The passage highlights a significant trend in the global economy and financial markets concerning gold’s role and value, particularly in the context of central bank strategies and broader market dynamics.

Summary:

- Rising Central Bank Gold Demand: Central banks worldwide have significantly increased their gold purchases, with demand reaching near-record levels in recent years. This trend is reshaping gold’s role as a global monetary asset.

- Interest Rate Environment: Despite the rapid increase in interest rates by central banks, particularly the Federal Reserve, gold has remained resilient and even strengthened in value, contrary to the usual negative correlation between gold prices and rising interest rates.

- De-Dollarization Efforts: Nations such as China, Russia, and Iran are reducing their reliance on the US dollar in response to geopolitical tensions and the desire for economic independence. These efforts include increasing gold reserves as a more neutral and stable store of value.

- Hedging Against Uncertainty: Central banks acquire gold to hedge against economic and geopolitical uncertainties. Gold’s reputation as a safe-haven asset makes it a preferred choice for diversifying reserves and ensuring financial stability.

- Improving Balance Sheets: The valuation losses on bond holdings due to rising interest rates have prompted central banks to turn to gold, which holds its value and does not carry credit or counterparty risks, to bolster their balance sheets.

- Gold’s Role in Financial Stability: Institutions like the Bundesbank have credited their substantial gold reserves for maintaining balance sheet stability despite operational losses, highlighting gold’s role in ensuring financial health.

- Sustained Demand Outlook: Analysts expect central bank gold buying to continue, given the ongoing economic and geopolitical risks. This sustained demand will likely support gold’s long-term price outlook and reinforce its status as a critical asset in global monetary systems.

- Implications for Investors: The central banks’ continued interest in gold underscores its enduring value and stability, potentially offering positive implications for investors, including those holding gold as part of retirement savings or diversified investment portfolios.

- Reaffirmation of Gold’s Monetary Role: The level and consistency of central bank demand for gold suggest a solid yet unofficial role within the world’s monetary system. This trend is expected to continue and could bode well for gold’s future as a global monetary asset.

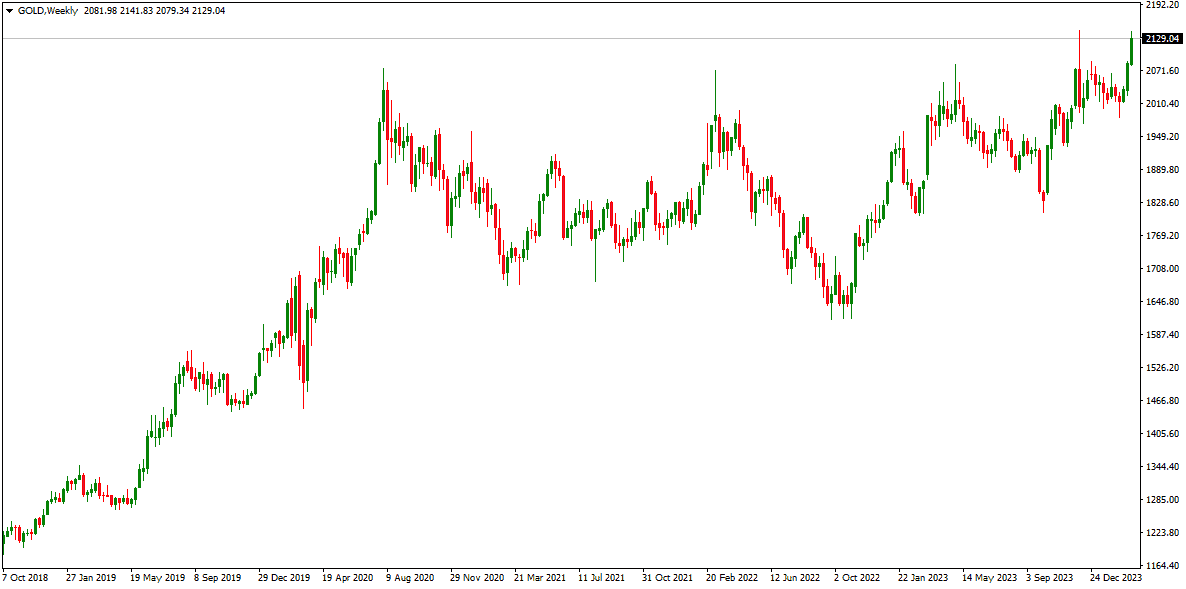

Firstly, it notes that despite aggressive interest rate hikes by the Federal Reserve from March 2022 through July 2023, which saw the federal funds rate increase by 525 basis points, gold has remained surprisingly resilient. Typically, gold, a non-interest-bearing asset, is expected to perform poorly in a high-interest-rate environment due to its higher opportunity cost than interest-bearing assets. Rising interest rates usually strengthen the dollar, making gold more expensive for non-U.S. buyers and potentially less attractive as an investment. However, contrary to these expectations, gold retained its value and outperformed other mainstream assets significantly during this period.

This anomaly is primarily attributed to the substantial gold demand from central banks worldwide. Since the aftermath of the global financial crisis in 2010, central banks have consistently been net purchasers of gold. Their buying activity reached record levels in 2022 and nearly matched that record in 2023. This robust demand from central banks is a critical factor that has supported gold’s price and performance despite the challenging conditions imposed by rising interest rates.

The reasons behind central banks’ increased interest in gold are multifaceted. Gold is a hedge against economic and geopolitical uncertainty, offering insurance against systemic risks. It is also seen as a tool for diversifying reserves away from fiat currencies, which can be subject to inflationary pressures and devaluation. In a way, central banks are signaling their confidence in gold as a stable and reliable reserve asset that can contribute to their overall financial soundness.

The Bundesbank, Germany’s central bank, is cited as an example of an institution that regards its gold holdings as a critical factor contributing to its soundness. This perspective underscores the evolving view of gold as a traditional safe-haven asset and a strategic component of central banks’ reserves.

The sustained accumulation of gold by central banks reflects their trust in the metal’s value preservation qualities and suggests a broader reconsideration of gold’s role in the global monetary system. If central banks continue to increase their gold reserves, it could further solidify gold’s standing as a mainstream financial asset and have significant implications for individual investors, potentially influencing investment strategies and the global financial landscape.

Central banks as Gold Buyers

The transformation of central banks into relentless gold buyers is a significant development in the global financial landscape. This shift is highlighted by the World Gold Council’s Gold Demand Trends Full Year 2023 report, which indicates that gold consumption in 2023 reached an unprecedented level of 4,899 metric tons.

Remarkably, central banks were responsible for purchasing 1,037 metric tons of this total, nearly matching the record-setting purchase of 1,081 metric tons the year prior. This surge in gold buying by central banks has been a critical factor driving gold prices, countering the downward pressure of rising accurate interest rates since early 2022.

The primary motivation behind this aggressive accumulation of gold by central banks is the desire to hedge and diversify their reserves in response to economic and geopolitical uncertainties. Gold is considered a safe-haven asset, prized for its ability to maintain value and provide stability in times of crisis. More than 90% of central bankers cite gold’s role as a hedge against systemic financial risk, its liquidity, and its capacity to act as a geopolitical diversifier and a store of value (e.g., as a hedge against inflation) as reasons for holding it.

Central bank reserves, like the investment portfolios of individual investors, are not naturally immune to global instabilities. Therefore, these institutions manage and optimize their holdings with a focus on liquidity and safety, often prioritizing these over performance. The widespread acknowledgment among central bankers of gold’s importance is evident in the World Gold Council’s 2023 Central Bank Gold Reserves Survey. The survey reveals that a significant majority view gold as crucial for managing risks related to global economic and geopolitical tensions.

Moreover, beyond the traditional reasons for holding gold, some central banks also purchase gold as part of their efforts to de-dollarize. This means reducing their reliance on the U.S. dollar to minimize the influence and control exerted by U.S. policies and sanctions. Holding gold allows these banks to diversify their reserves with an asset free from credit or counterparty risk and not directly influenced by any country’s policies.

The surge in gold buying by central banks is driven by the need for a reliable hedge against various uncertainties and the desire to diversify reserves away from traditional fiat currencies, particularly the U.S. dollar. Gold’s intrinsic qualities, such as its ability to retain value and offer liquidity in times of crisis, make it an attractive asset for central banks aiming to bolster their financial stability and independence.

De-dollarization and gold price

The focused efforts of countries like China, Russia, and Iran to reduce their dependence on the US dollar—a process often called de-dollarization—have significant implications for the gold market. By deliberately decreasing their exposure to the dollar, these nations aim to mitigate the potential negative impacts of US monetary and fiscal policies and reduce the risk of being subjected to US sanctions. This strategic shift involves increasing their central bank reserves in gold. This asset offers liquidity without credit or counterparty risk and is beyond the control of any government, unlike the US dollar.

The impact of de-dollarization on the gold price can be substantial for several reasons:

- Increased Demand: As central banks, particularly from countries seeking to de-dollarize, turn to gold as a store of value, this increased demand can push gold prices higher. The consistent buying of gold by central banks contributes to a reduction in supply available for other buyers, thereby putting upward pressure on prices.

- Market Sentiment: The move by major economies to reduce their dollar holdings and instead accumulate gold can influence market sentiment, encouraging other investors to also seek refuge in gold. This can lead to a self-reinforcing cycle of increasing gold purchases and prices.

- Reduced Dollar Influence: De-dollarization efforts by significant global players can potentially weaken the dollar’s dominance in international trade and finance. As the dollar weakens or concerns about its future role in the global economy grow, gold becomes an even more attractive investment, seen as a safer, more stable alternative. This shift can further drive up demand for gold, bolstering its price.

- Political and Economic Uncertainty: The reasons behind de-dollarization, such as avoiding US sanctions and reducing dependency on US monetary policy, highlight broader geopolitical uncertainties. Gold traditionally benefits from such uncertainty and is considered a safe-haven asset. Therefore, de-dollarization efforts can amplify gold’s appeal during political and economic stress, contributing to price increases.

- Long-term Strategic Reserves: The commitment of central banks like the People’s Bank of China and the Bank of Russia to continually increase their gold reserves signals a long-term strategic preference for gold over the dollar. This sustained buying interest not only supports current gold prices but also sets a bullish tone for the market’s future trajectory.

De-dollarization contributes to a higher demand for gold, enhances its status as a safe-haven asset, and potentially leads to an increase in gold prices. The strategic shift by some of the world’s largest economies away from the dollar and towards gold underscores the metal’s enduring value and stability in the face of global economic and political uncertainties.

Central banks accruing Gold

Central banks might be acquiring gold to bolster their financial stability due to the adverse impacts on their balance sheets from the rise in interest rates since the beginning of 2022. This period has seen bond values plummet as interest rates climbed, causing significant valuation losses for holders of these bonds, including central banks. Ironically, central banks have been the architects of these rate hikes aimed at curbing inflation but have consequently suffered from the depreciation in the value of their bond holdings. This scenario has undermined the role of government bonds as a foundational component of central banks’ reserves.

The rise in interest rates has led to notable financial strains on central banks’ operations. For example, the Federal Reserve has faced operating losses totaling nearly $117 billion since September 2022, alongside unrealized losses on its portfolio amounting to approximately $1.3 trillion. Such a situation, if experienced by a private-sector bank, could have led to dire consequences, such as takeover, bankruptcy, or liquidation.

This financial pressure is not unique to the Federal Reserve; central banks worldwide are grappling with similar challenges.

In response to these challenges, central banks have increasingly turned to gold as a strategic asset to reinforce their balance sheets. Unlike government bonds or other financial assets, gold does not carry credit or counterparty risk. Its value does not directly correlate with interest rates or the performance of financial markets, making it a stable reserve asset during economic volatility. The Official Monetary and Financial Institutions Forum (OMFIF) has indicated that central banks in Europe might use their gold revaluation accounts to offset balance sheet losses in the coming years, showcasing the asset’s role in providing financial stability.

The Bundesbank in Germany serves as a case in point, where gold reserves have been credited with ensuring the central bank’s balance sheet remains solid. Despite recording its first operating loss in four decades in 2022, the Bundesbank has highlighted its gold revaluation account as a critical factor in maintaining its financial health. This account reflects the unrealized gains on the bank’s gold holdings, which have significantly exceeded the original purchase costs, thus providing a substantial buffer against losses.

This strategic reliance on gold reflects a broader understanding among central banks of the metal’s value in preserving financial stability. The factors driving this accumulation—such as the need to diversify reserves, improve balance sheets, and secure liquidity from an asset free of credit risk—will likely remain relevant amidst ongoing economic and geopolitical risks. Consequently, this could sustain or even increase global gold demand, supporting the metal’s long-term price outlook.

The concerted move by central banks to bolster their reserves with gold underscores the metal’s reinstated, albeit unofficial, role within the global monetary system. As central banks continue to navigate the complexities of the current financial landscape, their sustained interest in gold highlights the metal’s enduring value as a haven and signals potentially positive implications for its future demand and valuation.

Investing in IRA precious metals can protect your retirement fund. Investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free PDF about Gold IRA.

GET GOLD IRA GUIDE