Table of Contents

Annuities are a crucial part of the portfolio for any trader, as it is sheltered from taxes and help the capital grow without hefty penalties. However, they are tricky to understand due to their foundation in the life insurance field. Hence, if you have an annuity in your portfolio, it would be better to use it for a different purpose or change it into an IRA. This is possible if you are fully aware of the formalities attached to the process.

What are qualified annuities?

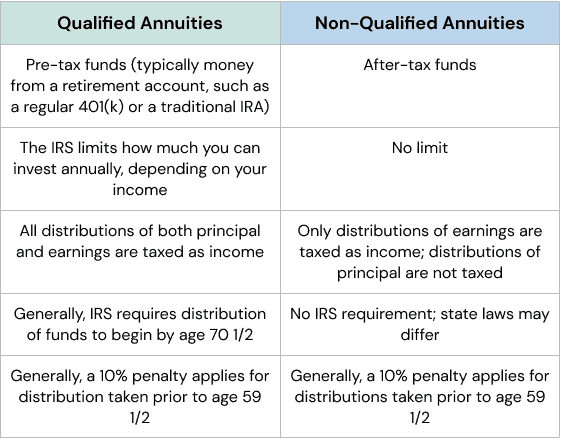

Annuities represent retirement savings plans funded with pre-tax dollars, similar to Roth IRA. Your contributions are made in after-tax dollars to avoid any deductions for your contributions.

Moreover, you will not be required to pay taxes if you contribute to the plan. Qualified annuities are included in a 401(k)/ 403(b) plan, which is eligible for tax deductions. This is not the natural choice as it is already a tax-sheltered option, but some employers give it as an investment alternative. Hence, if you have an annuity in the qualified plan, you can transform it into an IRA; if not, take it up with the IRS.

(Read our article Augusta Precious Metals Review and How is Gold Taxed in an IRA to learn more about this topic.)

Can You Roll an Annuity Into an IRA?

Yes, you can roll over an annuity established with pre-tax dollars into a traditional IRA. However, you can roll over only qualified variable annuities. Usually, If you apply for rollover, the annuity company will make an electronic payment or issue you a check for the total value of your annuity.

What is a non-qualified annuity?

A non-qualified annuity or “after-tax retirement annuity” represents a retirement plan you pay for with after-tax money. Remember, non-qualified annuities are not tax-deductible.

This kind of annuity is the most prominent and the one that is the most tricky to get the money from. The invested money is not taxed as you already paid after-tax dollars as a premium. However, your profits are taxable, just like normal income. Hence, after you turn 59 ½ years old and cash out the amount, you will be obliged to pay 10% in taxes. You can also incur a surrender fee if you have owned the annuity for lesser years. Hence, you will pay the taxes and penalties and will not be able to transform your annuity into an IRA.

Meaning of rollovers and transfers

The best way to convert an annuity to an IRA is to transfer the money from the annuity to the IRA. All you have to do is notify the companies that own your holdings and oblige with some formalities. The money will easily be transferred, and you won’t have legally binding responsibility for it! If you want to do this through a rollover, you will get a check or e-payment for your annuity’s value. You can add this money to your IRA within 60 days to avoid penalties. Or you will incur taxes on it, like a non-qualified annuities fund.

(Read our article Gold IRA Rollover to learn more about this topic.)

Other options

If your money is a fixed rate annuity, you can still acquire high returns through equity investments. In this manner, almost every company will allow you to transform your annuity into a variable annuity. These annuities invest in mutual funds or other financial investments to get greater returns without heavy penalties. If your current annuity has a high fee and too many limitations, you can use the 1035 advantage to transfer it to another company. However, ensure that the transfer to another company does not put you in the same situation again, as all your work will be for nothing then.

(Read our article What is Gold IRA? to learn more about this topic.)