Companies and investors face different kinds of risks that affect their profit or returns on their investment.

What is the systematic risk?

Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. As a result of this risk, the returns earned from risky investments will fluctuate.

What do you understand by systematic and unsystematic risk?

Systematic risks are related to macroeconomics, entire market risks while unsystematic risk refers to the probability of a loss within a specific industry or security. For example, systematic risk is a Coronavirus pandemic or world market crash while the unsystematic risk for an automotive industry can be a car tax increase.

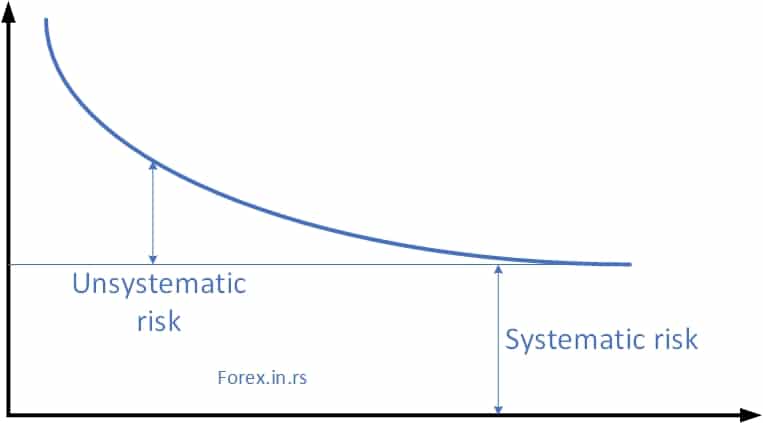

Some factors that affect a business’s profit can be controlled by the business and its management to some extent and are the unsystematic risk of doing business. These factors include labor disputes and mismanagement for a company. The total risk involved for investors can be categorized into unsystematic risk and systematic risk. Let us define systematic and unsystematic risk in finance.

Systematic risk factors are usually macroeconomic factors such as inflation, changes in interest rates, fluctuations in currencies, recessions, or some factors as wars, corona pandemic, etc. The best example of a systematic risk example that individual companies cannot control is the 2019–20 coronavirus pandemic.

Systematic Risk explained

Many unexpected events occur regularly, which cannot be controlled by investors, and these are the systematic risk of doing business, investing. This risk can only be avoided by avoiding any investment, which is risky. In reality, this is not a viable option for most investors since the only investment options available to them, in this case, would be the CDs and T-bills of government-related organizations. Hence every investor should consider these systematic risks while deciding their investment strategy if they want good returns.

To compensate for the systematic risks while investing, most investors will expect a premium on their risky investments. To explain with an example, if a 5% return is offered for a T-bill, which is risk-free, the investor will expect 10% returns while investing in shares. The investor hopes that the additional 5% return on shares will compensate for the systematic risk he takes while investing in shares. Due to macroeconomic factors, the investor can also lose his share investment, so he tries to get better returns.

Systematic risk should be considered the opportunity cost of choosing a particular investment when less risky options are available. Investors consider their personal choices and also financial goals while choosing their investment options. For a T-bill with a 3% return, though the returns are low, there are no systematic or other risks for the investor. On the other hand, for a stock offering 15% returns, the investor may lose his money, and there is also the opportunity cost, which should be considered when he chooses this option compared to the low-risk option of T-bill.

It is usually impossible for investors to avoid all systematic risks if they wish to get good returns. However, they can reduce the systematic risk involved by diversifying the investment. This ensures that even if they make a loss from one investment, other investments’ profits will compensate for the loss. Additionally, ensuring that resources are adequately utilized and procedures are followed provides that only quality investments are chosen can significantly reduce the risk involved. When a company is being sold, it is essential to consider the systematic risk involved since the buyer will be willing to pay a lower amount for the business to compensate for its risk.

Systematic risk examples

Systematic risk examples are examples of investing behavior changes, such as laws, tax reforms, interest rate hikes, natural disasters, political instability, foreign policy changes, currency value changes, banks’ failure, and economic recessions.

Economic Recession as Systematic risk example

In 2008, Lehman Brothers’ failure that has affected the entire economy and financial system was one of the most recent examples of systemic risk. This failure has caused a domino effect on the whole world’s financial system because Lehman Brothers was a big company. The government has to intervene to resolve this problem.

One of the latest examples of systematic risk is the economic recession faced by the entire world in the late 2000s. At that time, people who have invested in the market have seen drastic changes in their investments due to this economic crisis. The assets of different classes were affected differently due to this recession.

Systematic risk during an economic recession is when inflation and interest rate changes companies avoid investing in risky assets.

Covid 19 as Systematic risk example

For example, during Covid 19 pandemic, all airplane companies represent a risk for investing.

Managing Systematic Risk and Unsystematic Risk

Investing money is risky; the investor may lose some of their money. Experts believe that the most significant risk for investors is losing their capital amount permanently. Hence to avoid losing their capital completely, investors have to adopt a strategy for managing the risk for their investment portfolio. For this, they will have to understand how unsystematic and systematic risk will affect their portfolio. They will also have to find out the most effective way of reducing the risks involved in their investment. We can mitigate risks using Standard Operating Procedures (read article sop meaning)

Systematic risk is related to many factors affecting the entire investment market; it is not related to a specific risk associated with a particular investment. Changes in the bank, other interest rates, inflation, fluctuation in currency exchange rates, wars, and recession are macroeconomic factors that affect the systematic risk. These macroeconomic factors affect both the direction in which the market moves and the volatility. A single company or individual cannot control the systematic risk.

Asset allocation is widely used to reduce the systematic risk involved to some extent. Since the value of asset categories will change differently to macroeconomic data changes, investors can reduce their portfolios’ volatility by investing in asset classes with a low correlation to each other. When the value of some asset categories like domestic equities, stocks are increasing, others like bonds, cash will decrease in value, and vice versa to reduce volatility. Experts also believe that they should consider the value of the assets while investing. They should invest more in bargains and avoid investing in assets that are considered overpriced. To reduce systematic risk, they should also invest in cash, which is often not appreciated.

Unsystematic Risk

Risk, which is specific to a company or industry, is considered an unsystematic risk. This risk can be attributed to a particular investment or investment group. It is not linked to the returns from the stock market. It is also called the diversifiable, residual, or specific risk. These risks can be controlled to some extent by the industry sector or company. These risks are divided into financing, business, credit, product, legal, liquidity, political and other risks. Unsystematic risk can be almost completed eliminated by diversification. The investor with only one stock or bond will suffer significant losses if there is a stock problem. On the other hand, if the investor has a diversified portfolio of 40 various investments, the losses to a particular stock’s issues will affect the portfolio less.

Probability, Expected Portfolio Value

For calculating the expected value of a portfolio, the possible returns and probability of each return will be considered. One way to measure risk is to determine the deviation and how it compares with the expected returns. Diversification reduces the unsystematic risk, and portfolio risk is mitigated by allocating assets properly. Mitigating risk ensures that the portfolio manager has more profitable assets with higher risks resulting in portfolio optimization. The portfolio manager can handle a specific amount of risk, and if the systematic and unsystematic risk is lowered, he can opt for investments offering higher returns.

Difference between systemic risk and systematic risk

Systemic vs. Systematic Risk

Systemic risk can be defined as the momentary event risk related to the complete breakdown of a sector, industry, financial institution, business, economic system, or the entire economy. In contrast, Systematic Risk is the overall, day-to-day, ongoing risk that can be caused by a combination of factors such as changes in investing behavior, laws, tax reforms, interest rate hikes, natural disasters, political instability, foreign policy changes, currency value changes, banks’ failure, and economic recessions.

To understand systemic vs. systematic risk, both of these terms a bit more closely. Suppose an event causes a major setback to an economy or a particular industry. In that case, it is known as a Systemic Risk, but if the market experiences a consistent and everlasting risk for an extended time due to several reasons, then it is known as Systematic Risk. The information provided in this write-up will help you in understanding the primary differences between these two terms.

Systemic risk can give a complete shock to the system from outside, whereas the shock provided by the systematic risk based on several factors can be ongoing and on a day-to-day basis. For instance, the financial crisis of 2008 that has triggered a massive implosion in the world market was based on the threat of failure of one of the US’s major banks. It is an excellent example of systemic risk. The risks based on the changes in interest rates, corporate health, geopolitical issues, etc., are examples of systematic risk.

Moreover, it is hard to predict and scale systemic risks, whereas it is easier to predict and scale systematic risks in some cases.

Systemic risk can be defined as the risk related to the complete breakdown of a sector, industry, financial institution, business, economic system, or the entire economy. Some small but particular problems like leakage of website users’ information or flaws in bank accounts’ security can also come in systemic risks. In other words, systemic risk can be defined as a substantial danger in a company that can widely influence the entire financial system.

On the other hand, systematic risk is not easy to define, as it is a bit vague. In simple words, it can also be used as the term market risk’ which involves the dangers faced by the entire market and is not easy to resolve even if you spread your holding into several branches. The basis of such widespread risks for the market can be the period of weakness or recession in the economy, decline or rise in interest rates, wars, fluctuations in the prices of the commodities or currencies, etc. However, the systematic risk can be managed but cannot be eliminated by following the strategy of allocating the assets differently.