When traders test their trading strategies using Expert Advisors (EAs) on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), they often focus on the potential profitability and performance metrics without considering all transaction costs. Commissions, as a significant part of trading expenses, are frequently overlooked during these simulations. This oversight can lead to an inaccurate assessment of a strategy’s viability, as the results might look promising in a test environment but fail to account for the real-world costs of executing trades.

The impact of commissions can drastically alter the profitability outlook, especially for strategies that rely on a high volume of trades. Recognizing and including commission costs in strategy testing is crucial for a realistic understanding of a strategy’s potential success in live markets.

So, I will answer an important question:

Do MT4 and MT5 Include Commission Costs in Expert Advisor Test Results?

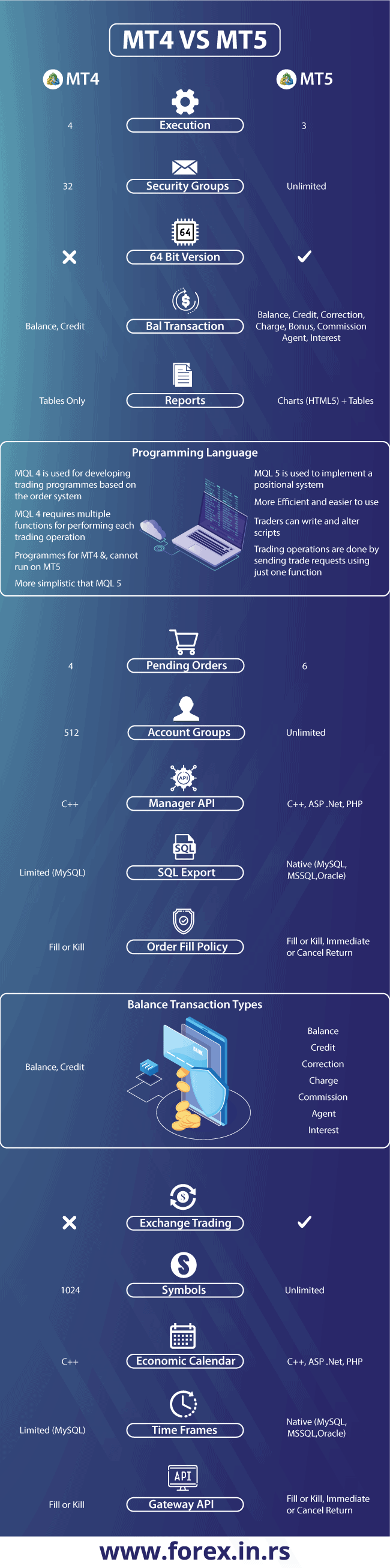

MT4 does not automatically calculate commission costs in Expert Advisor (EA) test results, leaving traders to account for these expenses manually. In contrast, MT5 includes commission costs directly in the EA test outcomes, which can be reviewed in detail by downloading the test report as an HTML file after backtesting, where all trades and associated commissions are displayed.

Understanding how each version handles commission costs is crucial for accurate performance evaluation when using expert advisors (EAs) for strategy testing in MetaTrader platforms.

MetaTrader 4 (MT4), a widely used platform for forex and CFD trading, does not automatically factor in commission costs during the backtesting of EAs. This means that when traders simulate their trading strategies to assess profitability, the results presented by MT4 will not include the commission costs. Consequently, traders using MT4 must manually calculate and subtract these costs from their test results to understand a strategy’s viability accurately. This additional step can be complex and time-consuming, especially for strategies that involve a high volume of trades, where commissions can significantly impact overall profitability.

On the other hand, MetaTrader 5 (MT5) offers a more sophisticated approach by automatically including commission costs in the results of EA tests. This feature provides a more realistic assessment of a strategy’s performance in live trading conditions, where commissions can eat into profits. After completing a backtest in MT5, traders can access a detailed report of their trading activity by right-clicking on the report and downloading it as an HTML file. This report includes a comprehensive breakdown of all trades made during the simulation and the commission charged for each trade. By integrating commission costs directly into the test results, MT5 allows traders to immediately see the net outcome of their strategies, considering all relevant trading costs.

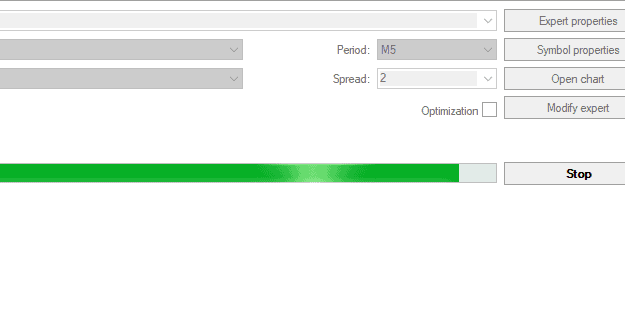

Here is an example:

When you set 0.2 pips spread for trading with a mini lot (10,000 units) in the EUR/USD currency pair, the cost of the spread is not directly labeled as “commission” but is an implicit cost of executing the trade. The spread is the difference between a currency pair’s bid and ask price, represented here as 0.2 pips.

The 2 x 0.2 pips spread is 0.4 pips; for one mini lot trade, it is $0.4 (open and trade close).

This distinction between MT4 and MT5 in handling commission costs highlights the importance of choosing the right platform based on the specific needs of the trader and the intricacies of their trading strategy. For those whose strategies are heavily affected by commission costs or seek a more accurate and hassle-free evaluation of their trading performance, MT5 offers a clear advantage. However, regardless of the platform chosen, understanding the impact of commissions on trading outcomes is essential for developing successful trading strategies.