Most companies require some money to fund they are the investments they require for growth, to repay debt and keep as cash reserves so that they can pay expenses in the future. Instead of taking a loan or using debt to get these funds, most companies are keeping some of the profit they are making to make these payments or reinvestments. Investors and shareholders can get information on the amount of profit a company is retaining for its growth, expense payment by checking the Dividend Payout Ratio (abbreviated as DPR) of the company which is usually specified in the lower section of the income statement of the company.

Payout Ratio Definition

What is the dividend payout ratio? The dividend payout ratio or DPR is a ratio of the dividend amount, which a company pays to its shareholders when compared to the net income of the business. The part of the net income which is not paid out to the investors is described as retained earnings of the company. This ratio is relevant for investors while making a decision in investing in a company. Investors can decide where they wish to invest in a company that pays large dividends or a business that has more growth potential. People should be aware that the DPR is different from the dividend yield, which the ratio of the dividend payout to the share price of the company at present.

How to calculate dividend payout ratio?

Dividend payout ratio calculation

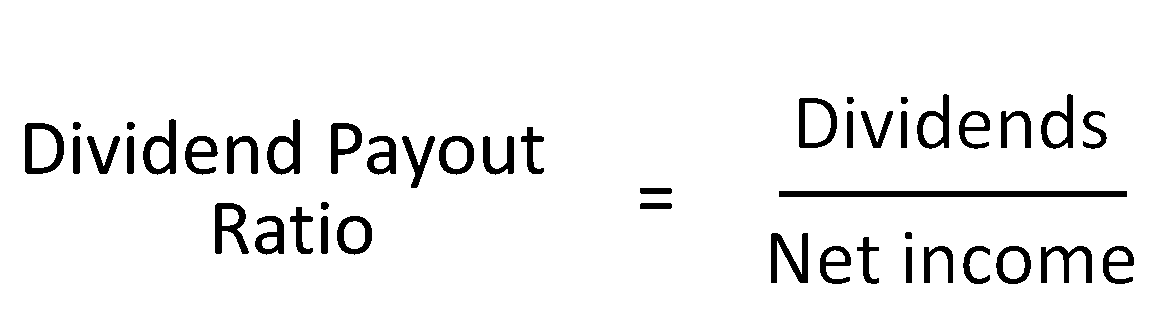

Dividend payout ratio = Dividend Payout (DP) / Net Income (NI)

Below is Dividend payout ratio formula:

Dividend payout ratio calculation video:

The formula for calculating the DPR based on the Dividend Payout (DP) and Net Income (NI) is as follows. DPR = DP/NI . The dividend payout can be calculated from the information in the balance sheet, which specifies the Retained earnings (RE) at the beginning of the financial year, and also the REclose, the retained earnings at the end of the financial year. DP = (NI + RE) – REclose. Assuming that a company is making some profit, the DPR helps the investor to decide whether he is interested in a steady income from dividends or wishes to reinvest the dividend so that the earnings in future are higher.

What is a good dividend payout ratio? The optimal dividend payout ratio is between 30% and 60%. When dividend payout ratio is too high (for example DPR is more than 100%) that means that the company pays out more in dividends than it earns.

What is a typical dividend payout ratio? It is around 30%.

Dividend payout ratio calculator

DPR vs Retention ratio

Another ratio that is related to the DPR is the retention ratio, which indicates the ratio of the income retained by the company after paying out the dividends to the shareholders. It is easy to calculate the retention ratio, only the DPR should be subtracted from one. i.e Retention ratio = 1 – DPR. Some investors are more interested in finding out the growth prospects of a company since the share prices and dividends are likely to increase in the future. Hence these investors will be more interested in the retention ratio. On the other hand, investors interested in a regular dividend income will check the DPR for the last few years.

DPR vs Dividend yield

Many investors who wish to have a steady income are focusing on the dividend yield for the company. However, they should be aware that if the DPR is more than 100%, it may not be a good sign, since it may not be sustainable in the future. When the DPR is more than 100%, the company is payout part of the dividend from its cash reserves, which are likely to get exhausted soon. So while a company may have a DPR greater than 100% for one year or a few years to keep investors happy, they will have to reduce the DPR after some time.