Table of Contents

What is microfinance?

Microfinance or microcredit represents financial services provided to unemployed or low-income individuals or groups, such as small loans to poor clients or microinsurance.

Microfinance institutions all begin with value capital. Aid organizations, depositors, and banks all borrow money. They borrowed according to their ability in terms of payback schedule, amount, and interest rate without going beyond thresholds risk put up by conglomerates of lenders, the board of directors, and management, not breaking regulations set by local banking. Microfinance bank owns divisional offices headed by credit officers who have cordial affairs with community members to deliberate on microfinance institutions’ products loan. They also take back interest and significant payback if those that borrow money must pay back in cash, which they have no means to take to the divisional offices. The head office and marketing department determine the loan approval processes. Which is subsequently implemented by the marketing department, department of operations, credit, and product department at the head office, divisional office staff inclusive.’

Before learning about microfinance, you should check the free Financial Markets course created by Robert Shiller, a Yale professor.

Difference between microfinance and bank

The difference between microfinance and bank lies in their scope because microfinance helps those who need loans with little to no assets, while a bank gives clients a loan if they have the collateral. Microfinance is individual-focused and provides money to needy individuals or small businesses that lack access to conventional resources. Microfinance has lower capital costs relative to risk, no collateral, and greater leverage than traditional banks.

Some MFIs are non-profit-oriented, but these are just an exception, not the norm. Although many MFIs kick off as non-profits and later transform into for-profits. Investors are profit-motivated such are MFIs owners. Sometimes, the owners use socially motivated funds to make investments; not always, though. Large MFIs heads such as CEOs, COOs and CFOs are mindsets similar to the managers of same-sized banks in countries like the U.S or another country. They give shareholders back value by planning to execute plans drafted with the directors’ concerted effort. To achieve this, there is a need to build a profitable, effective, and lasting organization that earns respect and trust from its customers, lenders, workers, and rural regulators. Some managers feel concerned about building their countries to create opportunities for their people. While some don’t care, their interest rates may be thirty percent annually. Their motives for profit-making and microfinance’s importance are evident in the other options customers would choose if MFIs were not in existence. These alternatives could be local money lenders lending money at an interest rate of less than 500% per annum.

What is the difference between microfinance and cooperative microfinance?

The difference between microfinance and cooperative is in the target population. Cooperative and regular microfinance are cooperative micro-financial products free from interest, but the structure is different. Cooperative microfinance represents finance services provided “by the members, for the members” to unemployed or low-income members who otherwise would have no other access to financial services. Cooperative microfinance’s final goal is social gains and commercial success.

Usually, Cooperative microfinance members must buy a membership first and then place their savings there. After a while, they may apply for a loan to purchase property, pay school fees, or start a small business. Cooperative microfinance membership is open and voluntary.

Profits earned are lower interest on loans, higher interest on savings, or new products and service development. Microfinance institutions use profits for cash reserves or are divided among investors.

The highlight here are some factors distinguishing microfinance banks from commercial banks:

- LOWER COSTS OF CAPITAL RELATIVE TO RISKS: This can make MFIs more lucrative than traditional banks. Most investors put their money in MFIs motivated socially and have minimal return rates if required social standards are met. Far below-market interest rates MFIs borrowed from their lenders, e.g., aid organizations or perhaps part of a large western bank. MFIs grow by taking deposits from their customers, motivating them with interest rates of 10% annually on the savings account. Unlike FDIC in the US, the government of countries where MFIs operate doesn’t guarantee these deposits. Deposits are attractive to financing independent because it helps them make financing independent of international capital markets. However, increased regulation and high costs often come with deposits.

- NO COLLATERAL: Lending in traditional commercial banks is not unsecured but often secured by assets like land, vehicles, etc. In contrast, MFIs’ lending is usually not secure. The borrower’s assets are safe even if they fail to pay back their loans, but with a penalty not to lend to such customers again. They may also report such borrowers to community leaders or lead to such a community’s social consequences by increasing interest rates on loans by any community members. So why didn’t MFIs take collateral? This is because the borrowers are almost poor or at the poverty line. Hence, it is unutterable by MFIs to socially inclined investors or local media.

Furthermore, MFIs jurisdiction’s legal systems are too feeble to support loan collateral. However, asset lending is not uncommon in MFIs when the loan is meant to acquire specific assets. - GREATER LEVERAGE THAN TRADITIONAL BANKS: Microfinance is often at the mercy of central banks more than other banks in any country they operate. For instance, the most excellent asset-to-equity ratio is higher for MFIs than for different banks. Low-income individuals often benefit from a certain percentage of their loans, making them licensed as MFI instead of a bank. MFI loan size average is usually under a certain amount. MFI makes access to capital more accessible for low-income earners than other banks. This is a result of their looser capital requirement.

- TARGET MARKET: The microfinance target market is low-income earners who do not use the bank. For instance, peasant farmers or petty traders earn between $800 to $5000 per annum. However, this doesn’t mean they are more generous. Knowing fully well that they charge these people higher interest rates than the high-income earner in the communities who possess assets can be collateral. The low-income individuals given loans relative to their income level are not riskier, provided their income is steady.

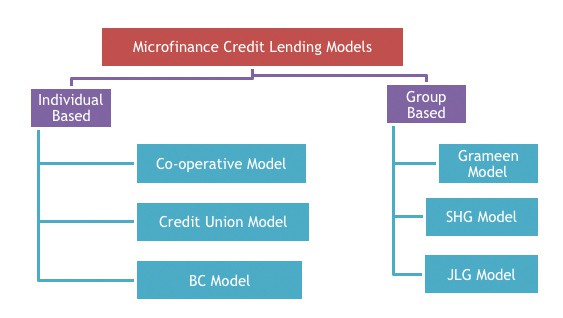

These MFI borrowers can also be diligent workers in their businesses, just like other wealthy community members. They can also be spurred to give their families opportunities even as they maintain their dignity and reputation in the community. - GROUP LENDING: one of the leading methods in MFI is group lending. A group of individuals in a community may secure loans and act as a guarantor to one another. The idea behind this is if one person cannot refund, others have to pay back, or they all face the penalty of not getting a loan from microfinance again. The operating costs accompanying this method’s implementation yield lesser profits than individual loans. However, it is not without benefits, among which is social pressure, which also helps the community.

Furthermore, MFI has many players they partner with, such as crowd-funding and insurance from micro-insurers. Some sellers of goods partner with microfinance to boost the finances of their business.

Difference between microfinance and commercial bank by definition

Commercial banks, as financial institutions, are established based on the banking regulation act. They function solely to accept money and lend money out to customers. Do banks trade forex? Other functions include brokerage, insurance, stocks, security, etc. All of these are non-banking activities. Commercial banks are profit-oriented. Among commercial banks’ characteristics are dividends, tax payment, registration, etc.

Microfinance is not profit-minded. The activity in microfinance is done more in a group. Each member of the group has savings. Thus microfinance aims at giving a loan to any member of the group. The group ensures the money is being used, and the member earns profit from any income-making enterprises they engage in. Thus, every group member is entitled to a loan or perhaps get a loan. This, in turn, self-sustain the group. Unlike a commercial bank, microfinance lacks registration, dividends, and taxation.

Difference between microfinance and commercial bank

GENERAL DIFFERENCE

They deal with various customers in terms of definition. For example, microfinance renders financial assistance and gives loans to low-income earners of local families. On the other hand, commercial banks provide loans to people and prominent organizations that open accounts. It is worth noting that their difference per se is based on their customers’ customers, not even the loan’s magnitude.

SPECIFIC DIFFERENCE

MFIs lend money funded by private equity holders and or individuals. So, sources of funds for microfinance institutions can differ from private equity holders to individuals. Commercial banks offer financial services ranging from lending and savings to insurance and pensions. Commercial banks are funded through stock markets.

MFIs services are DOORSTEP. That is, their staff take financial services to customers ’ doorsteps. Whereas commercial bank services are BANK DOOR services, the customers must go to the bank to obtain financial assistance.

Commercial banks’ loan risk is relatively low. Thus, charge lower interest rates ranging from 10% to 16%. This low loan risk is predicated because they deal with people with high-income levels. In contrast, the microfinance loan interest rate is high, say 20%-25%, operates collateral-free loans, and land loanees are riskier.

Among other differences are dynamics in the workforce, governance structures, use of or ICT use, physical presence, etc.

History recorded that in India, commercial banks do not understand the requirements of the local market. This birthed the idea of micro-financial institutions. They offer financial help to local families of low income that couldn’t transact business with commercial banks. With free collateral loans, they provide financial services to several poor people.

Commercial banks cannot cope with the high risk of giving loans to the poor residents in rural areas whose small loans are hard to maintain in terms of cost. Thus, despite the challenges of commercial banks, microfinance rose to conquer by giving loans to the needy.

MFIs help the poor in remote areas to scale up their business by giving them small loans. However, there is no provision for other facilities like insurance, cash withdrawal from automated teller machines, credit/debit card provision, etc. At the same time, such services are available in commercial banks. Commercial banks also help manage customer cash, give reports on their accounts, etc.

There is no collateral-free loan in commercial banks. MFIs give collateral-free loans. There’s extensive scrutiny in commercial banks before issuing the loan. Such scrutiny is not available in Microfinance.

Some amount has to be deposited to the MFI before giving out loans to any group members in terms of deposit. Whereas in commercial banks, the depositor is required to pay a fixed rate of interest corresponding to a specific amount to be given out as a loan

MFIs seek to bridge the gap in society’s segment not touched by commercial banks, which exposes them to private borrowers.

Commercial banks’ lending operations cover renewable energy, agriculture, housing, small and medium enterprises, education, etc.

They also differ in their approaches to risk management. For example, MFIs manage risk by contacting their customers often. Also, train their staff (off-field staff) and customers. Self-deserved and imposed risk management systems that are advanced are used in commercial banks.

Microfinance charges are higher than other banks to meet costs and make services available.

However, the local money lenders, whose interest rates can be thousands, receive far above this from people.

Microfinance still faces challenges in sustaining itself in rural areas.

MFIs are not profits oriented; experts give loans to local communities, groups, or individuals. They are into micro-financing and do not lend huge money to customers.

On the other hand, commercial banks do a wide range of financial services to corporate bodies and individuals. They are profit-minded. They offer other financial services like guarantees, savings, credit letters, etc.