A remaining balance formula is a valuable tool for calculating the remaining balance of a loan or other type of debt after making a series of payments. However, we traders can see this very often in stock reports.

What does the remaining balance mean?

The remaining balance represents the unpaid portion of a loan, debt, or credit card. The remaining balance formula is used to find the remaining balance on loan at any given time. For example, this formula can determine the loan’s final remaining balance. This formula can be used in the present or to calculate the value at a future date.

Finding the remaining balance on a loan can only be used with amortized loans. Amortized loans are a specific type of loan unique to other types. If the interest and principal applied to the loan are predetermined, the remaining balance formula can be utilized.

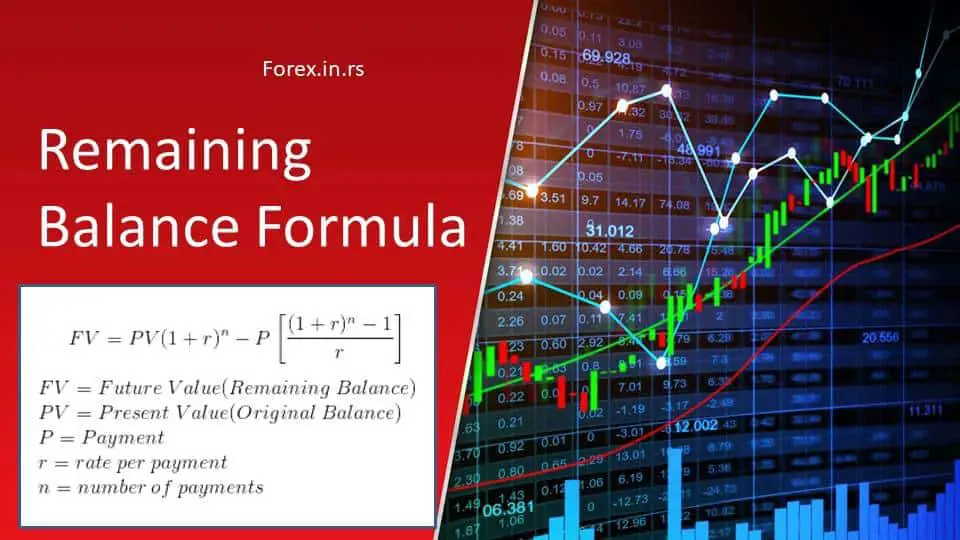

The Remaining Balance Formula

The remaining balance formula represents the difference between the future value of the original loan amount (minor) and the future value of the annuity (diminutive). If no payments were made, the loan amount’s future value determines the value at time n.

Remaining Balance Formula text:

FV = PV (1+r)^n – P((1+r)^n -1/r), where FV is the future value or remaining balance, PV is the present value or original balance, P payment, r rate, and n is the number of payments.

The remaining balance formula example in the video below is used to show how to calculate loan balance in the future:

Calculate the remaining loan balance formula. Example

Suppose you have taken out a $10,000 loan with a 5% annual interest rate to be paid back over five years (60 monthly payments). After making 12 monthly payments of $200 each, you want to calculate the remaining balance on the loan.

To calculate the remaining balance, we can use the remaining balance formula:

RB = P * (((1 + r)^n) – ((1 + r)^p)) / (((1 + r)^n) – 1)

Where:

- P = principal amount of the loan ($10,000 in this case)

- r = monthly interest rate (5% divided by 12, or 0.0041667)

- n = total number of payments (60 in this case)

- p = number of payments made so far (12 in this case)

Substituting the values into the formula, we get:

RB = 10,000 * (((1 + 0.0041667)^60) – ((1 + 0.0041667)^12)) / (((1 + 0.0041667)^60) – 1)

Simplifying the formula, we get the following:

RB = $7,953.64

- Initial Loan Amount (P): The principal amount or the original sum of money borrowed.

- Annual Interest Rate (r): This is the interest rate charged on the loan, usually given as a percentage. For calculations, it needs to be converted to a decimal by dividing by 100.

- Number of Payments per Year (n): This represents how many times you pay in a year. For example, monthly payments would mean

- Total Number of Payments (N): This is the total number of payments to be made over the life of the loan. It’s calculated as the number of payments per year multiplied by the number of years of the loan.

- Payment Amount (A): The amount paid in each installment can be calculated using the loan payment formula if not provided.

- Number of Payments Already Made (t): How many payments have been made when you want to calculate the remaining balance? This formula considers the compounding of interest over time and the reduction of the principal amount with each payment.

- Application of the Formula: To use this formula, substitute the respective values for P, r, n, N, A, and t. The result will give you the remaining balance on the loan.

- Importance of Timing: The timing of payments affects the calculation. The formula assumes payments are made at regular intervals (e.g., monthly) and at the end of each period.

- Understanding Amortization: This formula is often used in an amortizing loan, where each payment covers the interest expense plus a portion of the principal amount.

To implement this calculation in Python, we can create a function that takes in the loan principal, monthly interest rate, total number of payments, and number of payments made so far as inputs. The process can then output the remaining balance calculated using the formula.

This implementation takes in the inputs of the loan principal, monthly interest rate, total number of payments, and payments made so far. It returns the remaining balance calculated using the formula. In this case, the output is $7,953.64, which matches the result calculated manually.

The “future value” can often be challenging regarding the formula and the remaining balance. The balance after the payments have been made is known as the future value. Future value is a value that is estimated to be accurate once the settlements have been made. This is a crucial step to achieving a successful loan term. The interest rate and term must relate to each other to ensure the loan is paid back consistently. This principle is the same as most financial formulas, enabling structure and accuracy.

It is also essential to ensure monthly rates are calculated every month versus annually. This is important as it allows for accurate monthly payments. The remaining balance on the loan is shown for conventional loans. This means that when the payment amount, rate, and term are fixed, this formula works best. Conventional loans are different from other types of loans. Some qualities of a specialized loan are an option, graduated payment, and negative amortization. These terms will require particular calculations that differ from the overall conventional loan.

The most common uses for the remaining balance formula are consumer loans, mortgages, and commercial loans. Consumer loans, mortgages, and commercial loans benefit from the procedure to find the loan term’s accurate balance. The amount of funds spent does not affect the calculation of the remaining balance. This is important to understand as it helps pay the loan back according to the specific terms.

Solving the equation for the remaining balance formula requires two sections. The first section is the FV of the original. The second section is the FV of the annuity. The variable would be “N” when no payment was made. The second section of the overall formula would be future value. The payments’ future value is calculated until the “N” variable. The last step is subtracting the FV of the payment made from the original payment balance. This equation can be used to determine the overall remaining balance. The most common uses for this formula are mortgages, which allow for a remaining balance to be calculated to pay back the loan fully according to the specific loan terms agreed upon.