Table of Contents

Imagine you have a group of super-talented financial wizards who pool together money from various investors with one primary goal: to make more money. These wizards always seek unique and diverse ways to grow this pool, whether investing in stocks, bonds, real estate, or art!

Now, this isn’t magic—it’s called a hedge fund. It’s a bit like a mutual fund but with fewer rules on how they can play the game. They’re named “hedge” funds because they often try to “hedge” or protect against market downturns. So, in simple terms, hedge funds are just unique pots of money managed by experts aiming to achieve high returns using various clever strategies.

Are Hedge Funds Day Traders?

No, hedge funds are not day traders because 85% of all hedge fund trades are medium or long-term. However, rarely, hedge funds can trade day trading positions when that apply statistical arbitrage, high-frequency trading (HFT), news-based trading, Liquidity-Driven Trading, or Intraday Reversion Strategies.

Today, there is an increased number of hedge funds that apply complicated and various trading techniques. Every day, hedge funds apply not only macro long positions but also day trading positions.

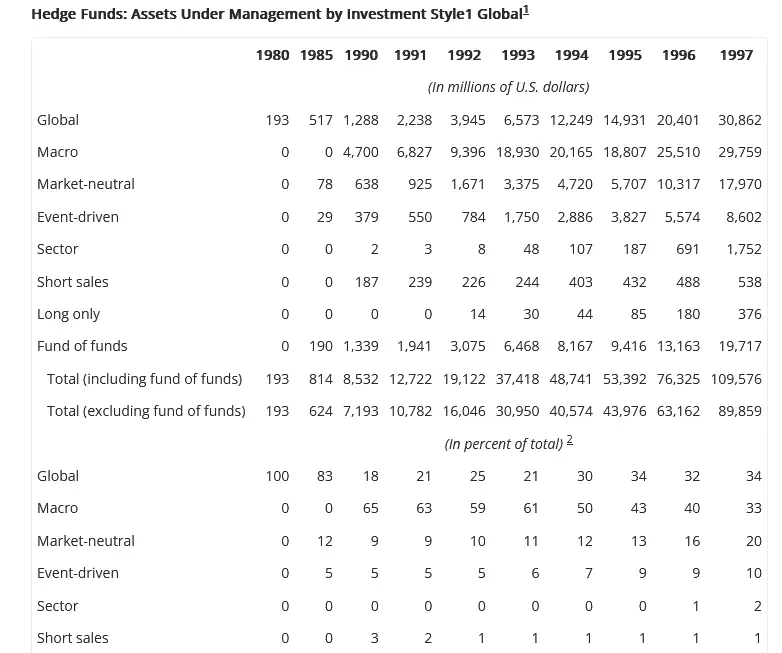

In the past, only 1% of all trades were day trading at hedge funds. Here are examples from the International Capital Markets book By a Staff Team from the International Monetary Fund:

Hedge funds employ various trading strategies depending on their objectives, risk tolerance, and market conditions. Some of the most common hedge fund strategies include:

- Long/Short Equity: This strategy involves taking long positions in stocks expected to increase in value and short positions in stocks expected to decrease in value. The degree to which these positions offset can vary.

- Market Neutral: Aimed at generating returns through stock selection while minimizing overall market risk. It seeks to offset losses in long positions with gains in short positions.

- Merger Arbitrage (Risk Arbitrage): Capitalizes on the price discrepancy between the current market price of a target company’s shares and the expected price after acquisition or merger.

- Event-Driven: Focuses on securities of companies undergoing significant corporate events such as mergers, spin-offs, or bankruptcy reorganizations.

- Macro: Bets on broad macroeconomic trends using futures, options, and spot contracts. This strategy might involve taking positions based on expected movements in interest rates, inflation, global economic events, etc.

- Fixed-Income Arbitrage: Seeks to exploit price anomalies between related interest rate securities.

- Convertible Arbitrage: Involves buying convertible securities (like convertible bonds) and shorting the same issuer’s common stock, betting on the convergence of their relative values.

- Distressed Securities: Investing in the securities (stocks, bonds) of companies facing bankruptcy or severe financial distress.

- Global Macro: Focuses on global macroeconomic trends and uses various instruments, including currencies, bonds, and commodities, to capitalize on them.

- Statistical Arbitrage: Employs quantitative models to identify short-term price discrepancies among related securities.

- Managed Futures (or CTA): Focuses on trading futures contracts in commodities, currencies, and other asset classes, often using trend-following strategies.

- Multi-Strategy: Utilizes multiple strategies simultaneously, providing the fund with greater diversification and the flexibility to allocate resources where the best return potential is seen.

- Volatility Arbitrage: Attempts to capitalize on the difference between implied volatility (typically of options) and a forecast of future realized volatility.

Long/short equity is an investment strategy where managers take long positions in stocks they expect to appreciate and short positions in stocks they expect to decline. This approach aims to capitalize on rising and falling markets, mitigating broad market risks and focusing on stock-specific gains.

Market neutral is an investment strategy that aims to achieve zero net-market exposure, meaning the total value of the short positions is equal to that of the long positions. As a result, the strategy’s performance relies solely on stock selection rather than market movements.

For instance, consider a scenario where a manager believes Apple will outperform the tech sector while Microsoft might underperform. They might buy shares of Apple and simultaneously short-sell shares of Microsoft, ensuring that the dollar amounts are equivalent. This way, even if the tech sector falls or rises, the performance difference between Apple and Microsoft will determine the portfolio’s return. Such strategies eliminate broad market risks, focusing on the relative performance of specific stocks. However, the trade-off is that the potential returns might be muted compared to strategies with net market exposure.

Merger arbitrage is an investment strategy where traders capitalize on the price discrepancies of merging companies’ stocks, buying shares in the target company while short-selling the acquiring company’s shares. The strategy aims to profit from the “spread” due to uncertainties around the merger’s completion.

For instance, if Company A announces its intention to buy Company B with a stock exchange ratio, and there’s a price difference (or spread) between the current value of Company B’s stock and the proposed merger value, arbitrageurs would buy Company B’s stock and short Company A’s stock based on the merger ratio. If the merger succeeds, the spread narrows, resulting in profit. However, if the merger fails or faces regulatory hurdles, the spread can widen, leading to potential losses, making this strategy both potentially rewarding and risky.

Hedge Funds news-based day trading

Some hedge funds use news-based trading as part of their strategies. News-based trading sometimes called event-driven trading, involves capitalizing on market inefficiencies that can arise immediately after major news events or announcements. This can include:

- Earnings Reports: Trading on the outcomes of a company’s quarterly or annual reports.

- Economic Data Releases: Actions based on macroeconomic data such as unemployment figures, interest rate decisions, or GDP growth.

- Mergers and Acquisitions (M&A) Announcements: Trading on the News of company takeovers, mergers, or other corporate restructurings.

- Regulatory News includes FDA approval for pharmaceuticals or other sector-specific regulatory decisions.

- Geopolitical Events: Developments such as elections, geopolitical tensions, or other major global events can impact markets.

- Other Corporate News: Product launches, leadership changes, legal decisions, and more can influence stock prices.

Hedge funds engaging in news-based trading often employ sophisticated algorithms and computer systems to scrape, process, and react to News faster than human traders. This rapid reaction can provide them with a competitive edge in the marketplace. Moreover, given the vast amounts of data available, quantitative techniques can predict how certain News will impact the markets, allowing these funds to position themselves advantageously ahead of the broader market’s reaction.

It’s essential, however, to differentiate between systematic news-based trading (which uses algorithms to trade on the News) and discretionary or qualitative news-based trading (where human judgment plays a significant role). Depending on their overall strategy and expertise, hedge funds might use one or both approaches.

Statistical arbitrage as Hedge Funds day trading strategy

Statistical arbitrage, often called “stat arb,” is a quantitatively driven trading strategy sometimes employed by hedge funds. While the exact techniques can vary among funds, here’s a general overview of how it works:

Foundations of the Strategy:

Statistical arbitrage operates on the idea that price discrepancies between related securities are temporary and will converge to a mean or a relative value over time. This could be between stocks, sectors, or other financial instruments. The key is to find pairs or groups of assets that have historically moved together.

Pair Trading:

One of the most straightforward forms of statistical arbitrage is pair trading. Imagine two companies in the same industry—Pepsi and Coca-Cola. If historically their stock prices have moved together, but suddenly Pepsi’s stock drops while Coca-Cola’s remains stable, a stat arb strategy would buy Pepsi (betting it will go up) and short-sell Coca-Cola (betting it will go down), anticipating a reversion to their historical price relationship.

Mathematical Models:

The heart of statistical arbitrage lies in sophisticated mathematical models. Hedge funds employ Ph. D.s in physics, mathematics, and computer science to develop these models. These models analyze vast amounts of data to identify temporary mispricings between securities.

Portfolio Diversification:

Instead of relying on a few pairs, hedge funds typically spread their bets across many different pairs or groups of assets. This diversification reduces the risk of any single pair not reverting to its mean.

Risk Management:

Even with sophisticated models, there’s no guarantee that prices will revert to their mean in the expected time frame (or at all). Therefore, robust risk management techniques are essential. These might include setting stop losses, dynamically adjusting portfolio weights, or even using machine learning techniques to adapt the strategy in real time.

Challenges and Limitations:

- Data Quality: The quality of the data is paramount. Erroneous data can lead to flawed trades.

- Model Risk: Even the best models can become obsolete as market conditions change.

- Competition: As more funds employ similar strategies, the arbitrage opportunities can diminish, reducing returns.

Leverage:

Given that mispricings between assets can be small, hedge funds often use leverage to amplify returns. However, this also amplifies the risk.

In conclusion, statistical arbitrage is a complex, quant-driven strategy that seeks to exploit price discrepancies between related assets. While it can be highly profitable, it requires sophisticated models, rapid execution, and stringent risk management to be executed successfully.

Liquidity-driven trading strategy as Hedge Funds Day Trading Strategy

Liquidity-driven trading focuses on capitalizing on price movements resulting from the market’s liquidity dynamics rather than the assets’ underlying fundamentals. When hedge funds employ this as a day trading strategy, they try to profit from short-term price changes stemming from market liquidity imbalances. Let’s delve into how this could work in detail:

Understanding Liquidity

Liquidity refers to the ease with which an asset can be quickly bought or sold without causing significant price changes. Highly liquid markets have tight bid-ask spreads and substantial trading volumes, while illiquid markets may have wider spreads and thin volumes.

Identifying Liquidity Mismatches

The crux of liquidity-driven trading is identifying a temporary liquidity mismatch. This could be due to:

- Large institutional order flows that can’t be absorbed immediately by the market.

- Market-opening or closing times, especially in markets with known liquidity issues during these periods.

- News events or data releases that lead to a sudden surge in trading volume.

Front-Running Large Orders

Hedge funds with sophisticated algorithms can detect large orders coming into the market. By anticipating the market impact of these orders, a fund can trade ahead of them. For example, if a big buy order is detected, a liquidity-driven strategy might buy the asset first, then sell it at a higher price once the large order has pushed the price up.

Exploiting Price Gaps

Even small orders can lead to significant price changes when liquidity dries up. A liquidity-driven trader might anticipate these price jumps and trade accordingly. This is especially prevalent during market openings or sudden news events.

Each market and asset class has its unique microstructure. By understanding these intricacies, traders can anticipate how liquidity will change throughout the day and execute trades that capitalize on these expected changes.

Risk Management

Liquidity-driven day trading is not without its risks. Prices can move against the trader, or anticipated liquidity events might not materialize. It’s crucial to have stop-loss measures and monitor market conditions constantly.

Costs:

Given that this strategy might involve a high number of trades, transaction costs can eat into profits. Efficient execution and minimizing slippage are vital.

Challenges

Competing with other professional traders and algorithms is a significant challenge in liquidity-driven trading. The advantages can diminish as more traders try to exploit the same opportunities.

In essence, liquidity-driven trading as a day trading strategy revolves around exploiting short-term price changes resulting from liquidity imbalances. It requires a deep understanding of market microstructure, quick execution, and vigilant risk management.

Additional Short time trading Strategies for Hedge Funds

The duration of investments can be categorized as short, medium, or long-term based on the expected time horizon for holding the investment. Let’s break down the mentioned investment opportunities in terms of these durations:

- Capital-raising events:

- Short to Medium: Capital-raising events can often be short to medium-term investments. Investors may put capital into a company expecting a relatively quick return on investment, especially if the company plans to use the raised funds for a specific project or expansion. However, the exact duration might depend on the specific terms and objectives of the capital-raising event.

- IPOs (Initial Public Offerings):

- Short: Some investors engage in “flipping” IPOs, where they purchase shares at the IPO price and sell them shortly after trading begins, hoping to capitalize on an immediate price jump.

- Medium to Long: On the other hand, some investors might see an IPO as an opportunity to buy into a promising company early, with plans to hold onto their shares for an extended period, expecting the company to grow substantially.

- Follow-on Secondary Offerings:

- Short to Medium: Investors might take advantage of secondary offerings to get a position in a company at a potentially discounted price. This could be a short- to medium-term investment, depending on the reasons for the secondary offering and the company’s prospects.

- Purchasing cheaply priced warrants:

- Medium: Warrants give the holder the right to purchase shares at a specific price before expiration. They can be medium-term investments as investors may hold onto them until they are in the money or close to their expiration date to capitalize on the difference between the share and exercise prices.

- Long: In some cases, if the warrant has an extended expiration date and the investor believes in the long-term prospects of the underlying company, this can become a long-term investment.

In general, the specific duration of these investments can vary based on the investor’s strategy, risk tolerance, and the individual circumstances of the investment opportunity.

Conclusion

Hedge funds, in their essence, are not synonymous with day traders as a vast majority, around 85%, of their trades focus on medium or long-term horizons.

However, there are instances when hedge funds dip into day trading, significantly when leveraging strategies like statistical arbitrage, high-frequency trading (HFT), news-based trading, liquidity-driven trading, or intraday reversion strategies. It’s essential to differentiate between hedge funds’ primary investment approach and their diverse strategies. While day trading can be a part of their toolkit, it does not define the overarching character of hedge fund operations.

Investment-style hedge funds rarely use day trading strategies!