The M&A (mergers and acquisitions) process refers to the series of steps that companies go through to buy or sell other companies, assets, or business units. M&A transactions can take many forms, including mergers, acquisitions, divestitures, and joint ventures.

The M&A process typically begins with identifying a potential target company or asset that a buyer is interested in acquiring. This may involve conducting market research, analyzing financial statements, and performing due diligence to evaluate the target’s strengths and weaknesses.

What is an Indicative offer?

An indicative offer or non-binding offer, or Letter of Intent (LOI) represents a preliminary proposal by a potential buyer to a seller that outlines the basic terms and conditions of a possible transaction. An indicative offer is typically made early in the M&A (mergers and acquisitions) process before a definitive agreement has been reached.

Using indicative offers, potential buyers express an interest, commit to good faith negotiations, and ensure the process’s confidentiality. The document will hold information about the buyer’s intent to buy specific products/services from the seller later. However, the buyer is not legally bound to make the purchase. Thus, this offer keeps the negotiation and discussion moving between the parties to make the sale process successful and hassle-free.

A binding obligation or a definite legal, contractual commitment only comes to play when both parties sign any document acting as a definitive agreement, i.e., PSA or Purchase and Sales Agreement.

An indicative offer is one of the best ways to keep the buyer and seller on the same page before the transaction. A potential buyer draws up this term sheet to stand out from other buyers by stating that they can meet any terms/conditions laid down by the seller.

Components Of Indicative Offer

An indicative offer is a non-binding proposal a buyer makes to a seller that outlines a potential transaction’s basic terms and conditions. Here are the components of an indicative offer and their explanations:

- Offer Price: This is the proposed price the buyer is willing to pay for the asset or business being sold. The offer price can be a fixed amount or a range of values that can be adjusted based on due diligence findings.

- Payment Terms: The payment terms outline how the buyer intends to pay for the asset or business. This can include cash, debt, equity, or a combination of these payments. The payment terms can also include any conditions or contingencies related to financing, such as the need to secure financingefore the transaction can close.

- Timing: The timing component of an indicative offer outlines the proposed timeline for completing the transaction. This can include important dates such as the proposed closing date, when due diligence is to be completed, and when any required approvals are to be obtained.

- Due Diligence: Due diligence reviews all relevant information about the asset or business being sold. The indicative offer should outline the required due diligence and information the buyer needs to complete the process.

- Contingencies: Contingencies are conditions that must be met before the transaction can be completed. The indicative offer should outline any contingencies the buyer has, such as the successful completion of due diligence, regulatory approvals, or resolving any outstanding issues.

- Non-Disclosure Agreement (NDA): An NDA is a legal agreement that protects the seller’s confidential information. The indicative offer may include an NDA that the buyer must sign before sharing personal information.

- Exclusivity Period: An exclusivity period is a periodwhenler agrees not to negotiate with any other potential buyers. The indicative offer may include an exclusivity period during which the buyer can deal with the seller.

A standard LOI will have the following components/characteristics:

Indicative Offer Pricing

A non-binding offer will hold the information regarding the potential buyer’s price for the said product/service. It can be a price range or a specific figure per the transaction’s nature and request from any parties involved. It will also have a summary stating how the buyer will acquire the amount. It may also display the period in which the buyer needs to earn that fixed amount. A buyer can know the different prices offered to the seller and decide based on the information provided.

Indicative Offer Payment Process

It will also contain a proper explanation of the terms of payment. It may also hold information related to non-cash considerations which the seller is comfortable with.

Indicative Offer Terms And Conditions

Indicative offers will have all the conditions parties must comply with during this phase. In addition, it will include any regulatory requirements and internal approvals that both buyer and seller must abide by. Here it should be mentioned that, in the case of any technical and specialized product, this contract will also include the support the seller must provide to the potential buyer to ensure that the complete buying and after-sales experience is ideal for the buyer.

Indicative Offer Timeline

It will also hold information about the fixed time period the buyer needs to purchase. Anything related to the total time to complete the process, the expected ending date of the contract, and the period of due diligence are mentioned to be well-informed and on the same page.

Indicative Offer Confidentiality

It also includes the complete assurance that the mentioned offer given by the buyer should be handled confidentially. It also consists of information the other party can disclose to facilitate the selling process.

Everything that both parties will be adding to the Indicative offer is drawn chiefly based on the details available from CIM (Confidential Information Memorandum). So, both the buyer and seller must sit through many management meetings and develop the offer’s conditions, satisfying both parties involved.

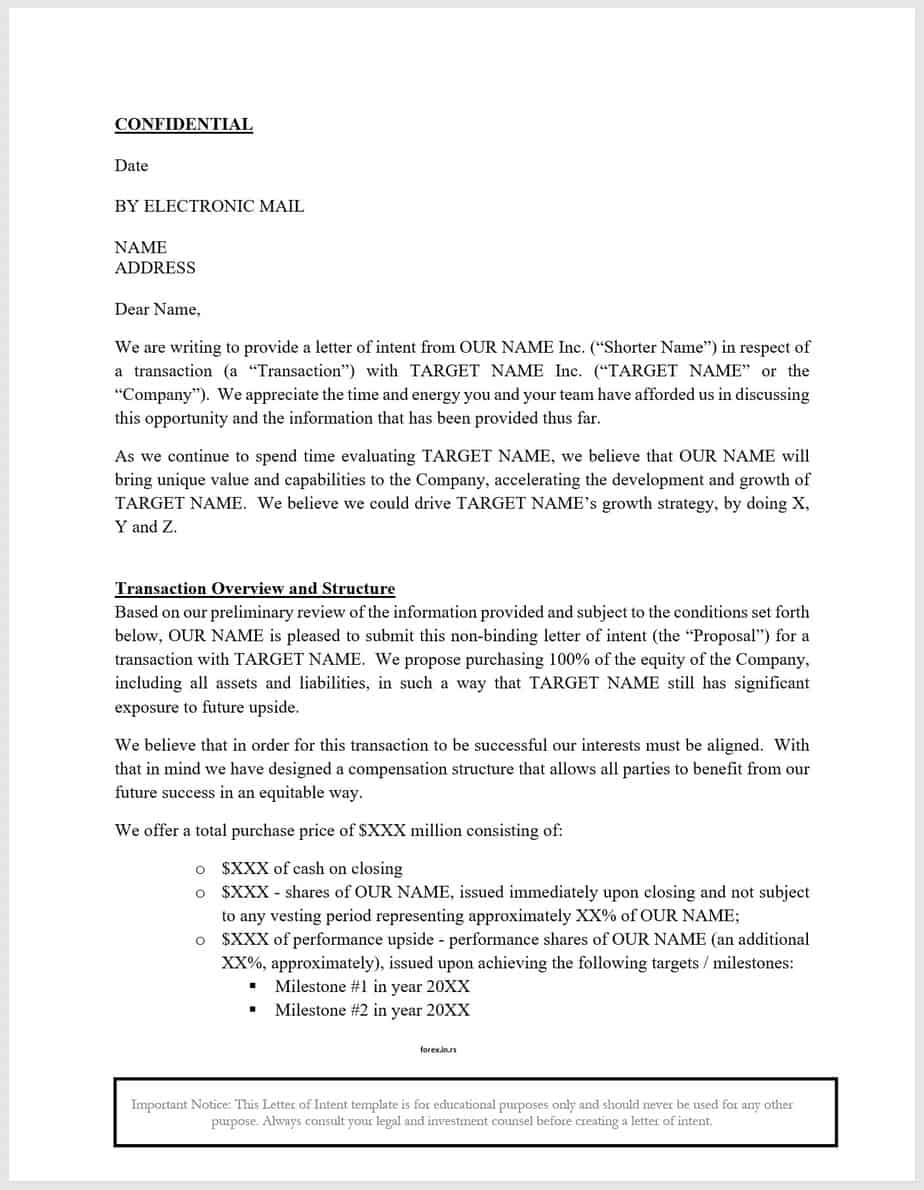

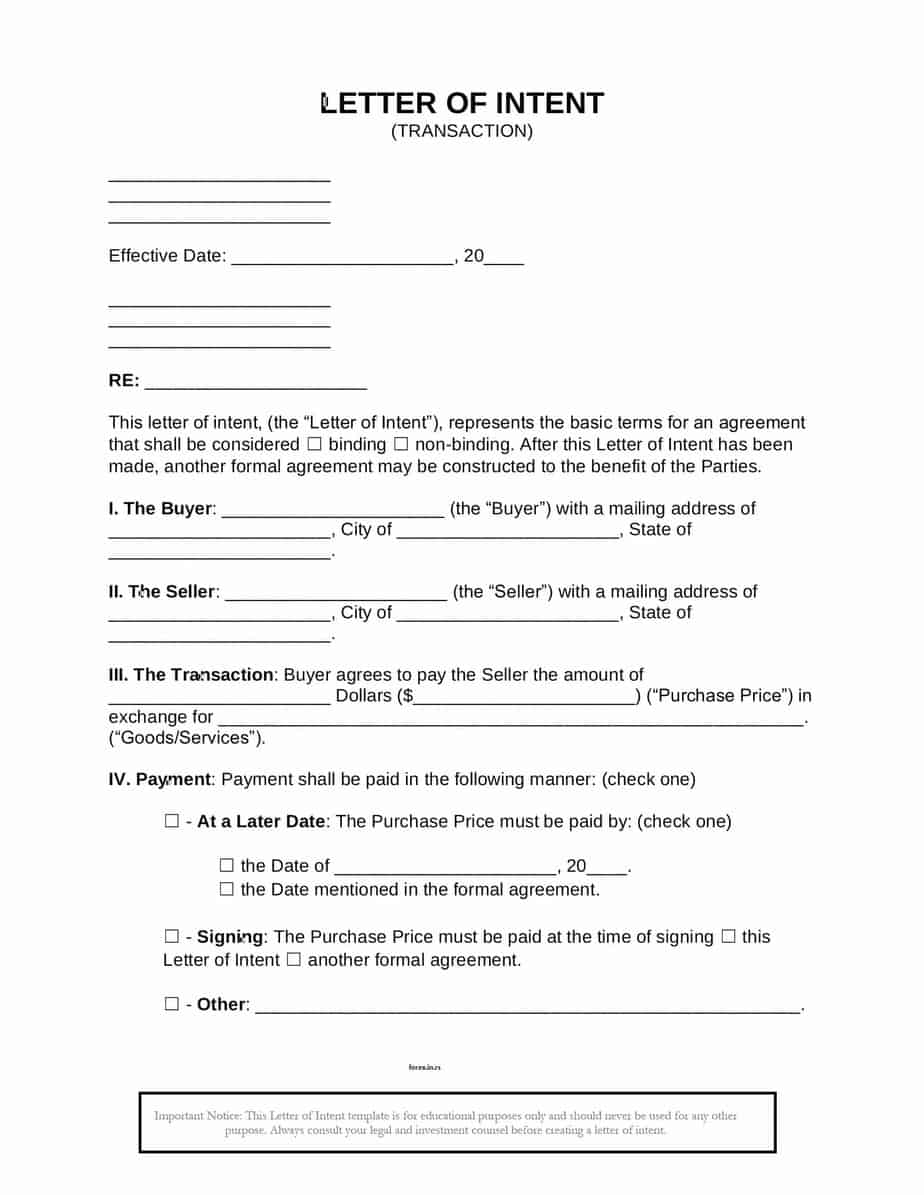

Indicative offer letter example

Below are two documents as indicative offer letters examples:

Conclusion

Indicative offers are a crucial component of the M&A process as they allow potential buyers to express their interest in a transaction and outline a possible deal’s essential terms and conditions. In addition, the indicative offer serves as a preliminary proposal that sets the stage for more detailed negotiations and due diligence.

By clearly outlining the offer price, payment terms, timing, due diligence requirements, contingencies, NDA, and exclusivity period, the indicative offer provides the seller with a clear understanding of the buyer’s intentions. It helps to establish a framework for further discussions. While the indicative offer is non-binding, it is an essential step in the M&A process that helps ensure both parties are on the same page and can move forward confidently.