Table of Contents

A brief overview of cross-commodity trading

We know many commodities are volatile assets but do you know about cross-commodity trading or cross-commodity hedging? If not, you will be requested to have a quick look at the following sections to know more about this topic. Alternatively, if you are already aware of cross-commodity trading, you can also check this article for in-depth details on this particular topic.

Cross commodity definition

Cross commodity hedging or cross hedging represents a risk trading strategy when a trader trades hedge positions on two positively correlated commodities (securities) with similar price movements. When a positive correlation shows that two commodities move in the same direction, such as gold and silver, Crude Oil and natural gas, etc., a trader can buy one commodity and sell another commodity to reduce risk.

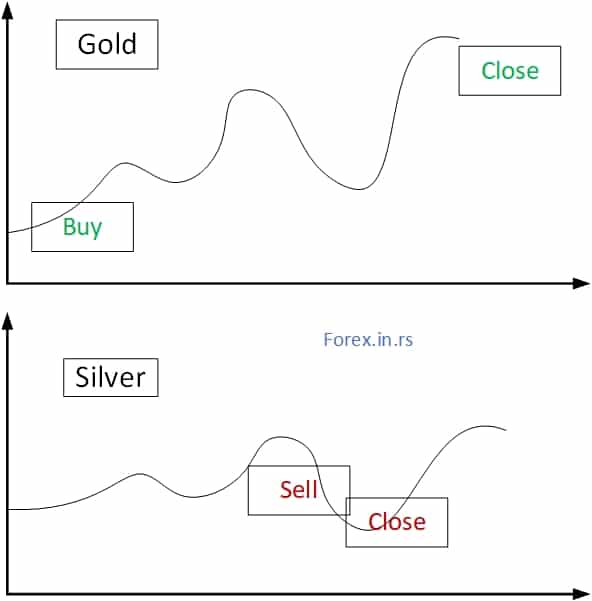

Cross commodity example 1:

Gold and silver are in the bullish trend. Gold is stronger in a bullish trend than silver. A trader buys Gold and holds positions for several days. In one moment, there are corrections in price, and the trend is changing. Gold and silver price decline and trader instead to close Gold BUY position he adds one SELL position (small size position) for silver. After a few days, when correction is finished, the trader closes the SELL silver position with profit and keeps the main BUY position for gold for several more days with excellent profit.

Cross commodity example 2:

Air travels: The application of cross-commodity trading is quite evident among commercial airline service providers. These commercial airlines are always active in developing and implementing cross hedge strategies to manage jet fuel pricing volatility and uncertainty. That’s why they oftentimes take opposing positions in correlated markets like heating oil and WTI crude oil.

Cross commodity example 3:

Sunflower oil: Sunflower oil producers also use cross hedge strategies to manage and mitigate risks. In most cases, they attempt to create a positive correlation between sunflower oil and soybean oil. In this way, the producers manage to maintain the spot market value and pricing of sunflower oil.

Needless to say, cross-commodity hedging is quite popular among speculators and producers. It’s even considered to be an excellent financial strategy that’s used to manage and mitigate risk. This methodology is widely known for securing and protecting wealth from a sudden turndown asset value.

Know more about cross-commodity hedging

The concept of cross-commodity hedging is indeed extremely complicated. It’s nothing but an efficient and effective risk management strategy used in trading to give you a simple overview. Here, the traders need to take the opposing position among two or more positively correlated markets. Plus, while taking the opposing positions, the traders must ensure equal quantity and maturation dates for the assets. By making a clever and consistent correlation, the traders can ensure limited systemic exposure. As a result, they can protect the assets from a sudden and unfortunate turndown value. Sounds quite interesting. But, please keep in mind that it’s not that easy to find an effective cross-commodity hedging or trading strategy.

In fact, it’s both tricky and challenging to find an appropriate cross-commodity hedging-based risk management strategy by creating a good amount of correlation between assets. Creating a perfect and consistent correlation between assets is a complex process due to multiple factors, such as frequent changes in asset values, nuance in creating a valid risk assessment and measurement, and much more. Nevertheless, if the traders can successfully develop a strong and consistent cross trading strategy, it can be a great way to reduce risk exposure.

Applications of cross-commodity hedging

In the above sections, you have revealed a basic overview of cross-commodity hedging. Let’s now quickly talk about the possible applications of this particular risk management strategy.

The final verdict:

Cross commodity trading is an excellent, potent, and meaningful way to limit downside exposure for assets. As you have already revealed before, cross-commodity hedging is primarily a risk management strategy. This success widely depends on how strong and consistent a correlation is established to mitigate the possible risks of downside exposure.