Table of Contents

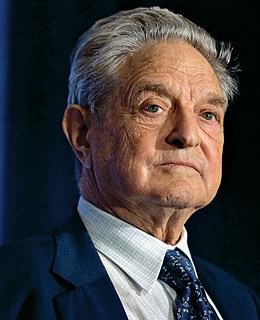

Who is George Soros, and what is he famous for?

George Soros is a Hungarian-American trader, investor, and philanthropist. As of February 2020, he had a net worth of $8 billion, having donated more than $32 billion to his philanthropic agency, the Open Society Foundations. Biography can be read in our new George Soros Biography article.

Here’s a detailed bullet-point biography of George Soros:

Early Life and Education

- Born: August 12, 1930, in Budapest, Hungary.

- Background: Born to a Jewish family, Soros survived Nazi Germany-occupied Hungary during World War II.

- Immigration to England: In 1947 Soros moved to England and attended the London School of Economics (LSE).

- Education: He graduated from LSE in 1952 with a degree in philosophy.

Career

- Early Career: Soros started his financial career at Singer and Friedlander in London in 1954, then moved to New York City in 1956, working as an arbitrage trader and analyst.

- Quantum Fund: In 1970, Soros founded Soros Fund Management and later the Quantum Fund, one of the first significant global hedge funds.

- Financial Success: He gained significant wealth through his hedge fund, known for its high risk-adjusted returns.

Major Financial Achievements

- “The Man Who Broke the Bank of England”: Gained fame in 1992 by betting against the British pound, earning him over $1 billion and the nickname “The Man Who Broke the Bank of England.”

- Currency Market Speculation: Known for his expertise in the global currency markets, Soros made substantial profits through speculation.

Philanthropy

- Open Society Foundations: The Open Society Foundations is a network of philanthropic organizations active in more than 100 countries, focusing on democracy, human rights, and social reform.

- Generous Donor: Contributed billions to philanthropic causes over several decades.

Political Involvement

- Political Activism: Actively involved in political causes, often supporting liberal and progressive agendas.

- Controversy and Criticism: Soros’s political activities and outspokenness have made him a polarizing figure in global politics.

Personal Life

- Author: Written several books on economics, finance, geopolitics, and society.

- Family: Married three times and has five children.

Legacy

- Influence in Finance: Soros is recognized as one of the most successful investors in the world.

- Impact on Global Philanthropy: His philanthropic efforts, mainly through the Open Society Foundations, have had a significant impact on various global causes, including the promotion of democracy and human rights.

- Controversial Figure: His political involvement and market activities have made him controversial in various circles.

George Soros’s life and career are marked by remarkable financial acumen, substantial philanthropic contributions, and significant political influence, making him a unique and influential figure in contemporary global affairs.

George Soros Education

He went to study in England when he was 17, and in 1952 he graduated from the London School of Economics. Soros got a Bachelor of Science in philosophy in the London School of Economics in 1951 and a Master of Science in philosophy in 1954.

After graduation, Soros started working in an Investment bank in London. Four years later, he went to the United States to work as an investment analyst and a manager in three different New York-based investment companies: F.M. Mayer from 1956 to 1959, Wertheim & Co. from 1959 to 1963, and Arnhold S. Bleichroeder from 1963 to 1973.

After gathering experience for seven years, he finally went to work independently. 1973 he started the Hedge Fund Company, which later became the famous Quantum Fund. The Hedge Fund Company was very successful, with a return of 30 % per year. During two decades of Soros’s leadership, there were two times when the returns on investment were more than 100%.

George Soros – The man who broke the Bank of England

There is an interesting anecdote about Soros’s business, after which he became famous as “the man who broke the Bank of England” (read more). In 1992, he invested 10 billion dollars in one currency speculation. The impact of that investment shorted the British pound. He risked losing 10 billion dollars in case he was wrong, but that wasn’t the case. The speculation was correct; he made a profit of 1 billion dollars in one day, and the profit on the transaction was 2 billion dollars. That wasn’t the only time he shook a country with investment decisions. Reportedly, he was the “last drop” that started an Asian financial crisis.

George Soros’s investment style

His investment style was not the one that other investors could copy. Accordingly, he had an instinctive physical reaction that would direct him when to buy or sell. He was a short-term investor, in other words, the speculator who was willing to take bets with significant stakes. He described financial markets as chaotic, where people – whose reactions are based on emotions – do not use logical analysis.

He also claimed that investors in the market influenced one another and acted like the herd. When one would move, the rest of the herd would follow him. He said that he also followed the herd but never missed a chance to take the leading position.

Even though he had a rough time during his career with many ups and downs, he made many people rich by speculating with billions of dollars. He was one of the wealthiest investors in the world.

His fortune allowed him to work only partly in his investment company and spend more time devoted to his Open Society Foundation by donating worldwide.

He also played an active role in politics by writing and lecturing on subjects like human rights education, political freedom, and the United States’ role in the world.

Soros describes himself as a financial, philanthropist, and philosophical speculator.

George Soros Quotes:

The financial markets generally are unpredictable. So that one has to have different scenarios… The idea that you can actually predict what’s going to happen contradicts my way of looking at the market.

Well, you know, I was a human being before I became a businessman.

Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.

I’m not doing my philanthropic work, out of any kind of guilt, or any need to create good public relations. I’m doing it because I can afford to do it, and I believe in it.

I put forward a pretty general theory that financial markets are intrinsically unstable. That we really have a false picture when we think about markets tending towards equilibrium.

Throughout the 19th century, when there was a laissez-faire mentality and insufficient regulation, you had one crisis after another. Each crisis brought about some reform. That is how central banking developed.

Stock market bubbles don’t grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.

George Soros Portfolio (Summer 2014)

| Ticker | Company | Industry | Shares |

|---|---|---|---|

| YPF | YPF Sociedad Anonima | Oil & Gas – Integrated | 13,783,638 |

| CNX | Consol Energy Inc | Coal | 5,088,283 |

| FB | Facebook Inc | Online Media | 1,841,260 |

| AAPL | Apple Inc | Computer Hardware | 1,833,764 |

| AIG | American International Group Inc | Insurance | 1,802,717 |

| ALL | American Airlines Group Inc | Airlines | 2,534,188 |

| LVLT | Level 3 Communications Inc | Communication Services | 1,787,306 |

| MSFT | Microsoft Corp | Application Software | 2,224,366 |

| INTC | Intel Corp | Semiconductors | 3,906,048 |

| TWC | Time Warner Cable Inc | Communication Services | 442,393 |

| EDU | New Oriental Education & Technology Group Inc | Education | 2,409,000 |

| PSX | Phillips 66 | Oil & Gas – Refining & Marketing | 1,234,822 |

| TIPS | TIBCO Software Inc | Application Software | 5,780,618 |

| CELL | Celgene Corp | Biotechnology | 688 |

| SYK | Stryker Corporation | Medical Devices | 1,678,108 |

| CLI | Mack-Cali Realty Corp | REITs | 4,005,539 |

| GOOD | Google Inc | Online Media | 194,489 |

| DOW | Dow Chemical Co | Chemicals | 825,792 |

| HERTZ | Hertz Global Holdings Inc | Consulting & Outsourcing | 1,522,272 |

| VRX | Valeant Pharmaceuticals International Inc | Drug Manufacturers | 472,187 |

Read George Soros’s biography in detail on the forex.in.rs website.