Table of Contents

Like any financial instrument, trading gold involves a deep understanding of its market dynamics, factors influencing its price, and how various economic reports impact its value.

What is The Best Time to Trade Gold?

The best time to trade gold is when European Session overlaps with the US session from noon to 4 PM GMT (8 EST to 12 EST) because of high liquidity and stronger forming trends. Additionally, the inflation report, the FED interest rate announcement, and the NFP employment report directly impact gold prices and can present an excellent time for gold trading.

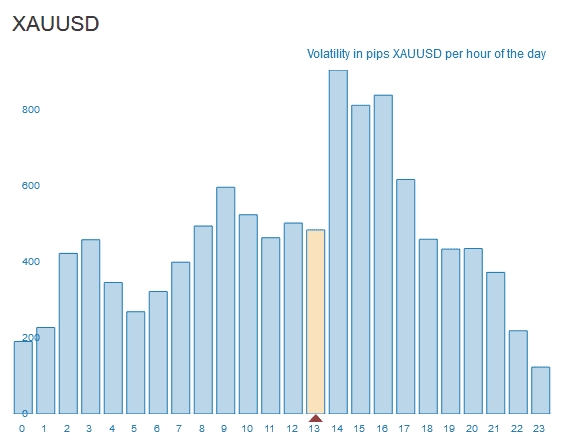

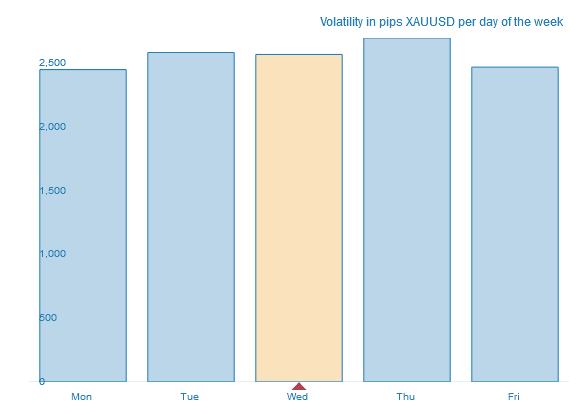

In our analysis of How Many Pips Does Gold Move in a Day, we saw exciting statistics that justify the best time for gold trading.

See gold volatility research:

And if we analyze days:

See the video that I published on youtube:

Let us analyze each segment:

Geographical Importance of the European and US Sessions

- Major Financial Centers: The European and US trading sessions encompass some of the world’s primary financial hubs. London, in particular, is a critical player in the European session and is considered the world’s largest financial center for foreign exchange. The US session, primarily centered around New York, represents the second-largest forex hub.

- The volume of Trading: Due to the concentration of financial institutions, banks, and trading entities in these regions, a significant portion of daily trading volume in forex and commodities, including gold, occurs during these sessions.

The Overlap and Its Effects on Liquidity and Trends

- Increased Liquidity: Liquidity refers to the ease with which an asset, like gold, can be quickly bought or sold without causing a significant change in its price. While the European and US sessions overlap, the market witnesses a surge in trading volume. This is because traders from both major financial hubs are active simultaneously. High liquidity benefits traders as it often results in tighter bid-ask spreads, meaning the cost of trading (in terms of the difference between buying and selling prices) is lower.

- More robust Forming Trends: With many participants in the market, price trends, whether upward or downward, tend to be more pronounced and more evident during the overlap. This is due to traders’ collective decision-making from Europe and the US. A clear trend is advantageous for traders because:

- It provides more predictable price movements.

- Traders can capitalize on the momentum of the trend.

- It reduces the “noise” or random price movements, making technical analysis more reliable.

- Economic Data Releases: Significant economic data is often released during these hours. For instance, the US might publish vital economic indicators in the morning (US time), still within the European trading session. Such data can substantially impact gold prices, especially if they pertain to interest rates, inflation, or overall economic health. With European and US traders reacting to this data simultaneously, it can lead to pronounced price movements and trends.

Gold Trading Time and Inflation Report

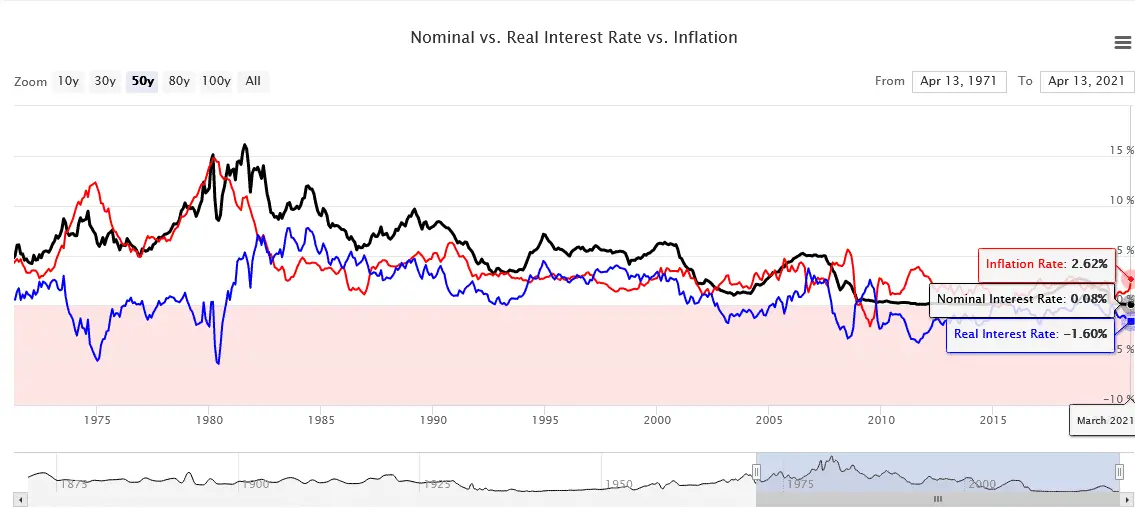

The inflation report plays a pivotal role in influencing gold prices and is keenly watched by traders and investors alike. In essence, inflation represents the rate at which the general level of prices for goods and services, thereby eroding the purchasing power of money.

Historically, gold has been perceived as a hedge against inflation. As inflation increases, the value of fiat currencies, like the USD or EUR, diminishes. This means that you would need more of the same currency over time to purchase the same goods or services. Gold, a tangible asset with a limited supply, often retains its value or even appreciates during inflationary periods. This makes it a preferred safe haven for investors looking to preserve their wealth when paper currencies are falling.

Gold is traditionally viewed as a hedge against inflation, as its value tends to remain stable or rise when the purchasing power of fiat currencies decreases.

When an inflation report is released, and the inflation rate is either higher than expected or shows a rising trend, investors and traders often flock to gold. This surge in demand can drive up gold’s price, providing a potential profit opportunity for those already holding or trading the commodity. Conversely, if the inflation report indicates a lower-than-anticipated inflation rate or a decline, the immediate appeal of gold as a hedge might decrease, potentially leading to a dip in its price.

Additionally, the inflation report can have implications beyond just the immediate numbers. It can indicate the overall health of an economy and influence central bank decisions regarding monetary policies, such as interest rate adjustments. For instance, central banks might contemplate raising interest rates to curtail rising inflation. Higher interest rates tend to boost the attractiveness of yield-bearing assets, making them more appealing than non-yielding ones like gold. Traders, in anticipation of or in reaction to such potential policy shifts, might adjust their gold trading strategies accordingly.

FED interest rate and Gold Trading Time

The relationship between the Federal Reserve’s (FED) interest rate decisions and gold trading is direct and multifaceted. The FED’s interest rate, often called the federal funds rate, is the interest rate at which banks lend money to each other overnight. It plays a pivotal role in influencing the broader economy, including the value of the U.S. dollar and the attractiveness of various investment assets, including gold.

Gold’s value often inversely correlates with FED interest rate decisions, as rate hikes strengthen the U.S. dollar and reduce gold’s appeal as an inflation hedge.

When the FED raises interest rates, it generally increases the yield on dollar-denominated assets, making them more attractive to investors. Higher yields on bonds or savings accounts can pull investors away from non-yielding assets like gold. This is because, with rising interest rates, holding gold, which doesn’t offer interest or dividends, becomes less attractive than other assets that benefit from higher rates. As a result, gold prices might experience downward pressure.

Conversely, the returns on dollar-denominated assets might decrease when the FED cuts interest rates or maintains a dovish stance. In such a scenario, gold becomes more appealing as a store of value and a hedge against economic uncertainty. Lower interest rates often suggest economic challenges, and in such times, investors traditionally flock to gold as a haven, potentially driving its price up.

Therefore, the periods leading up to and following FED interest rate announcements can be optimal times for gold trading. Traders often anticipate FED decisions and position themselves accordingly. They might reduce their gold holdings or short gold if they expect a rate hike. On the other hand, if they anticipate a rate cut or dovish sentiments, they might increase their gold positions.

Moreover, FED interest rate decisions don’t operate in isolation. They’re intertwined with broader economic data, geopolitical events, and monetary policies of other major economies. All these factors combined can influence the demand for gold and, by extension, its price.

NFP Report and Gold Trading Time

The Non-Farm Payroll (NFP) report is one of the most anticipated economic indicators released monthly in the United States. It represents the total number of paid workers in the country, excluding farm employees, private household employees, and employees of nonprofit organizations. As such, the NFP offers a snapshot of the employment health of the U.S. economy and, by extension, gives clues about its overall vigor.

Gold prices can be influenced by the U.S. Non-Farm Payroll (NFP) report, with solid employment gains typically boosting the U.S. dollar and pressuring gold downward, and vice versa.

Gold, precious metal and a traditional safe-haven asset, is sensitive to economic indicators that affect the strength of the U.S. dollar and the broader economy. The link between the NFP report and gold trading arises from how the employment data can shape economic expectations and influence investor sentiment.

When the NFP report shows substantial job gains, surpassing market expectations, it typically signals a robust economy. Such positive data can bolster the U.S. dollar, strengthening it against other currencies. A stronger dollar can exert downward pressure on gold prices as gold becomes more expensive for holders of other currencies. Furthermore, a thriving economy often boosts risk appetite, making riskier assets like equities more attractive. This can lead to a reduced demand for safe-haven assets like gold.

On the other hand, if the NFP report falls short of expectations or shows a decline in employment numbers, it can raise concerns about the health of the U.S. economy. In such situations, the U.S. dollar might weaken, making gold more appealing and affordable to investors holding other currencies. Additionally, signs of economic slowdown or uncertainty increase the allure of gold as a protective asset, potentially driving its price up.

Given the potential for significant market movements following the release of the NFP report, the time around its publication can be considered a prime period for gold trading. Traders often position themselves in anticipation of the report, making predictions based on other economic indicators or trends leading up to the NFP’s release. After the report is made public, there can be immediate and sometimes volatile reactions in the gold market, offering trading opportunities.

In essence, the NFP report, by providing insights into the U.S. employment landscape, plays a significant role in shaping investor sentiment and influencing gold prices. Gold traders watch the periods leading up to and following its release keenly, looking to capitalize on potential price shifts. However, as with all trading based on economic releases, traders must exercise caution, conduct thorough analyses, and implement robust risk management practices.

Conclusion

Gold is not just a commodity; it’s also viewed as a financial instrument and a store of value. Therefore, its price isn’t solely based on supply and demand dynamics but also global economic sentiments, geopolitical events, and monetary policies. The overlap period between the European and US sessions captures a wide range of these influences, given the economic significance of the regions involved.

In conclusion, the overlap between the European and US sessions from noon to 4 PM GMT (8 EST to 12 EST) is deemed an optimal time to trade gold due to the increased liquidity and the more robust, more apparent trends observed during these hours. This can translate to more reliable trading signals and potentially more profitable opportunities for traders.