Table of Contents

While investing, it’s only reasonable to look out for your financial well-being to be on the safe side. You can build a good, typically secure portfolio with ETFs. ETFs can help your money build momentum through minor modifications with the guidance of financial professionals. When it comes to controlling risk, diversifying your portfolio may be beneficial, but it’s better not to go crazy. Because they hold various assets, ETFs are, by definition, diversified investments.

When it comes to investing, there are various options to choose from. But when it comes down to it, Exchange-Traded Funds (ETFs) are one of the best ways to go. They offer diversity, liquidity, and low costs, making them an ideal investment choice for anyone.

According to industry experts, diversification through many ETFs is best achieved by holding six to nine. Any more might have negative financial repercussions. When you start investing in ETFs, you lose control over a lot of the process. This post will acknowledge everything regarding how many ETFs I should own.

How Many ETFs Should I Own?

You should own between 5 and 10 ETFs. However, the number of ETFs depends on several factors, including your investment goals, risk tolerance, and overall portfolio mix. But as a general rule of thumb, you should own less than 10 ETFs.

Why? Because owning a handful of ETFs gives you exposure to a broad range of assets while keeping your portfolio manager. It also lets you keep your costs low since most ETFs have relatively low expense ratios. And finally, it helps ensure that your portfolio is diversified across different asset classes and geographies.

So if you’re looking for a simple way to start investing, ETFs are a great option. Make sure you research first and find the right ones for your needs.

Whether you want to invest only in ETFs or prefer to have greater control over your funds, knowing how many ETFs to consider is an essential first step. Experts recommend buying between six and nine ETFs to reap the full benefits of ETFs while avoiding the drawbacks. Although ETFs are a terrific way to increase your money, you shouldn’t invest in more than 10. You won’t be able to fully benefit from the long-term stability that ETFs provide if you hold too few of them. In addition, having many ETFs in your portfolio might lead to more intricate problems.

Fewer might be better when it comes to constructing an ETF portfolio. There are long-term consequences to diversifying your portfolio with excessive ETFs, such as a worse risk-to-reward ratio. For most individual investors, 5 to 10 ETFs would be ideal, spread over several asset classes, regions, and other features. Hence, allowing for some degree of variety while maintaining things simple simultaneously. Additionally, holding a large number of ETFs can be a time-consuming process. An ETF-based portfolio with a few defined responsibilities is easier to control than a portfolio with numerous ETFs without clear duties. Because it is easier to understand the impact on the assets when major market news breaks, having a more simplified portfolio will allow you to respond more quickly.

Should I diversify my ETFs?

Yes, it would be best if you diversified your ETFs. Instant diversification is the most important reason for choosing an ETF over a stock. On the other hand, an ETF that follows an index of financial services companies, on the other hand, provides you with ownership of a collection of financial equities rather than a single firm.

Investing in various financial instruments is necessary to diversify a portfolio. Protecting your investment’s worth is more manageable if all of its stocks can replace one another in the event of a stock’s demise. As a whole, ETFs are often considered well-diversified. Although certain ETFs have a high price tag, financial institutions typically charge a moderate management fee for most passive investments. Having too much or too little diversification might hurt your portfolio’s return. An energy ETF that has fared exceptionally well in the first quarter of 2021 is a good illustration. Adding more ETFs to a portfolio that already includes this energy ETF might hurt its returns. As a result, the energy ETF’s contribution to the overall portfolio return will automatically fall.

You can also see the variety for yourself. ETFs provide excellent transparency via numerous companies, like Charles Schwab, allowing banks to watch their modifications and know precisely where your money is going. It removes most of the work from your hands when diversifying your portfolio. You may further bolster diversification by investing in various exchange-traded funds (ETFs). For example, you may want to select a real estate-focused ETF instead of a retail-focused one. Because of the safety that ETFs provide, many investors have opted to invest only in ETFs, eschewing stocks and mutual funds entirely.

What are the Benefits of Owning ETFs?

Portfolio diversification, tax benefits, trading flexibility, and risk management benefit from owning ETFs.

ETFs are similar to mutual funds, but they have two critical distinctions. Because ETFs trade like stocks, they’re easier to buy and sell than mutual funds, which don’t move until the market closes, unlike ETFs. Second, ETFs have lower cost ratios than mutual funds since many are passively managed products linked to an index or market sector. Active management is more common in mutual funds. ETFs may be preferable to actively-managed, high-cost mutual funds because they don’t often outperform indexes. Instant diversification is the most important reason for choosing an ETF over a stock.

On the other hand, an ETF that follows an index of financial services companies provides you with ownership of a collection of financial equities rather than a single firm. Sometimes you do not want to put all the eggs in one basket. An ETF can protect against volatility in the ETF’s holdings up to a certain amount. Most ETF investors are drawn to ETFs because of the elimination of company-specific risk. ETFs offer two main benefits over mutual funds when it comes to taxes. First, mutual funds are often taxed at a higher rate than ETFs because of structural differences. Capital gains taxes on ETF sales are borne solely by the investor, whereas mutual fund investors are taxed on capital gains during their investment life. For the most part, ETFs have fewer capital gains and are only paid out when the ETF is sold.

ETFs suffer from a tax arrangement that favors investors in capital gains over those in dividends. Qualified and unqualified dividends are the two types of dividends that ETFs payout. An investor must hold the ETF for at least 60 days before the dividend distribution date for the dividend to be considered eligible. Qualified dividends are taxed at a 5% to 15% rate based on the investor’s marginal tax rate. Taxes on unqualified dividends are paid at the investor’s income tax rate. Regardless of the fund’s form, operating expenditures are still incurred. Fees for portfolio management, custodial charges, administrative costs, marketing expenditures, and distribution are just a few of these expenses. In the past, costs have played a significant role in predicting future profits—generally, reduced investment costs lead prices to significant expected returns.

How many ETFs are too many?

10+ ETFs is too many for a retail investor.

Having many exchange-traded funds (ETFs) in the portfolio is probably wrong. Increasing the number of ETFs in the portfolio increases the likelihood that some may overlap (i.e., be redundant). You may think you’re diversifying your portfolio, but a deeper examination will show the truth. “GAFAM” is an excellent example of an over-exposed US tech company. If you own an S&P 500 ETF and a US technology ETF, such as the iShares US Technology, you are likely over-exposed to US tech companies. Because you invested in the same equities through two distinct ETFs, you aren’t reducing your exposure to risk in any meaningful way. In addition, investment in ETFs might be complex because of the overlaps between different ETFs. Track insight tracks over 7,000 ETFs and calculates their exposure to nations and sectors. Both these and the top holdings of ETFs are free, so you can ensure that your ETFs don’t overlap.

Even while ETFs are very inexpensive, the fees associated with owning a large number of them can considerably influence the performance of your portfolio. In addition, every time you purchase or sell an ETF to alter your portfolio, you’ll have to pay a charge. There are set costs and percentage-based fees, which might add up if you’re making several minor trades in a large number of ETFs. Therefore, having a low number of ETFs in the portfolio will give you a more cost-effective investment strategy.

How much of my portfolio should be in ETFs?

ETFs should be 30% of your portfolio, and 40% should be stock investments.

No more than 30% of your bonds and 40% of your stocks should be invested in international ETFs. You may restrict your exchange-traded fund investment strategy by using sector ETFs, which allow you to focus on specific industries or sectors. If you plan on using only ETFs, you should incorporate a variety of asset classes into your ETF portfolio. Start by concentrating on the following three areas: Finance sector ETFs and healthcare sector ETFs are two examples of industry ETFs. Select ETFs with low correlation across a variety of industries. For example, investing in a biotech ETF or a medical device ETF would not be considered diversified. Finally, you should make an ETF selection based on fundamentals (the value of sectors), technical analysis, and economic forecasting.

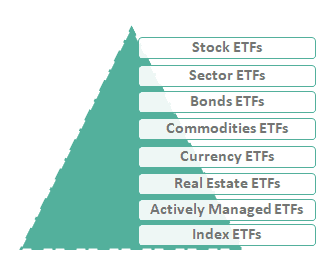

There are international ETFs for developing markets, developed markets, and everything. A global ETF can track investments in a single country, such as China, or an entire area, such as Latin America. The decision should be based on fundamentals and technical, similar to sector ETFs. The composition of each ETF, both in terms of individual stocks and sector allocation, should be examined. Investors’ portfolios would be incomplete without commodity exchange-traded funds (ETFs). ETFs and exchange-traded notes, their relatives, allow investors to keep tabs on anything from gold to cotton to maize (ETNs). ETFs that follow certain commodities are an option for investors confident in their knowledge. You may prefer a broad commodity ETF since specific things can be volatile.

Conclusion

Diversifying one’s portfolio is virtually always beneficial. Investing in a well-balanced portfolio of ETFs ensures that your money will increase over the long run. So keep your long-term aim in mind; this strategy works. ETF investing is more like a marathon than a sprint. Invest in a few ETFs and let the specialists take care of the rest, keeping your portfolio between five and ten. If you have a low-cost ETF portfolio, it should reduce the market’s volatility and help you achieve your investing goals. We hope you have acknowledged everything regarding how many ETFs I should own.