Table of Contents

Knowing how long it’ll take to double your money is a simple way to see how much you can make when you start investing. According to common belief, you may double your money using mutual funds in just seven years. Is that correct? The average return on mutual funds doubles every seven years. The Rule of 72 states that an investment’s value doubles every seven years if its return is at least 10.4%. It is true for most mutual funds, whose average returns are more than 10.4%.

Investing in mutual funds is like owning shares in a corporation. In a way, this dual nature is not unlike how AAPL shares reflect Apple Inc. It may seem unusual at first. It is a kind of ownership interest in the firm and its assets that an investor acquires when purchasing Apple shares. When you invest in a mutual fund, you become part of the firm and its assets. Apple’s focus on product innovation and tablet development makes it different from a mutual fund firm. This post will acknowledge everything related to mutual funds doubling every 7 years.

What is a mutual fund?

A Mutual Fund represents a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. A mutual fund is a professionally managed investment fund where the investors share profit.

A mutual fund is a type of investment vehicle that allows individual investors to pool their money and invest in various securities, such as stocks, bonds, and short-term debt. This will enable investors to access a greater diversity of investments than they might achieve, helping them earn higher returns with lower risks. In addition, many mutual funds offer a range of features that can make investing more straightforward and more convenient for investors, including automatic contributions and the ability to set specific parameters for how your money is invested. As such, if you’re looking for an effective way to invest your money, a mutual fund may be just what you need.

As an investing strategy, mutual funds collect money from investors and invest it in various assets. Shares and money market instruments like certificates of deposit and bonds are the most common investments made using the funds raised from investors. Asset types include equity, debt, and money market instruments. Long-term, medium-term, or short-term goals can all be pursued with these investments. The potential risk of the funds is also determined by the type of asset they are invested in.

One of the main advantages of mutual funds is that you can earn more significant returns than other investment alternatives that guarantee a certain amount of money back. It is why mutual fund returns are related to the market’s performance. In other words, your fund’s value will reflect if the market is on a bull run and does exceptionally well. On the other hand, a lousy market performance might influence your investment returns. Mutual funds, unlike traditional investments, do not guarantee capital preservation—research and invest in funds that will allow you to achieve your financial objectives correctly.

What Are The Types Of Mutual Funds?

Mutual funds types are:

- Equity Funds

- Index Funds

- Income Funds

- Specialty Funds

- Balanced Funds.

At its most basic level, a mutual fund is simply an investment vehicle that allows individuals to pool their money together and invest in various assets. There are many different types of mutual funds available in the US, each with its characteristics and benefits. Common mutual fund types include equity, index, income, specialty, and balanced funds.

Equity funds are designed to focus on investments in stocks, which can be held for long-term growth or short-term trading purposes. These types of mutual funds typically seek to outperform the broader stock market and generate higher returns than more traditional investments like bonds or cash.

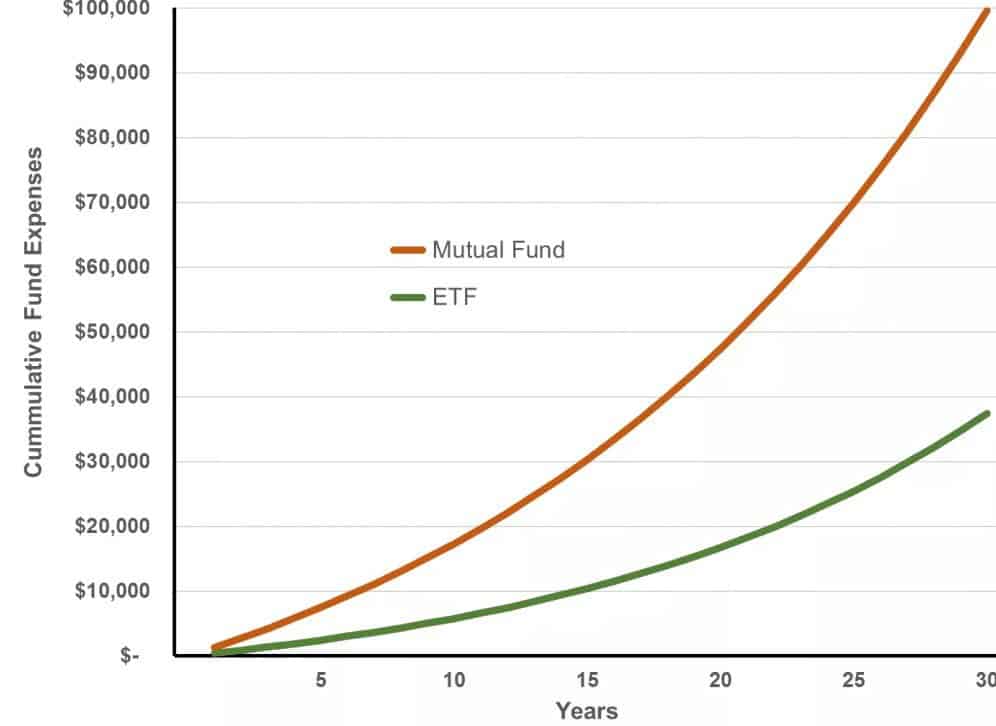

Index funds are another popular type of mutual fund that tracks a specific benchmark or index, such as the S&P 500 or Dow Jones Industrial Average. Unlike equity funds that actively trade stocks to outperform the market, index fund managers attempt to keep pace with their chosen benchmark. This typically leads to lower fees and more stable returns over the long term than equity fund performance.

Income funds are designed specifically for investors who need regular income from their investments. Still, they want to avoid taking on additional risk by investing directly in bonds or dividend-paying stocks. These mutual funds typically hold certificates of deposit (CDs) or other low-risk fixed-income investments and high-yielding dividend stocks. This combination can help investors generate steady cash flow without exposing them to unnecessary levels of risk in the markets.

Specialty mutual funds are often focused on narrow investment themes like technology start-ups or sustainable energy companies, giving them much greater flexibility than traditional equity and index fund strategies. While these themes may be very niche by nature, they can also lead to substantial profits for individual investors if they have good timing when buying into these companies at critical moments in their development cycle.

Finally, balanced mutual funds combine equities and fixed-income assets into a single portfolio strategy that seeks stable returns over time while managing the risk associated with investing only in stocks or bonds alone. This fund is beneficial for those looking for a mix between growth opportunities offered by equities and stability provided by fixed-income products like CDs and high-grade corporate bonds.

Common investments in money market funds include T-Bills, CPs, and other short-term, highly liquid securities. It’s a safe bet for individuals searching for immediate but modest returns on their extra cash. It’s important to note that money markets, also known as cash markets, have interest, reinvestment, and credit risks. Funds that invest in various asset types are known as “balanced” or “hybrid” funds. The equity-to-debt ratio might be more significant in certain circumstances than others. In this approach, risk and reward are equalized.

The mutual fund industry has become a vital component of the US financial landscape. As an investment vehicle, mutual funds offer many benefits to individual and institutional investors. Many US investors rely on mutual funds to help them achieve their financial goals, whether saving for retirement or building a solid portfolio for their children’s education.

One of the main appeals of mutual funds is their diversity and flexibility. Because they invest in a wide range of assets, mutual funds can offer exposure to different market segments and sectors, helping to diversify an investor’s portfolio. Furthermore, because they can be bought and sold at any time during trading hours on the stock exchange, mutual funds also provide investors with flexible investment options that allow them to adjust their holdings as their needs change over time.

In addition to these benefits, many US mutual funds also offer professional management, providing investors with access to the knowledge and expertise of skilled money managers with extensive experience investing in securities markets. This expertise can often help investors protect against risk, improve returns over time, and make more informed investment decisions.

Overall, a US mutual fund may be the right choice if you’re looking for a way to invest your money safely and effectively in pursuit of your financial goals.

Do mutual funds double every 7 years?

Yes, mutual funds can double every seven years if your mutual fund gives you an annual return of 10.4%. In the last 30 years, mutual funds, on average, compounded by 12% annually.

Every seven years, mutual funds that follow the Rule of 72 double their value, resulting in an annualized return of 10.4%. It can be a high rate, but historically, mutual funds have had better average returns. The S&P 500 has returned 11.64 percent on its investments since 1928. Many investors pool their money together to form mutual funds, which invest in various equities. As a result, the S&P 500’s annualized return is a reliable predictor of mutual fund performance.

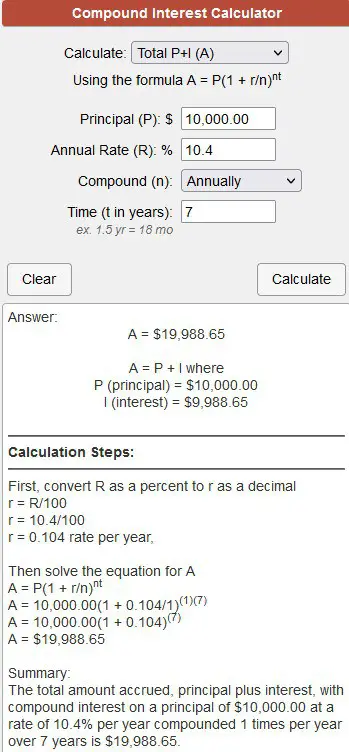

r = R/100

r = 10.4/100

r = 0.104 rates per year,

Then solve the equation for A

A = P(1 + r/n)nt

A = 10,000.00(1 + 0.104/1)(1)(7)

A = 10,000.00(1 + 0.104)(7)

A = $19,988.65

Summary:

The total amount accrued, principal plus interest, with compound interest on a principal of $10,000.00 at a rate of 10.4% per year compounded 1 time per year over 7 years, is $19,988.65.

According to The Global Growth of Long-Term Mutual Funds research paper, small, medium, and significant stock mutual funds have returned an average of 10.4 percent over the previous five years. As a result, if the overall index return is more critical than 10.4 percent, an investment in mutual funds with most equities will be worth half as much after seven years. Because bonds carry less risk than stocks, the returns of bond-focused mutual funds are lower than those of stock-focused funds. For secure investments, such as mutual funds, the time it takes to double the return will naturally be longer. Keep in mind that seven-year returns on mutual funds are never a given. The typical time is seven years, although it might be greater or lower. You can read the book Regulation and Governance of Mutual Funds: United Kingdom and United States of America Perspectives on Investor Protection.

Instead of focusing on the negatives, let’s take a more optimistic look at stocks as an alternative to certificates of deposit. It’s hard to predict stock prices in advance. We are well aware that past results are no guarantee of future success. The only way to know for sure is to study the past. Standard and Poor estimate that from 1926 through 2020, the S&P index, which became the S&P 500, had an average yearly return of 10%. Your initial investment would grow by 10% every seven years (72 divided by ten). If you invest in low-risk bonds, which have returned an average of 5 to 6 percent over that period, your money will double in 12 years.

How often do mutual funds compound?

Mutual funds compounded around 12% annually in the last 30 years, based on the book Mutual Funds Ladder to Wealth Creation.

It’s essential to keep in mind that you’ll be charged interest on the interest that has already accumulated. Amounts borrowed the principal amount and any extra deposits or interest equally. Think of this as an interest-on-interest strategy. Simple interest, which considers the principal amount, does not allow your balance to rise as quickly as it would with compound interest. As a mutual fund investor, you have a lot of flexibility to increase your compound interest rate—more money invested over more extended period results in greater returns. Compound interest increases your chances of making more money by reinvesting dividends in your fund. Since the distributions are reinvested, you buy shares of the fund. One’s original investment in the fund and the fund’s value will continue to rise at a higher rate due to the accumulation of compound interest.

Here’s an example of compound interest using a fictional mutual fund. Assume a mutual fund with a $10,000 initial commitment without yearly contributions. With an average annual return of 12 percent over 30 years, the fund’s projected value will be $299599. Compound interest is the difference between the amount of money invested and the value of the investment at the end of the period in question.

Based on past performance, you will have almost $300 000 after 30 years and a deposit amount of $10 000, using the formula A = P(1 + r/n)nt

Why are my mutual funds losing money?

Inflation might be one of the reasons mutual funds might not double in 7 years and why you lose your money.

It is possible that mutual funds will not double as quickly for several reasons. The general state of the market is one possible explanation. Your mutual funds may suffer if the market’s growth slows as anticipated. Global pandemics, political upheaval, and recessions can cause severe market slowdowns. Another possibility is that the mutual fund manager isn’t doing well. Your broker can provide you with information about a mutual fund. Investing with a broker that sells stocks at a discount or only buys equities when in great demand is unlikely to yield significant profits. A new fund may be in order if you think this is true.

Stocks and bonds can be found in most mutual funds. As previously stated, investing in a bond-heavy mutual fund would provide lower long-term returns than investing heavily in inequities. In the short term, bonds are a more secure option, but stocks are a superior choice in the long run since their gains may more than offset any losses. Finally, your mutual funds’ failure to double in 7 years may be due to inflation. Historically, stocks have done better when inflation is low and worse when high. The slowing of the economy, the reduction in the frequency of consumer spending, and the ensuing drop in stock values are all consequences of high inflation for equities and, by extension, mutual funds. Therefore, it is possible that an inflation-heavy mutual fund might not always perform as predicted.

Conclusion

There are few ideas in finance as straightforward as compound interest. But you don’t need to be a millionaire or a trading pro to benefit from it. Instead, start investing as soon as you can after learning about the time value of money. Regardless of how much money you have to invest, the idea is the same. By reinvesting interest income into the initial capital investment, the value of a mutual fund rises over time. According to the Rule of 72, investments will double in seven years if they yield at least 10.4%.

With an average five-year return of over 10.4%, mutual funds are likely to double in value within seven years or less. The market average may be used to analyze mutual fund growth over time and anticipate how your mutual funds will increase. Remembered mutual funds are best suited for long-term investments, mainly when they include a high percentage of equities over bonds in their portfolios. We hope you have acknowledged whether mutual funds double every seven years.