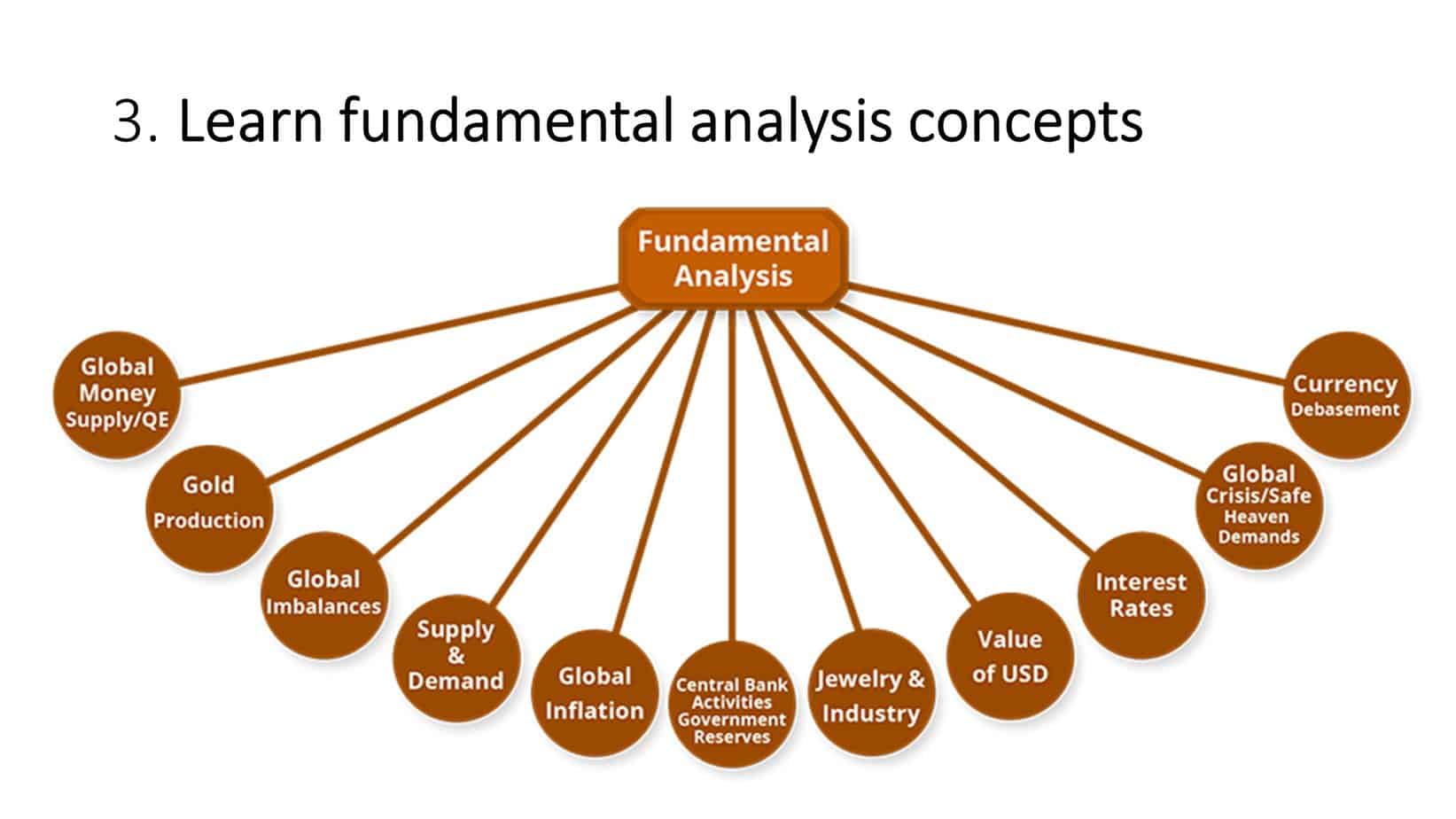

The dynamics of the gold market and its recent resilience despite rising interest rates highlight several critical factors in its valuation and investor sentiment. Typically, gold is seen as a safe-haven asset, but it doesn’t yield interest, making it less attractive in environments where interest rates are high or rising. Higher interest rates can lead to a stronger dollar, making gold more expensive for international buyers, and suggest a reduced risk of currency debasement, decreasing the immediate need for gold as a store of value.

Despite these factors and the Federal Reserve’s aggressive rate hikes since March 2022, gold has maintained its value and outperformed many other assets in 2022 and 2023. This anomaly can be attributed to significant purchases of gold by the world’s central banks, who have been net buyers of gold since 2010. Their unprecedented buying spree in the last two years has been driven by the desire to diversify reserves, reduce reliance on the U.S. dollar, and enhance their balance sheets, among other reasons.

Let us make a summary:

- Historical Sensitivity of Gold to Interest Rates

- Gold is traditionally seen as less attractive in rising interest rate environments since it does not yield interest.

- Rising rates typically lead to a stronger dollar, making gold more expensive for international buyers and diminishing its appeal as a store of value.

- Recent Performance Contradicts Expectations

- Despite the Federal Reserve’s aggressive rate hikes, gold has outperformed many assets in 2022 and 2023.

- Analysts attribute this resilience to record levels of gold buying by the world’s central banks, seeking to diversify reserves and reduce reliance on the U.S. dollar.

- Projections by Major Investment Banks

- UBS and J.P. Morgan: Predict gold could reach record highs, bolstered by central bank demand and potential shifts in monetary policy towards lower interest rates.

- Citigroup: Suggests gold could hit $3,000 per ounce, driven by an acceleration in de-dollarization efforts by central banks in emerging markets and a possible crisis of confidence in the U.S. dollar.

- Central Bank Demand as a Key Driver

- Central banks have been net buyers of gold since 2010, with demand surging to record levels in the last two years.

- This demand is partly due to efforts to diversify away from the U.S. dollar (de-dollarization) and bolster balance sheets.

- Future Outlook

- Continued central bank demand for gold and a potential shift in monetary policy (easing by the Federal Reserve) could support higher gold prices.

- Analysts note that the impact of falling rates could be more substantial for gold prices than the impact of previous rate hikes.

- Impact of Geopolitical and Economic Trends

- De-dollarization and diversification efforts by emerging market central banks will continue driving gold demand.

- A crisis of confidence in the U.S. dollar could further accelerate gold purchases by central banks, supporting higher price projections.

- Investor Implications

- Investors and market watchers are advised to pay attention to central bank actions, monetary policy shifts, and global economic trends as critical indicators of gold’s price trajectory.

- While indicative of bullish sentiment, the specific price targets are less important than understanding the underlying dynamics influencing these forecasts.

This central bank demand is expected to persist, providing a robust foundation for gold’s value. Investment banks, recognizing the combination of sustained central bank demand and the prospect of falling interest rates, project a bullish outlook for gold. UBS and J.P. Morgan, for instance, anticipate that gold prices could reach record levels in the coming years. This optimism is based not only on the expected shift in monetary policy but also on the structural demand from central bank purchases, which could drive prices higher as the policy environment becomes more favorable to precious metals.

In essence, while traditional economic theories might suggest that gold’s value should decline in a rising interest rate environment, the practical market dynamics, including significant central bank activity and the anticipation of a shift in monetary policy, have supported and are expected to continue to support gold’s value. This scenario underscores the complex interplay between monetary policy, currency valuation, and commodity markets, illustrating how gold’s role as a financial asset and a geopolitical tool can influence its market performance in ways that may not always align with macroeconomic expectations.

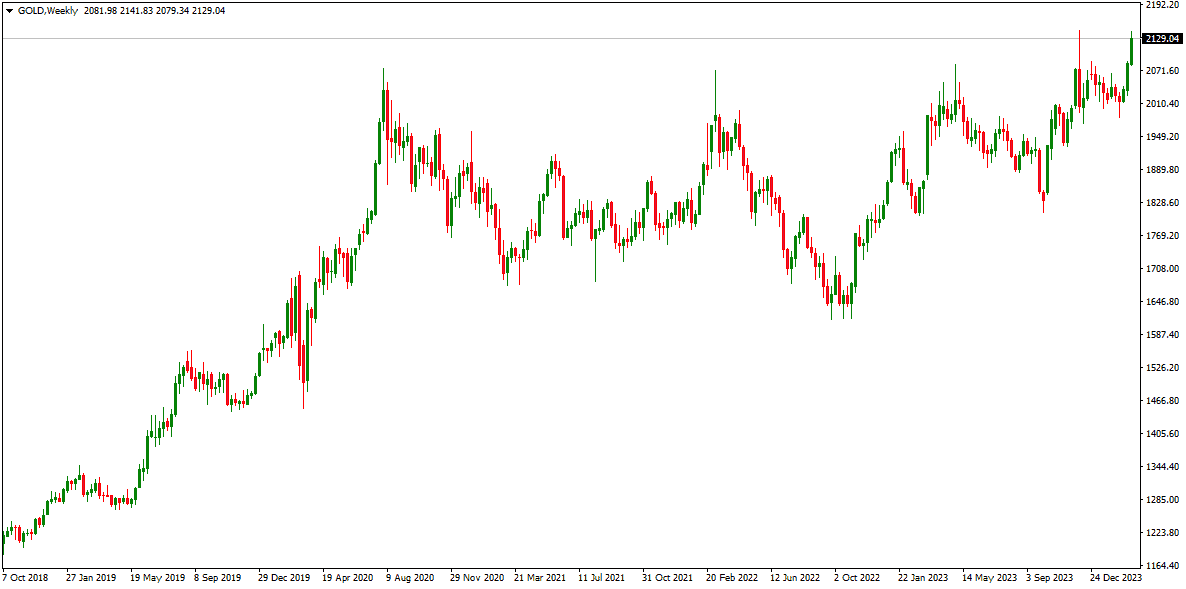

See gold rally in March 2024:

J.P. Morgan Gold Price Projection

The perspective offered by Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan, underscores a nuanced understanding of the gold market’s dynamics and its sensitivity to interest rate changes. Despite a slight anticipated decrease in central bank gold purchases compared to the record-setting years of 2022 and 2023, J.P. Morgan expects the demand from central banks to remain historically high in 2024, with projections of 950 metric tons. This level of purchasing reflects a strategic shift among central banks towards diversifying their reserve assets, suggesting a long-term structural increase in demand for gold compared to the patterns observed in the late 2010s.

Shearer’s analysis indicates that the upcoming shift in monetary policy, precisely the anticipated rate cuts by the Federal Reserve, will likely serve as a primary catalyst for a significant rally in gold prices later in 2024. This expectation hinges on the premise that the impact of falling interest rates and declining U.S. real yields will substantially boost gold prices more than the suppressive effect of the preceding period of rising rates.

The analysis further suggests that gold’s relationship with real yields tends to strengthen in favor of gold prices during declining yields following a Fed transition from a hiking to a cutting cycle. This relationship implies that the effect of falling rates on gold prices could be more pronounced than the impact of rising rates, leading to what J.P. Morgan anticipates as a “breakout rally” for gold.

For price projections, J.P. Morgan anticipates that gold could approach $2,200 per ounce in 2024, with a further increase to $2,300 per ounce in 2025. This bullish outlook aligns with expectations from other central investment banks, like UBS, which also forecast strong performance for gold based on a combination of sustained central bank demand and favorable shifts in monetary policy.

In summary, the analysis from J.P. Morgan articulates a bullish scenario for gold, grounded in continued high demand from central banks and anticipated policy shifts that favor lower interest rates. This environment is expected to create favorable conditions for a substantial rally in gold prices, reflecting a complex interplay between macroeconomic policies, central bank strategies, and the intrinsic characteristics of gold as a financial asset.

CitiGroup Gold Price Projection

Citigroup’s projection of gold potentially reaching $3,000 per ounce shortly underscores a notably bullish outlook on the precious metal, anchored significantly in global economic and geopolitical trends. Aakash Doshi, Citigroup’s North America head of commodities research, and his team suggest that a dramatic increase in central bank demand for gold, fueled by an accelerated trend towards de-dollarization in emerging markets, could be the key driver behind such a significant price movement.

This perspective hinges on a couple of critical assumptions and trends. Firstly, Citigroup analysts posit that the demand from central banks, which has already shown substantial growth in recent years, could escalate even further. Their argument is not just based on a continuation of recent trends but on the possibility of an exponential increase in gold purchases by central banks, particularly those in emerging markets like Russia and China, which have been actively looking to reduce their reliance on the U.S. dollar.

De-dollarization refers to the process by which countries reduce their dependence on the U.S. dollar in international trade and reserves, often favoring other currencies or assets, such as gold. The motivation behind this trend includes diversifying reserve assets, reducing vulnerability to U.S. monetary policy, and mitigating the impact of U.S. sanctions or financial market fluctuations.

According to Citigroup’s analysis, if it leads to a crisis of confidence in the U.S. dollar, the transition towards de-dollarization could dramatically increase the demand for gold. In such a scenario, central banks might double down on their gold acquisitions as a stable reserve asset, potentially pushing the annual demand to unprecedented levels.

The historical context provided by Citigroup illustrates the rapid increase in gold buying by central banks over recent years, with a notable surge in 2022. Despite a slight decrease in 2023, the overall trend points to a heightened role of gold in central banks’ strategies. Doshi’s comment about the possibility of gold demand among central banks doubling and its bullish implications for gold prices emphasizes the potential scale of impact such demand could have on the market.

While reaching a gold price of $3,000 per ounce would require a confluence of favorable conditions, including significant monetary policy shifts and continued de-dollarization efforts, Citigroup’s analysis presents a compelling case for considering the broader geopolitical and economic dynamics.

The exactitude of specific price targets may be less critical than understanding the underlying factors driving such forecasts. For investors and market watchers, the evolving dynamics of gold demand, central bank policies, and global economic trends will be crucial areas to monitor in the coming years, offering insights into the potential trajectory of gold prices and the broader implications for the global financial system.

Investing in IRA precious metals can protect your retirement fund. Investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free PDF about Gold IRA.

GET GOLD IRA GUIDE