Difference between passive income and residual income

Passive income is income earned with little or no effort. Residual income is a form of passive income, which entities earned without any effort. Residual income comes from building any asset that continues to pay you after the work has been done. So, what is the passive residual income in practice? For example, a songwriter can write a song, and the next 50 years can receive compensation for that song without any additional effort, without any additional work.

Residual income vs. Passive income

A business entity or person’s income is the money they receive to make an investment or provide a service. Though they are sometimes used interchangeably, investors, professionals, and employees should know the difference between passive income and residual income. Passive income is the income that a person makes with very little or no regular effort required. While the residual income may be from passive income sources, passive income is not always residual. Residual income is the discretionary income available for spending to the organization or person. This income is the amount that is available to the person after all the bills and financial obligations are paid. Specifically, forex traders should be aware of how the forex residual income is calculated.

Forex residual income

Forex residual income represents any passive income (dividend income, income from the invested fund, receive profitable signals from other traders, PAMM, etc.) that traders can earn during some period. Usually, forex residual income can be earned using expert advisors or signal services in the forex trading industry. The trader usually pays programmers to create trading expert advisors or use forex signals to generate profit. However, profitability is not so high, and it is in the range from 15% to 60% portfolio gain per year (based on risk level).

What is the Forex residual income chart?

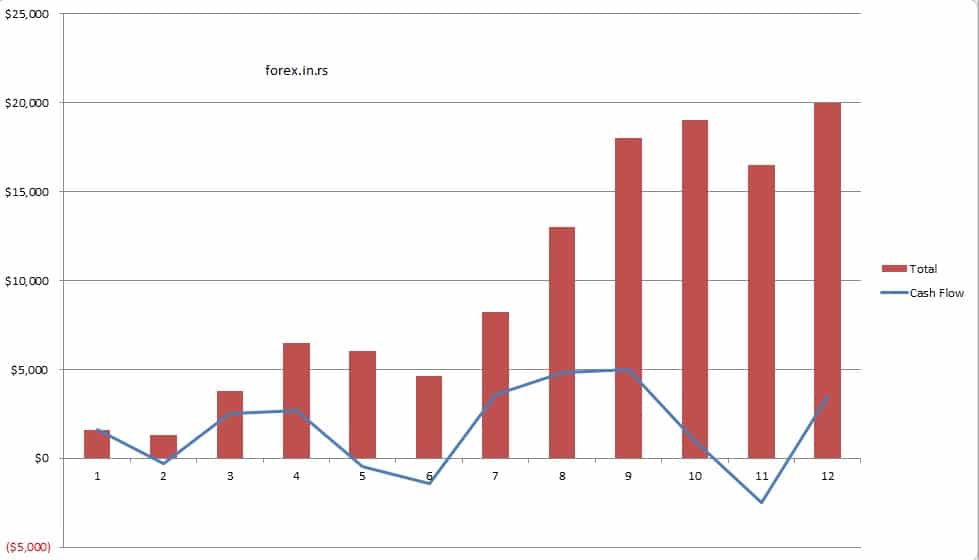

Forex residual income chart represents a Period (months) chart on the x-axis and a cash flow on the y axis. Using this chart, traders can track monthly income during the year.

See the example below:

For example, the trader had these trading results during last year:

| Month | Cash Flow | Total |

|---|---|---|

| 1 | 1600 | 1600 |

| 2 | -300 | 1300 |

| 3 | 2500 | 3800 |

| 4 | 2674 | 6474 |

| 5 | -450 | 6024 |

| 6 | -1400 | 4624 |

| 7 | 3600 | 8224 |

| 8 | 4800 | 13024 |

| 9 | 5000 | 18024 |

| 10 | 1000 | 19024 |

| 11 | -2500 | 16524 |

| 12 | 3450 | 19974 |

Forex residual income chart is:

Passive Income – earn while you sleep.

Individuals and companies will earn their passive income regularly, with very less or no additional effort. Investments and peer-to-peer lending are some of the sources of passive income. For tax purposes, passive income is treated differently from the earned income by the Internal Revenue Service(IRS) since it is received from an entity in which the investor is not involved. The salaries, wages, commissions, bonuses, and tips received are earned since they are working to make money. However, for a passive income, the person is an investor, silent part, lender, not the business owner or management.

Persons who have a large enough passive income can have enough free time to do whatever they wish instead of working. Though it is risky to establish a source of passive income initially, it also leads to increased financial security. A passive income source is a great security source since it is not linked to a person’s time. Even if the amount is not large enough to permit a person to leave his day job, it is good to have an additional income source to supplement the earned income. Having a large source of passive income can greatly improve the quality of life, especially for a person with more debt or if the person has a dependent who is unwell.

If the investor does not have to spend much time managing his rental property and profit from it, it is a passive income source. Stocks/shares which are paying a dividend annually are another source of passive income. Though the investor must spend time to find a suitable stock and purchase it, no additional effort is required.

Residual Income in the Finance industry

In some cases, legal entities may have a residual income earned without additional effort from passive income sources. However, the residual income is calculated differently based on whether it is required for equity valuation, corporate finance, or personal finance. More details are provided below:

Personal Finance and residual value

The amount of money available to the individual after paying the expenses and personal debt is the residual income for personal finance calculations. The income level is used to determine whether a potential borrower will be able to repay the loan. To determine whether the loan applicant will be able to afford the mortgage, the bank will calculate the applicant’s residual income and compare it with the cost of living in the area. The residual income is calculated by subtracting the mortgage payment, taxes, insurance, credit card bills, installment, and student loans from the applicant’s monthly income. The remaining amount is the residual income and does not consider food, utility expenses.

Corporate finance and residual value

Incorporate finance; residual income is calculated as the company’s profit or net income, exceeding the specified return rate. A company must pay the cost of its capital, and the remaining profit is the residual income. This income is used for assessing the performance of a business unit and determining the capital investment required.

Equity Valuation and residual value

For equity valuation purposes, the residual income is derived from the valuation method and income stream to determine a particular stock’s value. This valuation model for residual income determines a company’s value by combining the book value with the present value of the residual income expected in the future. The residual income is calculated after deducting the capital cost from the net income.

The same rule we can see for forex residual income is the same as for stocks. Automated strategy can bring profit to forex traders as the residual value.

When the residual income is used for the valuation of investments, it is obtained by subtracting the net income amount’s minimum return rate.