Table of Contents

Options are well-known methods for purchasing or selling assets of various organizations and other monetary instruments. Suppose you are buying an option that will have the possible chance to trade shares at a specific cost for a set period, but there’s no commitment.

Is an option contract always 100 shares?

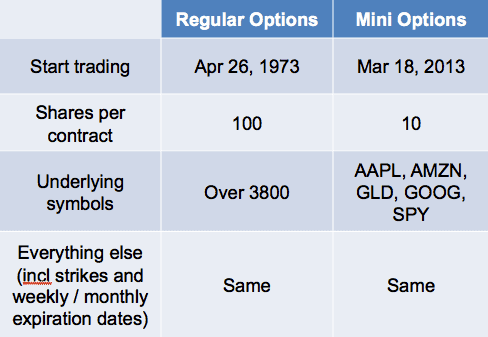

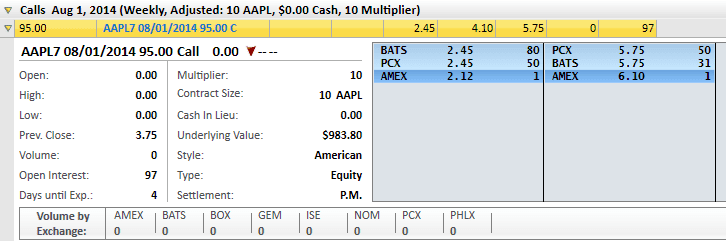

Yes, one option is usually 100 shares in the US trading markets. However, if you trade mini options, then 1 option can be 10 shares. For example, a call option can be quoted in the trading platform at $3, but you will pay $300 ($3 x 100) if you trade regular options (100-share lot) or $30 if you trade mini options (10-share lot).

Options are usually 100 shares because it’s fast to trade and are recorded with the cost per share. For what reason are options usually 100 shares, and what are the exceptional cases that apply to this standard? To get more familiar with purchasing options and for information to assist you with finding out about Options exchanging, kindly continue to peruse.

On another side, you can trade 1 lot of 10 shares in mini options. See the example below:

Why Are Regular Options 100 Shares?

Options are usually 100 shares because, for traders, it can be easy to buy without continually checking the number of shares that are in every option. Trading can be a swift operation, and having all options be 100 shares makes trading easy. The cost recorded is per share when options are available to be purchased. Yet, shares are still usually sold in collections of 100—implying that when individuals use options, they will likely trade with 100 shares either when buying or selling. There are no irregularities for this, which could be a disadvantage of choices for some individuals and investors.

However, there is one advantage. When you use your options to buy, you can sell your shares, keep the shares, or do both. Possessing or selling your shares can be profitable because the shares can be sold for a gain; keep the shares hoping there’ll be a price increment, or do both to gain now and later.

A relatively few exceptions to options sold in 100 shares if the count of 100 shares per option agreement makes estimations easy. However, exemptions for the 100 shares options are smaller options of 10 shares or a more significant option of 1,000 shares. It may be challenging to see these options because they’re scarce, but you may find them in specialty markets or advanced trading websites.

To check out more details on a few exceptions to options being 100 shares, watch this enlightening video below from YouTube:

What Happens If You Can’t Buy or Sell 100 Shares Of An Option?

When options are bought and sold in addition to 100, you should buy or sell 100 shares when using your options. But, in a situation where a trader may not be able to buy 100 shares or does not have 100 shares to sell, what happens?

Here’s the answer, if you can’t buy or sell shares, you may not use the options. Not using the options means not buying or selling shares, and the options will expire. However, the only disadvantage of allowing options to expire is that a trader will lose the fund used in buying the options. Alternatively, an individual can always buy different options and buy or sell more than 100 shares. Although you can still buy or sell in multiples of 100, you don’t have a limit to 100 shares if you can purchase more options.

Since there are no limits to buying options, an individual can gain more than lose if you don’t use your options. If you don’t use your options, the only loss will be the cash paid for the option, but the profits could have no limit because stock prices can rise. Since you’re under no rule after purchasing shares to buy or sell them, there is no return on the cash paid for options if not in use. Take note that an individual is always needed to buy or sell 100 shares when deciding to use options.

The History Of 100 Shares Options

Share options became normalized in 1973 when one option became equivalent to 100 shares of stock—before then, purchasing an option with a lesser number of shares than 100 was quite challenging to find.

Before 1973, you could buy shares of options to any degree you wanted, beginning from one share. Still, it wasn’t suitable for the market because option buyers were matched with option sellers, and the more flexible the number of shares, the harder it was to pair buyers and sellers.

What To Know When Trading Options

During buying options, a few things to put in mind. A trader will be buying an option for 100 shares, but the price shown will be per share. This implies you’ll have to multiply the price by 100 to get the total amount paid to use an option.

Furthermore, a variety of options permit buying and selling shares. A call option permits traders to purchase stocks at a specific price for a particular period. A put option permits selling shares at a specific price for a particular period. Make sure to buy the appropriate option depending on how you want to use your options.

If a trader cannot trade all 100 shares, or the stock heads down some unacceptable path, the trader may need to accept the loss for the option to make money. However, allowing your option a loss for expiring will be less damaging than using your option to trade. It may be better to allow the loss of the option expiring.

Options can make a trader some cash in the stock market but can lose money too if the right option is not purchased correctly or the strategy to use for the option isn’t utilized.

However, make sure to learn and understand more about options and trading before losing money that could have been used to earn. Options should never take the whole portion of your portfolio, but you can always invest in other things to balance risk.

Here are a few ways how to trade options in four steps:

- Open an options trading account

Before you decide whether to start trading options, you must demonstrate your knowledge of trading options. By stating your expectations and investment goals, this would include growth, capital, income, and speculations.

Brokers would also want to know your trading experiences, personal information, and the types of options you wish to trade.

- Pick which options to buy or sell

As a beginner, a call option permits you to have the right and no obligation to buy shares at a predetermined strike price within a specific time frame. A put option gives you the right and no obligation to sell shares at a stipulated price before the contract expires.

- Predict the option strike price

When purchasing options, the option stays valuable provided that the stock price closes the options lapse time frame in the money, which means if above or under the strike price. (For call options, it’s above the strike; it’s below the strike for put options.) a trader may want to buy an option using a strike price that shows where the stock is predicted during the option’s timeframe.

- Determine the option time frame

Each option agreement has a time-lapse period that displays the deadline to use the options. The lapse date could be days to months to years. Every day and week after week, options can be riskier. More prolonged expiration provides the shares with more time and additional opportunities for your speculated proposition to work out. The longer the expiry may be, the more valuable it is.

How Can I Learn Options Trading?

For individuals who want to get more familiar with purchasing options and develop as a trader, educating oneself by reading books can be the most effective way to learn. The accompanying books below are appropriate for options traders of any level.

Books about options trading are available on Amazon:

- Trading Options for Dummies by Joe Duarte: This book is ideally suited for inexperienced traders who want to begin buying options but have little experience in trading. This book explains all that is needed to know to be aware of before trading options, including your portfolio and different information to be informed.

- The Options Playbook Second Edition by Brian Overby: This book is for all looking to expand knowledge about options. The book will provide all you want to be familiar with purchasing options in a single place.

- Options Trading Crash Course by Frank Richmond: This book has a significant guarantee for inexperienced traders. The Options Trading Crash Course is a decent book for beginners without any information on trading options but is prepared to trade immediately.

Conclusion

Remember that options are sold in 100 shares except for a few cases in advanced trading markets and specialties. When an individual wants to use the options to trade shares, it must be 100 shares. If it is challenging to buy or sell 100 shares, you should allow your options to expire, so the only money lost will be the cash you used to purchase the option.

A trader can buy various options if the intention is to trade more than 100 shares but will need to trade in 100 share increments when using the options.