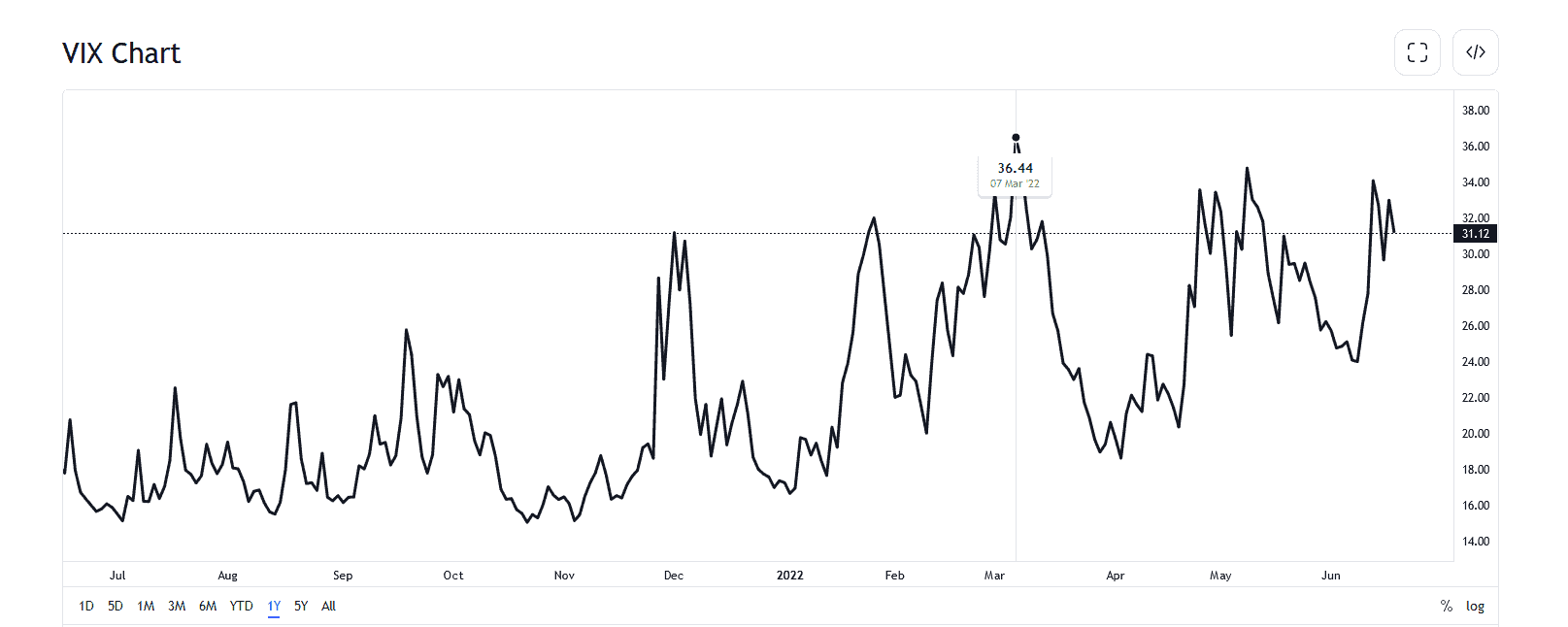

The Volatility 75 Index, commonly known as VIX 75, is a popular measure of the stock market’s expectation of volatility based on S&P 500 index options. It is often called the “fear gauge” or “fear index,” reflecting its role in capturing market sentiment and investor expectations of future volatility.

Calculated and provided by the Chicago Board Options Exchange (CBOE), the VIX 75 is a real-time market index representing the market’s expectations for volatility over the coming 30 days. The index is particularly notable for its ability to spike during financial turmoil, making it a critical tool for traders and investors who aim to gauge market risk and uncertainty. As a result, VIX 75 is extensively used by market participants as a hedging tool and a means for speculative trading, especially in times of significant market fluctuations.

Before we start, you need to know how to Buy VIX (read our article).

What is the best time to trade the Volatility 75 index?

The best time to trade the volatility 75 indexes is when the U.S. market overlaps with the E.U. session between 12 to 16 GMT (7 – 11 EST) when volatility is highest. Usually, when volatility increases, the best moment to trade VIX 75 is during a trendline breakout (price reversal).

For me, the best setup for VIX is 1 hour before the US market opens (8:30 EST) when vital news for the US dollar comes. VIX price positively correlates with the USD Index (DXY), so US news impacts VIX indirectly.

Trading the Volatility 75 index, often called VIX 75, involves understanding the optimal times for market participation to maximize potential gains. The best time to trade VIX 75 is generally during the overlap of the U.S. and European Union (E.U.) market sessions, which occur between 12:00 and 16:00 GMT (7:00 – 11:00 EST). This period is characterized by increased trading activity and liquidity, as both European and American markets are open, leading to higher volatility and potentially more trading opportunities.

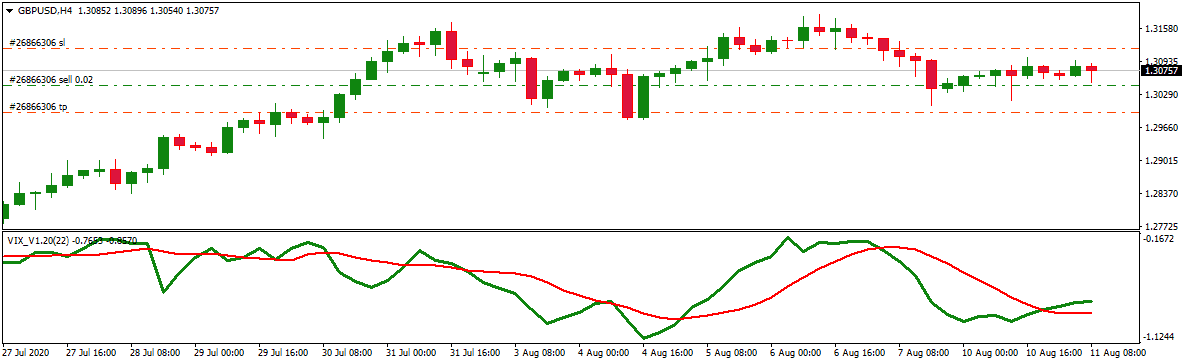

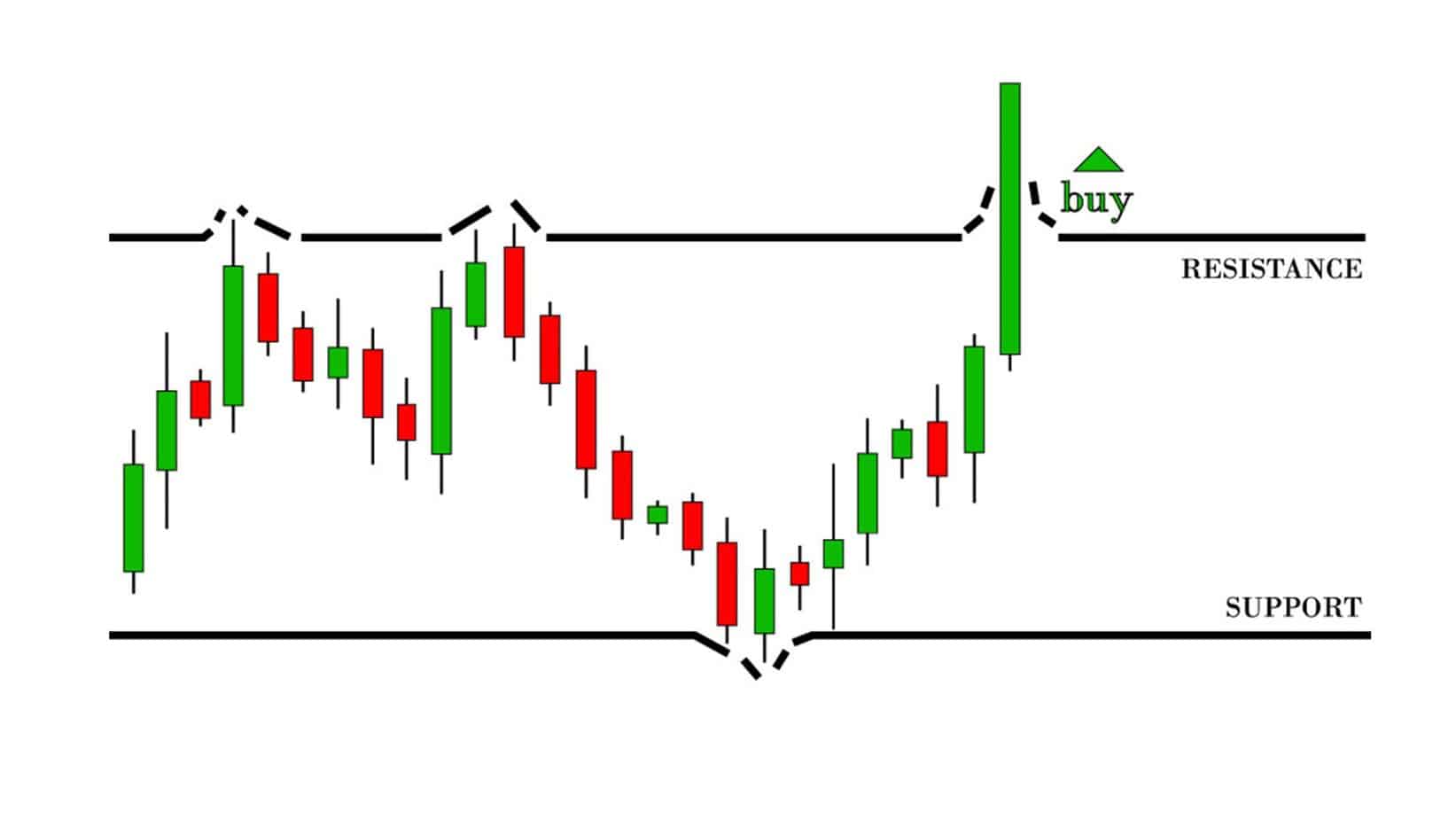

During these hours, the movements in the VIX 75 are more pronounced, offering traders the chance to capitalize on more significant price swings. It’s essential to monitor the VIX 75 closely during this window, as the increased volatility can lead to rapid changes in the index’s value. Traders often look for trendline breakouts or price reversals in the VIX 75 during these times, as these can signal significant shifts in market sentiment and provide entry or exit points.

Trendline breakouts in the VIX 75 typically indicate a decisive move away from an established price pattern, signaling a potential opportunity for traders. Using appropriate risk management strategies when trading during these periods is crucial, as higher volatility can increase the risk of significant losses. Many traders use technical analysis tools, such as moving averages and support and resistance levels, to identify potential trendline breakouts in the VIX 75.

Economic news and events, particularly those from the U.S. and the E.U., can significantly impact the VIX 75 during these overlapping trading hours. Therefore, staying informed about key economic indicators and news releases is vital for traders looking to capitalize on movements in the VIX 75. Additionally, traders should be aware that the period between 12:00 and 16:00 GMT may not always be the best time for everyone; individual trading styles and strategies can influence the optimal trading window.

Finally, traders need to remember that while high volatility can offer increased trading opportunities, it also comes with higher risks. It is essential to approach VIX 75 trading with a well-thought-out strategy and a clear understanding of the potential risks involved.