On December 13, 2023, the Federal Reserve’s policy decision is expected to echo a familiar and calming sentiment reminiscent of the British government’s World War II advice to “Keep Calm and Carry On.” This message comes when calm has been a rare commodity in financial markets, with recent aggressive movements causing 10-year Treasury yields to behave unpredictably, rising to nearly 5% and then dropping to 4.24%.

As the Fed gears up to review its policy, there’s a buzz among Wall Street economists debating the potential start of a recession next year. Traders in derivative markets believe that the Fed might aggressively cut its benchmark interest rate by more than 100 basis points. Interestingly, concerns about inflation and the Federal government’s fiscal deficit have seemingly taken a backseat.

Stephen Gallagher, U.S. chief economist at Societe Generale, anticipates only a mild pushback from the Fed against these market expectations. The consensus is that the Fed will maintain its benchmark interest rate at 5.25%-5.5%, marking the third consecutive meeting without change, with the last rate hike occurring in July.

The Fed’s approach is expected to be methodical and gradual, akin to an “ocean liner” rather than a “speed boat,” a comparison made by former Boston Fed President Eric Rosengren. The Fed is likely to maintain a hawkish stance in its policy statement, hinting at possible future tightening. At the same time, its new “dot-plot” is predicted to show a modest 50 basis points cut in 2024, unchanged from September. The new forecast suggests slower economic growth in 2024 but stops short of predicting a recession.

In his press conference, Fed Chair Powell is expected to remind markets of the possibility of hiking interest rates again if inflation reaccelerates and emphasize that discussions about rate cuts are “premature.” This narrative might be slightly offset by PGIM Inc.’s chief U.S. economist, Tom Porcelli, whose expectation is that Fed officials might envisage three rate cuts in 2024, prompting Powell to sound slightly more hawkish.

The Fed’s delicate balancing act involves avoiding too dovish a tone, which could inadvertently ease financial conditions and reignite inflation. Traders widely anticipate the first rate cut in March, but Gallagher believes it would require “jarring news” for such an early adjustment.

MUFG Bank’s U.S. economist Agron Nicaj notes that recent data showing slower economic growth and subdued inflation gives Powell some leeway to adopt a marginally dovish stance. For instance, Powell is likely to reiterate that interest rates have reached a significantly restrictive level, hinting that they might not need to remain high for an extended period.

Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, points out Powell’s challenge in sounding hawkish amidst an economic slowdown and the Fed’s projections showing no further rate hikes. He recalls the November press conference where Powell’s tone gradually shifted to a more dovish stance the longer he spoke.

Overall, the Fed’s decision and Powell’s subsequent address are expected to reflect a cautious, data-dependent approach, with an underlying theme of maintaining rates “higher for longer.” However, whether the market will align with this cautious optimism remains to be seen.

- Economic Growth Slowdown: Recent data indicates a slowdown in economic growth from its strong pace in the third quarter.

- Employment Trends: Employment growth has become moderate but remains robust, characterized by a consistently low unemployment rate.

- Inflation Dynamics: Over the past year, inflation has decreased but remains high.

- U.S. Banking System Strength: The U.S. banking system is robust and resilient.

- Impact of Tighter Financial Conditions: Tighter financial conditions are expected to affect economic activity, employment, and inflation, though the extent of this impact is uncertain.

- Inflation Monitoring by the Committee: The Committee vigilantly monitors inflation risks.

- Committee’s Objectives: The Committee’s goals are to achieve maximum employment and a long-term inflation rate of 2%.

- Federal Funds Rate: The target range for the federal funds rate is maintained at 5.25-5.50% to support the Committee’s goals.

- Data Assessment for Monetary Policy: The Committee will continue to evaluate incoming data for its implications on monetary policy, considering the cumulative impact of monetary tightening, the time lag of policy effects, and ongoing economic and financial developments.

- Continuation of Securities Reduction: Reduced holdings of Treasury securities, agency debt, and mortgage-backed securities will persist as planned.

- Commitment to Inflation Target: The Committee is committed to returning inflation to its 2% target.

- Readiness to Adjust Monetary Policy: The Committee remains ready to adjust monetary policy to achieve its objectives, considering factors like labor market conditions, inflation pressures and expectations, and financial and international developments.

- Unanimous Policy Decision: The policy decision was unanimously supported by Federal Open Market Committee (FOMC) members: Jerome H. Powell, John C. Williams, Michael S. Barr, Michelle W. Bowman, Lisa D. Cook, Austan D. Goolsbee, Patrick Harker, Philip N. Jefferson, Neel Kashkari, Adriana D. Kugler, Lorie K. Logan, and Christopher J. Waller.

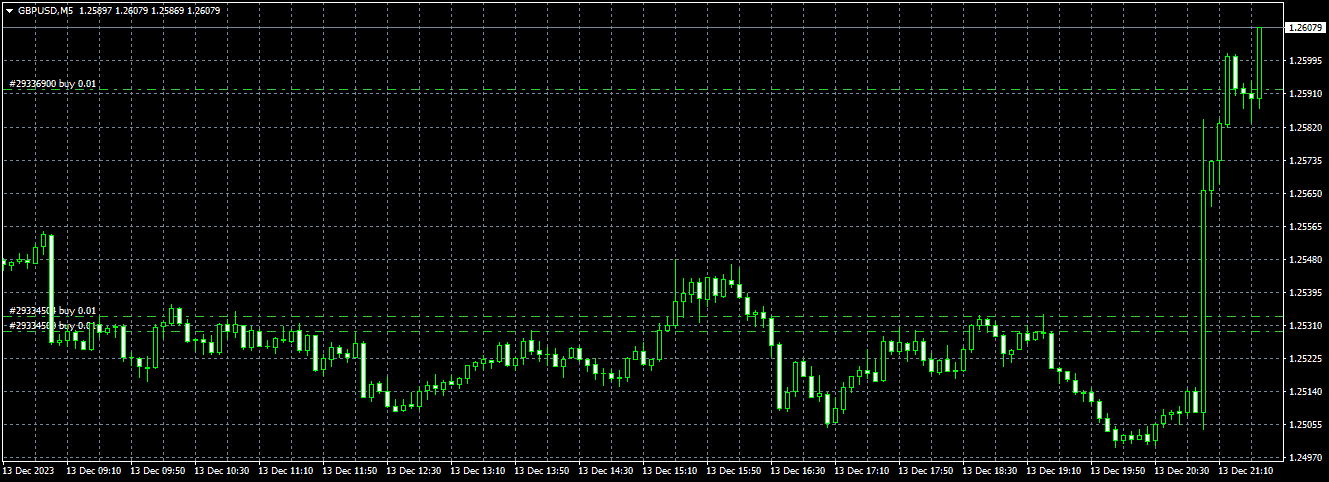

See chart of EURUSD:

The markets’ reaction, particularly in the forex (foreign exchange) market, to major economic announcements like those from the Federal Reserve can be pretty dramatic and instantaneous. Here’s a breakdown of how this typically happens and what occurred with the GBP/USD pair:

Market Reaction to Economic Announcements:

Anticipation and Speculation: Before a significant announcement, traders and investors form expectations based on forecasts and their interpretation of various economic indicators. This leads to speculation, which can cause fluctuations in currency values.

Immediate Response: Once the announcement is made, there’s an immediate response from the market. Traders quickly assess whether the actual news aligns with or contradicts their expectations.

Adjustment of Positions: Traders who had positioned themselves based on certain expectations might need to adjust rapidly if the actual news differs. This can lead to significant buying or selling of currencies.

Impact on Currency Pairs: For significant forex pairs like GBP/USD, this rapid adjustment can result in swift and substantial movements. These pairs are highly liquid, meaning large volumes can be traded without significantly affecting the price, but in scenarios like these, even liquid markets can experience sharp movements.

Specific Case: GBP/USD Movement:

When the GBP/USD moves 60 pips in one minute, it reflects a sudden and robust reaction to the news.

This kind of movement typically indicates that the news was unexpected to a significant degree. Perhaps the market anticipated a more hawkish stance from the Fed, and the actual announcement was perceived as less aggressive, weakening the USD against the GBP.

A move of 60 pips in such a short time suggests a rapid reevaluation of the GBP’s value relative to the USD. Traders might be buying GBP and selling USD quickly, believing that the new information has made the GBP more valuable or the USD less so.

This can also trigger automated trading systems, which are programmed to act on specific news triggers, exacerbating the movement.