Table of Contents

First, let us see what working capital is.

Working capital is available capital that a company can use for day-to-day operations and represents the difference between current assets and current liabilities.

Working capital = Assets (cash, unpaid bills + inventories of raw materials + finished goods +, etc.) – liabilities (for example, accounts payable)

Working capital is a vital measure of financial health for any company, as it represents the resources available to fund current operations and support future growth. A business with high working capital typically has a strong cash position, ample inventory, and low debt levels. Conversely, a company with negative working capital may face difficulty meeting its short-term financial obligations, particularly if it has more current liabilities than current assets.

To maintain healthy working capital levels, businesses must carefully monitor their current assets and liabilities. This requires investing in strategies that help attract new customers and generate consistent sales revenue while minimizing expenses and managing debt responsibly. Businesses should also be aware of potential opportunities for low-cost financing through sources such as lines of credit or factoring arrangements that can help them manage cash flow challenges during periods of low working capital. Sufficient working capital is ultimately critical to long-term success in any competitive market.

Now, we need to see what is Non-cash working capital.

What is Non-cash working capital?

The Non-Cash Working Capital (NCWC) represents the sum of inventory and receivables. The Non-Cash Working Capital (NCWC) is a financial asset calculated after considering the value of all the business’s current assets, excluding the cash component, and deducting the current liabilities.

Non-cash working capital is the capital businesses use to fund their operations, not including their liquid cash. This can include a company’s raw materials, finished goods, and accounts receivable inventory. To accurately assess the financial health of a business, it is essential to calculate non-cash working capital to identify any areas of weakness or inefficiencies. This can also help companies to plan for future investments or determine which areas should be streamlined.

Now to see the calculation:

Non-Cash working capital calculation

Non-cash working capital can be calculated in two ways: Calculate non-cash current assets and subtract current liabilities from the non-cash CA. for the current year or, the second way, add receivables, inventory, and subtract payables.

To calculate a company’s non-cash working capital, you must calculate its current assets. This typically includes cash, accounts receivable, inventory, and other similar assets that can be easily converted into cash. Once you have these figures, you must subtract any cash holdings from the total current assets. Next, you will need to subtract any liabilities from the existing assets. The resulting number will give you an estimate of a company’s non-cash working capital, which represents the value of its current assets minus any liabilities or other obligations. This can be useful for understanding a company’s financial position and potential risks associated with changes in its working capital.

Non-cash working capital formula:

Non-cash Working Capital = Current Assets without cash – Current Liabilities

or

Non-cash Working Capital = Receivables + Inventory – Payables

Now let us discuss the results:

The net change in non-cash working capital

If the net change in non-cash working capital is positive, additional capital is tied to working capital in the current year. If non-cash working capital is negative, then capital got released from working capital.

Usually, during the due diligence of a business being considered for sale, the historical NCWC of the company is calculated for each month for two or three years before the sale of the business. This will help the potential buyer understand the working capital the firm will require to ensure that the company will continue functioning, paying all the ongoing expenses like the salaries.

The amount of NCWC required for running the business is one of the most disputed aspects when the business owner negotiates with any potential buyer. When a buyer purchases any business, the purchase price offered will usually cover the cost of the business’s current and fixed assets. This is because the industry will require these assets to function normally to sell products or services as before, as the company did before the sale was finalized. One of the assets considered in the business’s sale price is a reasonable amount for the NCWC.

Non-Cash Working Capital Example

A company with a sales revenue of $10 million typically requires approximately 15% of the sales value in NCWC. The NCWC amount for the business is $1.5 million. However, the average NCWC is usually 10% of the sales revenue for other companies in the same industry sector. Hence other businesses in the same sector had $10 million; the NCWC will be lower at two million dollars annually. This implies that the business being sold has historically required more working capital for its normal functioning than other similar companies in the same sector.

A potential buyer may insist that the three million dollars the company has historically required for running normally remain with the company, even if all other businesses in the same sector only require $ two million. Hence, a business owner needs to know the business’s right working capital based on industry standards. If the working capital needed for the company is higher than the industry standards, it may be necessary to make some changes in how the business is run to conform to the industry norms.

A business owner needs to reduce the business’s working capital levels if they consider selling it. This ensures that the business is not a business of sale with cash in working capital when the deal is finalized with the buyer. By reducing the working capital reduced for running the company, the working capital’s money will be returned to the owner before the business sale is finalized. This ensures that the business owner gets the best deal from the company sale.

Non-Cash working capital cash flow:

Cash flow and non-Cash working capital will decrease if the company buys a fixed asset (for example, a building).

Cash flow and non-Cash working capital will rise if the company sells a fixed asset (for example, a building).

Let us summarize:

Change in Non-cash working capital

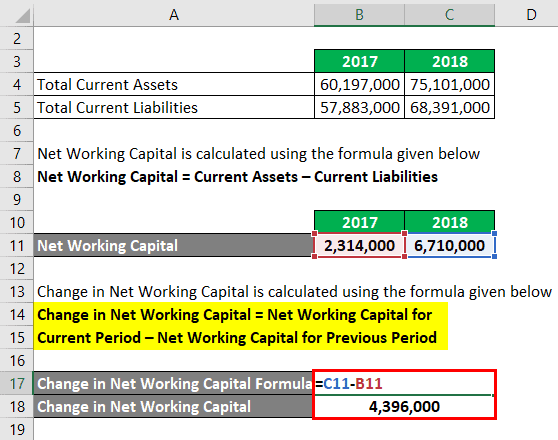

Change in working capital can be seen in the cash flow statement such as:

- When a transaction increases current assets and current liabilities by the same amount, there is no change in working capital.

- Cash flow and working capital will decrease if the company buys a fixed asset (for example, a building).

- Cash flow and working capital will rise if the company sells a fixed asset (for example, a building).

- When the company purchases inventory with cash, there is no change in working capital, but inventory purchases will reduce cash flow.

The change in non-cash working capital is a crucial indicator of the overall financial health of your company. This measure can give you an idea of how much cash your company has available to cover its short-term expenses and obligations and whether it is investing in long-term growth opportunities.

To calculate a change in non-cash working capital, you must look at your current assets and liabilities. A decrease in non-cash working capital indicates that your company relies more on its existing reserves. At the same time, an increase may suggest that you are investing in new opportunities or taking on more debt.

Several factors can impact the change in non-cash working capital for your business, including fluctuations in sales volume, changes in inventory levels or accounts receivable collection times, and adjustments to your accounts payable balances. However, it is essential to remember that these changes may not always be negative for your company. For example, an increase in inventory may reflect greater customer demand or new product launches. In contrast, increasing accounts payable could mean taking advantage of supplier discounts or extending payment terms to save on costs.

As such, it is essential to take a holistic view of the change in non-cash working capital for your business and analyze all the factors that contribute to this metric over time. By doing so, you can identify potential areas for improvement and make informed decisions about managing and growing your company’s assets.