CFTC’s COT report?

To read the COT report from the CFTC website, please go to Go to www.CFTC.gov.In the next step, select “Market Reports,” then select “Commitments of Traders.” The next page will allow you to view the COT Reports and choose assets.

CFTC has a website with the latest COT reports available every Friday. Users visit the site to locate the reports and select a COT. Finding the COT reports on either website is easy. This offers a full range of benefits, such as market sectors, exchanges, past reports, and insight into position sizes. There are countless resources and help for analyzing and using COT reports. These reports can be used and applied every day in business and require little to no effort to find. The best way for traders to look for reports is to use the most effective method.

If traders want to learn more about COT reports’ benefits and the best ways to use them, they can network and build a group of ready and eager individuals to commit to resource trading. Therefore reading COT reports significantly benefits traders in understanding exactly where their best investments will be. COT reports help every trader in the industry regardless of size or purpose. Thspecialique trade instructions can be applied to ment markets for a successful outcome.

Of course, the COT report is not a very reliable tool. Therefore, we can not use it alone and decide on investment based on the COT report only—this report we need to use only in combination with other indicators.