Table of Contents

Traders prefer forex because of the size of the assets market, the wide variety of currencies to trade with, the versatility of volatility, fewer transaction costs, and complete accessibility during the week.

The goal for each trader is to increase revenue during the time and increase annual profit.

What is compounding in finance?

Compounding represents accumulated percentage increase over time as an exponential function. For example, if you have $1000 and can increase your money by 6% each month, you will double your money each year and have more than a million dollars after ten years.

What is Compounding in Finance?

Compounding, often referred to as the world’s eighth wonder is one of the most powerful strategies available to investors. It is a process where you can earn higher returns by reinvesting your interest or earnings on top of your original capital. Compounding works as an exponential function that builds upon itself over time and allows your money to grow at an accelerated rate.

When it comes to investing, there are two primary ways to support – through compounding or non-compounding. Non-compound investments involve taking income or profits from investments and spending them when they are generated. Compound investments, on the other hand, include reinvesting any interest earned back into the same investment such that it gains additional interest on top of the initial amount invested. This process leads to an exponential increase in growth over time due to compounded returns and can help investors reach their financial goals faster than non-compound investments alone.

One example of compounding’s power is when you have $1000 and increase your money by 6% each month. Utilizing compounding here would cause you to double your money each year, resulting in more than a million dollars after ten years! This highlights how compound investments can create immense wealth quickly when done correctly.

Another benefit of compounding is that its effects are continuous. Once you start earning returns through compounding, those returns will continue until all principle has been withdrawn from the investment account; this makes it easier for investors to plan for long-term wealth creation and security since they know what kind of return they’ll receive ahead of time.

It also helps alleviate some risk associated with investing since investors don’t have to rely solely on capital gains for their earnings but instead use compound earnings. This further reduces volatility associated with capital markets activity, as volatility generally decreases with longer holding periods.

Compound investing also offers tax benefits that can further improve returns; since any gains made from compound investing are subject to taxes only when they are withdrawn rather than when they are earned (as would be the case with non-compound investments), investors can take advantage of tax deferment opportunities which may allow them to keep more money in their accounts and let it accumulate over time while still receiving all applicable tax benefits at withdrawal.

Additionally, any dividends or distributions received as part of compound investing (if applicable) may also be taxed at preferential rates depending on individual circumstances, again providing another tax benefit that could boost performance even further.

Overall, understanding how compounding works and utilizing its potential effects can significantly enhance an investor’s success over time; however, investors need to do their due diligence before making decisions related to compound investing so that they can make sure their particular situation best suits them with regards to risk tolerance and goals for return on investment. With careful planning and attention given to compound investing, investors can benefit from utilizing this powerful tool to achieve tremendous success within their portfolio’s management strategy!

Now let us see what is compounding in the forex industry.

What is forex compounding?

The forex compounding plan represents the money management technique where traders change investment size through accumulation and reinvestment of forex trading profits from past trades over time.

If you have $10000 and use one mini lot average position size, you need to increase the average position size as your portfolio grows.

Forex Compounding is an investment strategy that takes advantage of the power of compound interest to generate substantial returns on investments over a long period. This trading style has become increasingly popular as traders seek to maximize their profits without taking on too much risk. At its core, compounding involves reinvesting your earnings into the market to benefit from the increased rate of return that comes with repeating investments. This way, you can turn small amounts of money into massive sums over time through careful management and strategic investment decisions.

Compound interest is when your original account balance earns interest, then any profits earned can be reinvested into the account and begin making interest again, creating a snowball effect. The longer you hold your position, the larger this snowball grows, and the more profitable your trading becomes. For example, if you start with a balance of $1,000 and earn 10% each month for 12 months, you will end up with around $3,500 – almost four times more than investing a lump sum at 10%.

To successfully implement a Forex compounding plan, it is essential to plan and have realistic expectations about potential returns – although compound returns can be significant over time, they are often limited when compared to other trading styles, such as day trading or scalping.

It is also essential to manage risk by setting stop-losses and not risking large sums without adequate protection against losses. Additionally, experienced traders may look at capitalizing on compounding markets (such as currencies) where there is less volatility so they can benefit from long-term price trends rather than short-term movements.

Another crucial part of successful Forex compounding strategies is strategically selecting appropriate currency pairs to trade with and using leverage. Leverage allows traders to increase their exposure while minimizing their risk levels – however, it should always be used responsibly, or else traders may be exposed to very high levels of risk if the market moves against them.

Experienced investors may also look at strategies for managing open positions, such as pyramiding or scaling out of profitable trades, to take advantage of favorable market trends while protecting themselves from sudden price reversals.

Compounding strategies can dramatically improve profitability over time but require patience and discipline. Therefore, it is vital for traders to monitor their positions regularly and adjust their tactics accordingly based on current market conditions. Forex Compounding requires consistent effort but can be incredibly rewarding for those willing to put in the work necessary for success – so make sure you study markets closely before embarking upon this journey!

Forex compounding plan example:

- Define portfolio

In the first step, the trader needs to create a portfolio and decide what amount of money they will invest in which assets. You can open multiple trading accounts for each type of asset separately (account for indices, account for forex, account for metals, etc. )

- Define risk tolerance

In the next step, risk tolerance needs to be defined.

For example:

I can risk 1% per trade at most and 2% risk maximum risk at any moment (all open trades). In this case, the maximum portfolio drawdown (usually) will be less than 15% at any time (this number is my empirical number from my experience).

Do not forget about risk recovery:

Forex compounding plan – position size

In the next step forex compound plan can be made like in the Table below:

| Forex compound plan treshold | Average Position size | Maximum portflio risk for all open positions |

|---|---|---|

| $10000 | 0.1 lot | 2% |

| $20000 | 0.2 lot | 2% |

| $30000 | 0.3 lot | 2% |

| $40000 | 0.4 lot | 2% |

| $50000 | 0.5 lot | 2% |

| $60000 | 0.6 lot | 2% |

| $70000 | 0.7 lot | 2% |

| $80000 | 0.8 lot | 2% |

| $90000 | 0.9 lot | 1.90% |

| $100000 | 1 lot | 1.90% |

| $110000 | 1 lot | 1.90% |

| $120000 | 1 lot | 1.90% |

| $130000 | 1.1 lot | 1.90% |

| $140000 | 1.1 lot | 1.90% |

| $150000 | 1.1 lot | 1.90% |

| $160000 | 1.2 lot | 1.90% |

| $170000 | 1.2 lot | 1.90% |

| $180000 | 1.2 lot | 1.90% |

| $190000 | 1.3 lot | 1.80% |

| $200000 | 1.4 lot | 1.80% |

| $210000 | 1.5 lot | 1.80% |

| $220000 | 1.5 lot | 1.80% |

| $230000 | 1.6 lot | 1.80% |

| $240000 | 1.6 lot | 1.80% |

| $250000 | 1.7 lot | 1.80% |

As we can see, your risk is negligible as you increase revenue in your portfolio. More money in the portfolio means higher funds protection and position size risk decrease.

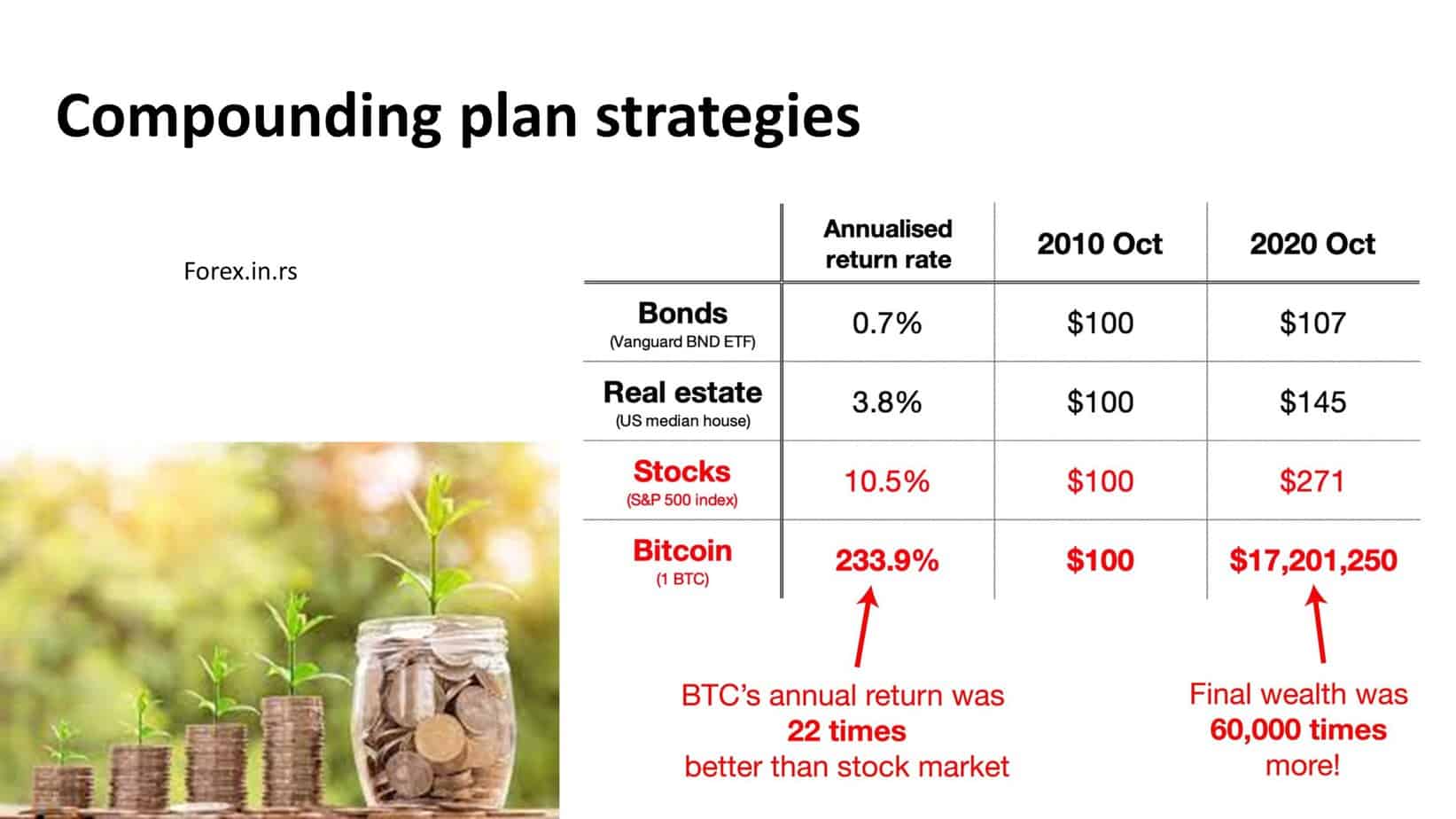

Forex compounding plan strategies

Trading and investment require exceptional dedication of hours and constant practice along with the virtues of patience. By diversifying and enhancing portfolios and gaining profit from specific asset strategies, traders can enhance and enrich their profiles. Regardless of being a beginner or proficient in Forex trading, the traders need to be disciplined and perform better in the international market for currency exchange.

Another way to engage trading skills and build a commendable portfolio is through Forex compounding. It is an ideal approach to generate a steadfast and dependable trading structure that will invite large-scale profit and returns on investments. Traders are encouraged to build a program to compound the required profit to the investment portfolio.

This is highly valuable and productive for those who have just stepped into the world of Forex trading and are looking for potential Growth as a post to their basic account. A drastic and exponential growth can be observed if the compounding Forex approach is utilized, making the investments look richer and full of growth. Most of the Forex accounts rise slowly in a linear trajectory, but Portfolio growth can experience exponential positive effects to Forex compounding.

Having a compounding account relates directly to excessive profits. There is more than one way to generate profit through Forex trading, but you should have a systematic and scientific approach if you opt for a compounding account.

Contrary to the idea of compensating loss by taking on the next step with a heavier investment, compounding phonics strategy advice is the traders to depend on pips. It does not involve waiting and adding increased investment per point to the trading cycling to compensate for losses.

Rather, compounding is all about scientific trading strategies that are operational through positive pips over time, irrespective of the position and size of the trade. For example, if all your trade positions are at one standard lot over time, then there is a high chance of garnering profit over the trading. You can change or alter positions to compensate for the previous losses, but it will only provide you temporarily monetarily profit but would not ensure measuring total pips gain.

Compounding is directly associated with positive pips and having a positive net pip is the chief idea behind a compounding Forex account. In addition to the net positive pips having an operational system with a great success rate above 51% is a significant requirement. The traders need to be efficient in accumulating profit and success, analyze the entry point to the exit. The expected success rate of traders for compounding accounts needs to be more than half of conception.

If traders achieve this condition, they can use the lever is provided to them by the Forex marketplace. However, this leverage needs to be used successfully and wisely as otherwise, all the extra effort will go to waste.

Suppose the traders acquired the two fundamental requirements, including the net positive path and more than 51% success rate. In that case, you can perform minimal alterations, which include shifting the workflow and assessing trading actions to percentages. The percentages can be measured according to the two ending points. Traders can protect and analyze the exact percentages through this perspective and profit expectation.

Forex traders should aim to build a sustainable structure to assist them in their expected return on investment. Compounding for this account is a proper money management platform that aims to optimize profit by deemphasizing losses by bearing them with the subsequent gain.

Under compounding account, traders exponentially grow their assets except for time, profits, and losses. A small amount of money is placed in the account, which is used in future investments. This investment amount will double due to the estimated profit, which can be withdrawn when it reaches the threshold. If you are not in favor of withdrawing that amount, and that amount can also remain in the account completely, or you can take out a percentage from it.

As traders, it is imperative to frequently analyze and review trading strategies and techniques and gain additional knowledge to discipline and monitor yourself.

Regardless of the platform you use, the investment will be directed to you at the end of the day. Most of the successful traders and experts use the process of compounding to double their profit for the next investment. However, unrealistic profit goals and thresholds will instantly plummet your expectations; therefore, setting clear goals and logical thresholds, especially for beginners, is important. Setting more than 20 to 30% of the profit expectation is unrealistic.

In addition to the profits, the traders need to be mindful of the existing gains and losses they might encounter. In the end, it is all about the strategies and techniques you adopt and how you carry yourself in the discipline to initiate Forex trading; begin by finding an online forex broker.

Conclusion

In conclusion, Forex Compounding Plan is a great way to make significant returns in the foreign exchange market without taking excessive risks. By investing small amounts of capital regularly and allowing profits to be reinvested, traders can gradually build their capital base over time. This approach reduces both the risk of large losses due to fluctuations in the market, as well as the need to source additional funds from outside sources. Furthermore, compounding forex trading profits allows traders to track their investments effectively and make intelligent decisions about when to enter or exit trades. Ultimately, this makes Forex Compounding Plan an attractive and viable option for investors looking to gain long-term financial success in the foreign exchange market.