Table of Contents

In the expansive realm of global financial markets, the foreign exchange (forex) market is distinguished by its unparalleled size, liquidity, and the ceaseless nature of its operations. Amidst this vast landscape, forex proprietary trading companies emerge as a distinct and fascinating segment. Unlike many others in the trading sector, these firms employ traders to deploy the company’s capital in the market, not the funds of external clients.

Essentially, they handpick talented traders and provide them with substantial resources, and in turn, these traders strive to generate profits. The symbiotic relationship sees traders gaining from vast capital exposure while the firm benefits from the collective success of its traders. It’s a high-stakes world of risk, reward, and rigorous strategy, where aligning a trader’s success with the firm’s creates a dynamic and captivating aspect of the forex market.

A prop trading company, short for “proprietary trading company,” is a specialized financial firm that trades financial instruments, such as stocks, bonds, commodities, or forex, using its capital rather than trading on behalf of clients.

You can learn more about instant funding prop firms on our page.

The primary objective is to generate profits directly from market activities. Traders employed by such firms are typically compensated based on their trading performance, and they operate within risk parameters set by the company. Unlike hedge funds or asset management firms, prop trading companies do not manage client funds or assets but instead focus exclusively on maximizing returns from their capital investments.

How to Start Forex Prop Firm?

To start a forex prop firm, you must register an LLC company and collect initial capital. Suppose you plan to run a prop company where you will hire traders. In that case, you need at least a million dollars to manage multiple portfolios, while if you plan to provide funded forex accounts, your initial minimum start-up capital should be at least $100K.

There are two types of prop companies. One type of prop trading company has several employed traders who work for a company for salary plus performance-based bonuses. However, in recent years, most forex prop companies offer funded forex accounts, and their profit correlates with trader fees. The forex-funded accounts business model is similar to the insurance business model.

Traditional Prop Trading Company:

Structure: These companies employ a team of traders who work in-house. They are provided company resources, tools, and capital to trade in the financial markets.

Compensation: Traders in this setup usually receive a base salary. On top of this, they get performance-based bonuses, typically a percentage of the profits they generate beyond a certain threshold.

Focus: Their primary goal is direct profit generation from trading activities, and they often operate in various markets, including stocks, bonds, commodities, and forex.

Forex-Funded Account Prop Companies:

Structure: These are more recent entrants in the prop trading landscape. Instead of employing traders traditionally, these firms provide aspiring traders with funded accounts. These traders might not be formal employees and might work remotely.

Compensation: These traders don’t receive a salary. Instead, they are provided with a trading account funded by the prop firm. Profits on these accounts are then split between the trader and the company at a pre-determined ratio. If traders incur losses beyond a specified limit, they might be stopped, and their agreement with the company can be terminated.

Revenue Model: These companies often profit from the trading profits and fees associated with the funded account. These fees might include training, monthly desk, or software/platform fees. The comparison to the insurance business model implies that these firms anticipate that while some traders will be profitable (and thus a liability in terms of profit-sharing), others will not be successful, similar to how insurance companies anticipate claims.

In the insurance model, companies collect premiums from many clients, expecting only a subset to make claims. Similarly, prop companies provide capital to many traders in the forex-funded account model, anticipating that only a subset will be consistently profitable. In contrast, others might lose or break even. The fees collected from all traders, successful or not, contribute to the revenue of the prop firm, just as insurance premiums do for insurance companies.

In summary, while traditional prop trading companies operate on a straightforward profit-generation model from market activities, forex-funded account prop companies blend trading activities with a fee-collection model, much like how insurance companies operate. This diversifies their revenue streams and hedges against the unpredictability of trading outcomes.

10 Steps How to Start Forex Prop Company that offers funded forex accounts

1. Market Research and Business Plan:

- Research the Demand: Gauge the demand for forex-funded accounts. Who is your target audience? Are they novices, experienced traders, or a mix?

- Competitive Analysis: Examine existing prop firms. What are their terms? What percentage splits do they offer? What are their fee structures?

- Draft a Business Plan: Outline your firm’s objectives, operational structure, anticipated expenses, and projected revenue.

2. Regulatory Compliance:

- Licensing: Depending on your location, you might need specific licenses to operate a forex business. Ensure you obtain these licenses to operate legally.

- Hire a Legal Consultant: Get advice on contract law, especially for drafting agreements between your firm and the traders.

3. Capital Allocation:

Given a startup investment of $100K:

- Reserve Capital: To fund traders’ accounts, keep a significant portion (e.g., 60% or $60K) as reserve capital.

- Operational Expenses: Allocate a portion (e.g., 25% or $25K) for operational costs such as office space (if needed), software, salaries, marketing, and other initial setup costs.

- Emergency Fund: Retain a portion (e.g., 15% or $15K) for contingencies and unexpected expenses.

4. Technology and Infrastructure:

- Trading Platform: Invest in a reliable trading platform. Consider white-label solutions if you’re not developing your own. Usually, forex prop companies offer MT4 and MT5. They make contracts with brokerage companies.

- Risk Management Tools: Essential for monitoring traders’ activities and ensuring they remain within set parameters.

- Educational Resources: Offering webinars, tutorials, and other educational materials can be a value-added service for aspiring traders.

5. Set Terms and Conditions:

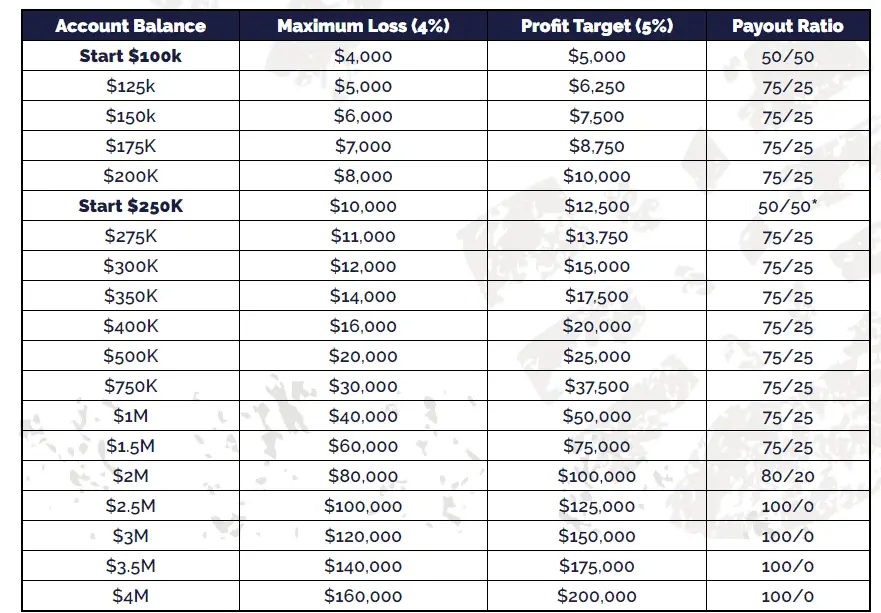

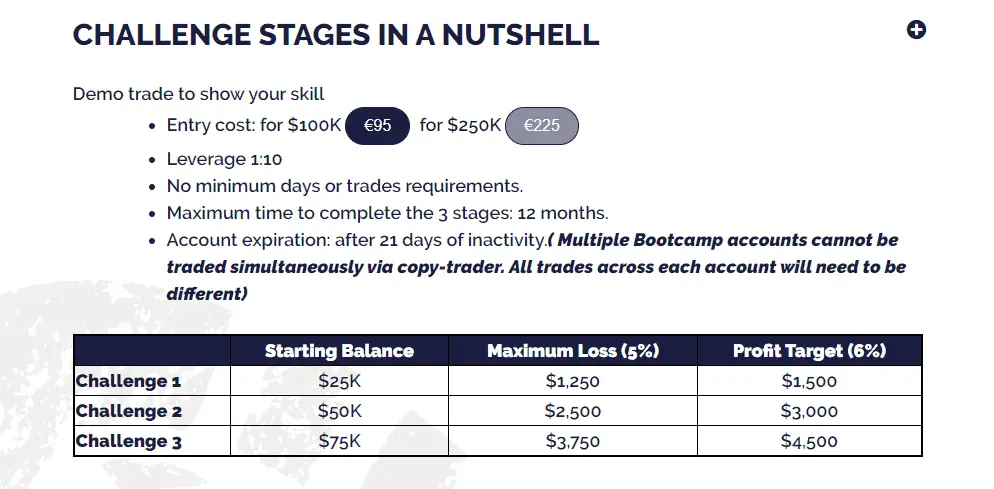

- Profit Split: Decide on the profit-sharing ratio between the firm and the traders.

- Fees: Determine any associated fees – software access, platform usage, training, etc.

- Trading Limits: Set maximum drawdown limits and other risk parameters to ensure traders don’t expose the firm to undue risk.

6. Marketing and Outreach:

- Branding: Design a professional website and logo. Consider creating promotional content like videos or blogs to attract traders.

- Outreach: Engage in social media marketing, attend forex trading events, or host webinars to create awareness.

7. Screening and Onboarding Traders:

- Screening Process: Develop a process to evaluate traders, possibly including a demo trading phase or a series of tests.

- Contract Agreements: Once traders pass the screening, have them sign an agreement detailing the trading arrangement terms.

8. Continuous Monitoring and Feedback:

- Performance Review: Regularly review the performance of traders. Offer feedback and possibly further training if required.

- Risk Management: Monitor your firm’s risk exposure and adjust strategies or limits as necessary.

9. Reinvestment and Expansion:

- Profits: As the business grows, consider reinvesting profits to fund more traders or enhance infrastructure.

- Diversification: Look into expanding into other markets or offering additional services, like advanced training programs or analytics tools.

10. Continuous Learning:

- Stay Updated: The forex market is ever-evolving. Stay updated with market trends, new tools, and trading strategies.

- Seek Feedback: Encourage feedback from traders and adapt based on their needs and market demands.

Remember, while starting a forex prop firm can be profitable, it also comes with substantial risks. Effective risk management and continuous evaluation of traders and market conditions will be crucial to your firm’s success.

Market Research and Business Plan for Prop Company

Market Research helps you understand the forex trading landscape, the competition, and the demand for forex-funded accounts.

- Understanding the Forex Landscape:

- Learn about the forex market’s size, significant players, and trading volumes.

- Understand the differences between currency pairs, including majors, minors, and exotics.

- Demand Analysis:

- Identify the target audience: Beginners, intermediate traders, or professionals.

- Survey potential traders or use online forums and platforms to gauge interest in forex-funded accounts.

- Competitive Analysis:

- List major existing prop firms and analyze their offerings.

- Understand their fee structures, profit splits, trading conditions, support services, and educational resources.

- Identify gaps in their services or areas where your firm can offer a unique value proposition.

- Regulatory Environment:

- Research the licensing requirements in your jurisdiction.

- Understand the legalities surrounding forex trading and how they might affect your business model.

- Technological Trends:

- Study the technological tools and platforms popular in the forex market.

- Recognize the importance of mobile trading, automated trading bots, and other technological advancements.

Business Plan for a Forex Prop Company

A Business Plan is your roadmap, detailing how the company will operate, generate revenue, and grow.

- Executive Summary:

- Please provide an overview of the company’s mission, vision, and goals.

- Briefly describe your primary services and value proposition.

- Company Description:

- Detail the structure of your company: Will it be a sole proprietorship, partnership, or corporation?

- Define the company’s primary services and any secondary or complementary services.

- Service Line Details:

- Describe in-depth the funded accounts you plan to offer.

- Detail the profit splits, fee structures, trading tools, and educational resources.

- Specify other services like mentorship, advanced analytics, or trade signals.

- Market Analysis:

- Summarize your market research.

- Describe your target audience, their demographics, and trading behavior.

- Present a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats).

- Marketing and Sales Strategy:

- Outline how you will attract traders to your platform.

- Plan for branding, online marketing, partnerships, or attending industry events.

- Describe your sales process: How will traders be onboarded? What is the process for profit withdrawal?

- Operational Plan:

- Detail the day-to-day operations: trading hours, support services, monitoring, and risk management procedures.

- Include technological infrastructure details, like which trading platforms you’ll use or if you’re developing proprietary technology.

- Management and Organization:

- Describe your team’s structure. If you have partners or key employees, detail their roles and expertise.

- If you’re starting solo, outline potential future hires as the company grows.

- Financial Projections:

- Provide a forecast of revenue, expenses, and profitability for the next 3-5 years.

- Factor in startup costs, recurring operational costs, expected trader profits, and company revenue from fees and profit splits.

- Appendix:

- Attach any supplementary information, such as traders’ surveys, mock-ups of your trading platform, or detailed SWOT analysis.

A robust Business Plan guides your operations and can also be instrumental if you’re seeking external investors or partners. Always remember to keep it updated as market conditions and company strategies evolve.

Regulatory Compliance for a Forex Prop Company (no obligation)

Prop company does not manage other clients’ money but should be somewhat regulated.

- Licensing and Registration:

- Depending on your jurisdiction, you will need a specific license to operate a forex business. This might involve obtaining a broker’s license, even if you aren’t offering traditional brokerage services.

- Regulatory bodies in major forex hubs include the U.S. Commodity Futures Trading Commission (CFTC), the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and others depending on the region.

- Capital Requirements:

- Some jurisdictions require forex businesses to maintain a minimum amount of liquid capital. This ensures the company can meet its financial obligations, especially if things go awry. The exact amount can vary significantly between countries and is often proportional to the size and scope of the company’s operations.

- Risk Management:

- Regulators often require forex businesses to have robust risk management procedures in place. This can involve setting maximum leverage ratios, ensuring that traders’ positions are automatically closed if their losses exceed a specific limit, and other measures to prevent catastrophic financial losses.

- Transparency and Reporting:

- Regular reporting to the regulatory bodies might be mandatory. This includes financial statements, lists of traders, details about the company’s risk exposure, and more.

- Companies might also be required to undergo periodic audits.

- Client Protection Measures (traders are clients):

- This is especially relevant if the prop company holds traders’ funds. Regulations might dictate how these funds are held (e.g., in segregated accounts) and set out rules for fund withdrawals, dispute resolution, etc.

- Some jurisdictions also have compensation schemes to protect clients if a forex business becomes insolvent.

- Educational and Marketing Standards:

- Any educational material or marketing communications the company disseminates might be subject to regulatory standards, for instance, ensuring that advertising is not misleading, clearly representing the risks associated with forex trading, etc.

- Conduct and Ethics:

- Employees, especially those in decision-making roles, might be required to adhere to specific conduct standards, ensuring they act ethically and in the best interests of the traders and the broader financial market.

- Hire a Compliance Officer:

- Especially for more extensive operations, hiring a dedicated compliance officer can be beneficial. This person will be responsible for ensuring the company adheres to all regulatory requirements, stays updated on any changes to relevant laws or regulations, and acts as a liaison with regulatory bodies.

- Legal Consultation:

- Before starting operations, consulting with legal experts specializing in forex or financial services is advisable. They can guide you through the registration process, help draft contracts (like those between the company and traders), and ensure that your operations are compliant from day one.

- Continuous Training:

- Continuous training for your team is essential as regulations change and your business evolves. This ensures that everyone understands the regulatory landscape and the importance of compliance.

Capital allocation for Prop forex Company

Capital allocation is crucial to any startup’s strategy, especially for a Forex prop trading company. Given a startup investment of $100K, here’s a detailed breakdown of how one might allocate the funds:

1. Reserve Capital ($60K or 60%):

This portion primarily serves to fund traders’ accounts. Here’s why it’s essential and how it could be managed:

- Primary Purpose: The main allure of a forex prop trading company for many traders is the ability to trade with more capital than they have. By offering them a substantial fund to trade, you’re giving them the leverage to earn more while profiting from their successful trades potentially.

- Management:

- Diversification: Avoid allocating the entire reserve to one trader. Spread it among multiple traders to diversify risk. For instance, if you fund ten traders, you might give each $6K.

- Safety Measures: Establish strict risk management parameters. For example, if a trader loses 10% of their allocated capital, their positions might be automatically closed, and they might undergo a review.

- Periodic Review: Regularly review the allocation based on trader performance. Successful traders might be given more capital, while underperforming ones might get less or be delisted.

2. Operational Expenses ($25K or 25%):

These are the costs required to set up and run the company, especially during its initial months when revenues might be minimal.

- Office Space: Even if you begin as a virtual company, you might need a small office for administrative tasks or meetings.

- Software & Technology:

- Trading Platform: You might license a third-party platform or develop your own.

- Risk Management Tools: Vital for monitoring trader activity.

- Salaries:

- This includes employee compensation, such as a compliance officer, customer support representative, or yourself.

- Marketing:

- Branding: Logo design, website development, and other branding materials.

- Promotion: Costs for online advertising, attending industry events, or hosting webinars.

- Legal & Licensing Fees: These are for obtaining the necessary licenses and legal consultations.

- Miscellaneous: Other costs like utilities, internet, office supplies, and initial educational resources or training materials.

3. Emergency Fund ($15K or 15%):

This fund is essentially a safety net. The unpredictable nature of the forex market and business, in general, makes it essential.

- Unexpected Expenses: These could be sudden software upgrade requirements, hiring a specialist for a critical issue, or unforeseen regulatory costs.

- Market Volatility: If the forex market becomes particularly volatile, you might face situations where several traders hit their loss limits simultaneously. An emergency fund ensures you can cover these without impacting the central reserve.

- Business Contingencies: Examples include legal disputes, tech crises (like a data breach or cyberattack), or other unforeseen challenges.

- Long-Term Planning: This fund can be strategically employed if not utilized in emergencies. Maybe you’ll see an opportunity to expand, launch a new service, or invest in a valuable tool.

Efficient capital allocation ensures smooth day-to-day operations and safeguards the firm against potential pitfalls. It’s crucial to continuously review and adjust the allocation based on the evolving needs and circumstances of the business.

Trading Platform and Infrastructure for Prop Company

The trading platform is the central hub where all trading activity occurs. Its reliability, speed, and features can directly influence a trader’s performance and satisfaction.

- White-label Solutions:

- If you’re not inclined to develop a platform in-house, consider licensing a white-label solution. It’s a cost-effective way of obtaining a tried and tested platform without extensive development.

- Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widespread and trusted by traders worldwide. By offering these platforms, you align with industry standards, making it easier to attract traders.

- Contract with Brokerage Companies:

- Since prop firms don’t typically act as brokers, they must establish relationships with brokerage companies.

- This partnership allows traders in the prop firm to access the liquidity and trading infrastructure the broker provides while trading under the firm’s conditions and capital.

- Customization:

- Whether you choose MT4, MT5, or another platform, ensure it can be customized to fit your company’s brand and specific requirements.

- Features like custom indicators, expert advisors (EAs), and algorithmic trading capabilities can benefit advanced traders.

Risk Management Tools:

Every trading activity carries inherent risks. The right tools can help mitigate these risks by providing real-time monitoring and automatic interventions.

- Monitoring:

- These tools allow the company to monitor all trading activities in real-time. This includes overseeing open positions, margin usage, and profit/loss statistics.

- Automated Alerts:

- If a trader’s actions approach or breach set parameters, the system should automatically alert the trader and the firm’s management.

- Automatic Stop-Loss:

- Implementing features that automatically close positions when losses reach a certain threshold can protect the firm’s capital.

- Drawdown Limits:

- Setting a maximum allowed drawdown for traders ensures they don’t expose too much of the allocated capital to losses.

Educational Resources:

Knowledge is power, especially in the forex market. By offering educational resources, a prop firm enhances its value proposition and invests in its traders’ success.

- Webinars:

- Interactive sessions where experienced traders or industry experts discuss strategies, market analysis, or other relevant topics. They also offer a platform for traders to ask questions and interact with the firm and each other.

- Tutorials:

- Step-by-step guides on various aspects, from using the trading platform efficiently to understanding complex trading strategies.

- E-books and Articles:

- Comprehensive written materials on forex basics, advanced techniques, market news, and more.

- Demo Accounts:

- Allow traders to practice strategies in a risk-free environment. It’s a practical educational tool and can also be a testing ground for traders before they’re given natural capital.

- Forums or Discussion Boards:

- Encourage traders to share insights, ask questions, and learn from each other. This can foster a sense of community and collaborative learning.

Set Terms and Conditions for Prop Company

1. Profit Split:

One of the primary attractions for traders to join a prop firm is the ability to earn a share of the profits made using the company’s capital. Thus, the profit-sharing ratio is a crucial term.

- Fixed vs. Tiered Ratios: Decide whether the profit-sharing ratio remains fixed or if it changes based on performance metrics. For instance, a trader might start with a 50-50 split but move to a 60-40 split in their favor if they consistently perform well over a given period.

- Payment Frequency: Clearly define when profits will be distributed – monthly, quarterly, etc.

- Minimum Payout Amount: Some firms set a minimum profit amount before paying. This can reduce transaction costs and administrative work, especially when dealing with many traders.

- Reinvestment: Allow traders the option to reinvest a portion of their profits to increase their trading capital, thus potentially increasing their earnings in the long run.

2. Fees:

These are charges that the firm might levy on the traders for various services. Transparently communicate all fees to avoid mistrust.

- Software Access Fee: There might be licensing fees if you use a white-label trading platform or specialized software. Decide if these costs are passed on to the traders or absorbed by the firm.

- Platform Usage: Some firms charge for access to their trading platform, especially if it offers advanced features.

- Training Fees: If you offer specialized training or mentorship programs, these might cost additional.

- Data and Research Fees: Access to premium market research, advanced charting tools, or real-time data feeds might incur additional charges.

- Inactivity Fees: To ensure that allocated capital is utilized, some firms charge fees if traders do not place a certain number of trades within a specified period.

3. Trading Limits:

Setting boundaries on traders’ activities is essential to safeguard the company’s capital.

- Maximum Drawdown Limit: This is the maximum allowable loss from the peak before action is taken. For instance, if a trader has a drawdown limit of 10%, their positions might be automatically closed, or their trading might be temporarily halted once they hit this threshold.

- Leverage Restrictions: Define the maximum leverage traders are allowed to use. Lower leverage reduces risk but can also limit potential profits.

- Position Size: Setting a maximum position ensures that traders don’t take on outsized positions that could pose significant risks to the company’s capital.

- Instrument Restrictions: You might restrict trading on specific volatile pairs or instruments, especially during major economic announcements or geopolitical events.

- Behavioral Clauses: Add clauses that prevent traders from employing risky strategies like “martingale” or “over-trading” – placing excessive trades quickly.

Conclusion

Starting a Forex prop firm requires a well-thought-out strategy that encompasses several elements. From initial market research to determine your firm’s feasibility and potential niche to drafting a comprehensive business plan, every step must be executed meticulously. Adequate capital allocation ensures enough reserve for traders, operational costs, and unforeseen contingencies. Technological infrastructure, including a reliable trading platform and risk management tools, ensures smooth operations and instills trust among traders. Equally essential is offering educational resources, which equips traders with the necessary knowledge and adds value to your firm’s offerings. Setting clear terms and conditions will set the foundation for your relationship with traders, clarifying profit splits, fees, and trading limits. Aspiring entrepreneurs can launch and run a forex prop trading company by carefully attending to these elements and adapting to the ever-changing forex market landscape.

Please read our article about the list of forex prop firms.