Table of Contents

CFD trading, or Contract for Difference trading, allows investors to speculate on the future price movements of various financial assets without actually owning the underlying asset. It’s a popular form of derivative trading that offers the flexibility to bet on price movements in either direction – meaning you can profit from prices going up (going long) or prices going down (going short).

When you trade a CFD, you agree to exchange the difference in the price of an asset from the point when the contract is opened to when it is closed. Your profit or loss depends on the accuracy of your speculation and the extent of the asset’s price movement.

Here’s a closer look at the critical aspects of CFD trading:

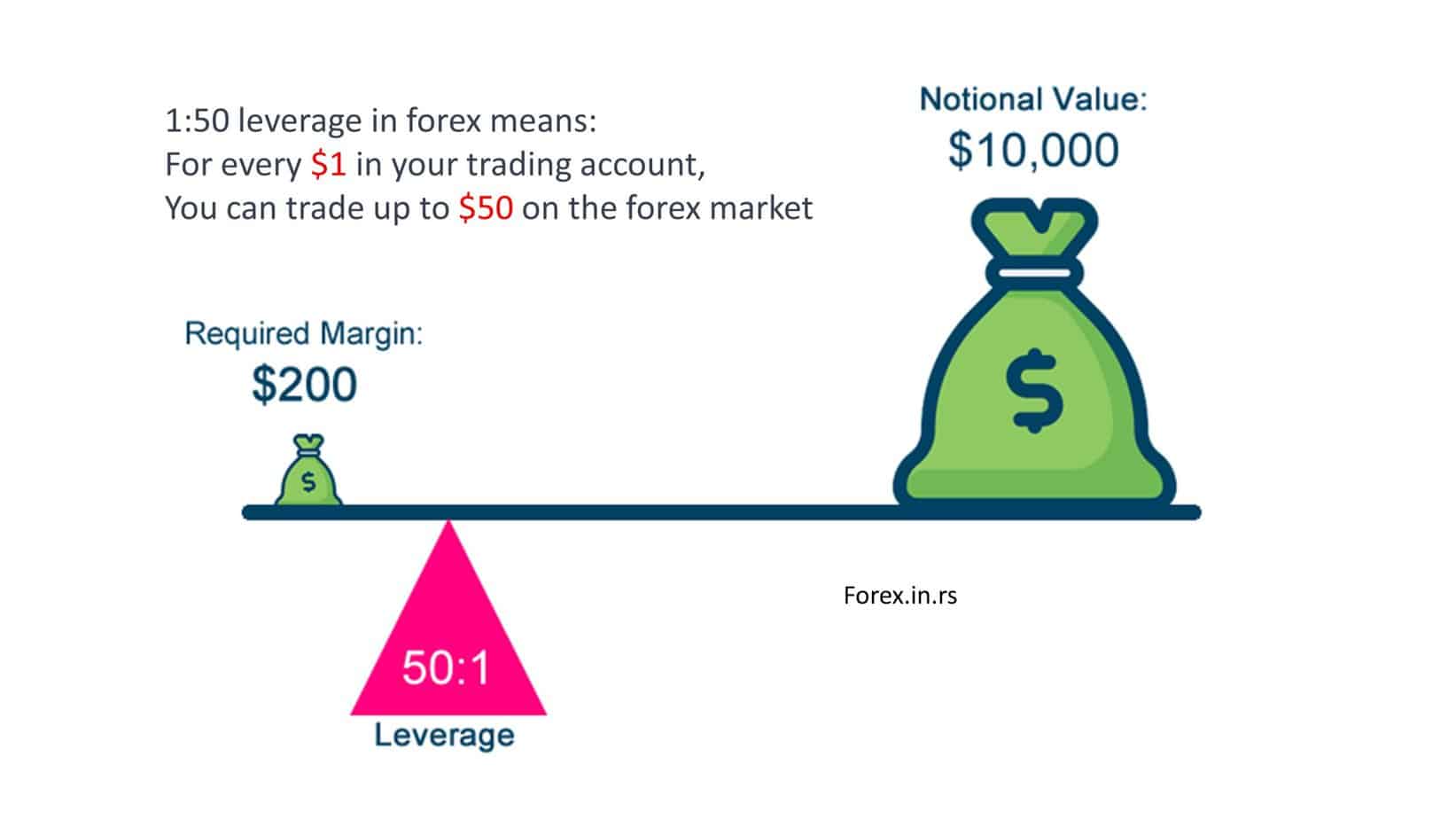

1. Leverage: CFD trading is often leveraged, meaning you can open a prominent position while only needing to put up a fraction of the total value (known as margin). While this can amplify profits, it also significantly increases the risk of losses.

2. Market Access: CFDs provide access to various markets, including shares, indices, forex, cryptocurrencies, and commodities. This allows traders to diversify their portfolios without needing to access multiple trading platforms or exchanges.

3. Going Long or Short: You can speculate on price movements in both directions. If you believe the price of an asset will rise, you can go long (buy). Conversely, if you expect the price to fall, you can go short (sell).

4. No Ownership of the Underlying Asset: CFD traders do not own the underlying asset, unlike purchasing stocks or commodities directly. They’re merely speculating on the price movement, which means they do not have the rights to dividends or voting that typically come with asset ownership.

5. Costs and Fees: Trading CFDs involves various costs, including the spread (the difference between the buy and sell price), holding costs for positions kept open overnight, and possibly commission fees, depending on the broker.

6. Risks: The leveraged nature of CFDs means risks are high. Market volatility can lead to substantial losses, often exceeding the initial investment. Traders must employ risk management strategies like stop-loss orders to mitigate potential losses.

7. Regulation: The regulation of CFD trading varies by country. Some jurisdictions have strict rules regarding leverage limits and marketing practices to protect retail investors, while others may offer less protection.

CFD trading can be a powerful tool for experienced traders looking to capitalize on short-term price movements across various financial markets. However, due to its complex nature and high risk, it’s essential for individuals to thoroughly understand the mechanics and risks involved before diving into CFD trading.

If you are from the US, please read our article on whether CFD is allowed in the US.

Traditional stocks trading vs. CFD trading

When you trade a stock, you purchase actual company shares, obtaining ownership with rights to dividends and voting, and profits are made if the stock’s price increases above the purchase price. In contrast, trading a stock using a CFD (Contract for Difference) allows you to speculate on the stock’s price movement without owning the actual shares, with the potential to profit from rising and falling prices. Furthermore, CFD trading often involves leverage, amplifying potential profits and losses, while traditional stock trading requires paying the total value of the shares upfront.

Let’s consider trading Apple stocks to illustrate the difference between traditional stock trading and trading using a CFD:

- Traditional Stock Trading: If you buy 100 shares of Apple Inc. at $150 each, you’re investing $15,000 and owning part of Apple. If the stock price rises to $160 and you sell, you make a profit of $1,000 (excluding trading fees). You benefit from any dividends Apple pays and can vote in shareholder meetings because you own the stock.

- CFD Trading: Instead, if you trade Apple stocks using a CFD, you might open a position on the same 100 shares at the same price without actually owning the shares. If you predict the stock price will rise to $160, you can close your position and profit from the price difference, which would also be $1,000 (before accounting for spreads, overnight fees, or other charges). However, you don’t receive dividends or have voting rights because you don’t own the stock. Moreover, if you use leverage, say 10:1, you’d only need to put down $1,500 as a margin to open the same position size, magnifying potential profits and losses.

For more examples, read the article Bitcoin CFD vs. Bitcoin.

3 Main Characteristics of CFDs

CFDs offer Flexibility in Long and Short Market Direction

One of the primary characteristics of Contracts for Difference (CFDs) is their unique feature that allows traders to speculate on both upward and downward price movements of underlying assets. With CFDs, traders can effectively “go long” or “go short” on an asset, providing unparalleled flexibility in market direction predictions. When traders believe an asset’s price will increase, they can opt to “buy” or go long on the CFD contract. Conversely, they can “sell” or go short on the contract if they anticipate a price decrease. The outcome hinges upon the trader’s pred accuracy theory: profiting if the asset’s price moves in the anticipated direction and incurring losses if it moves against their prediction. This capability to profit from rising and falling markets distinguishes CFDs from traditional investment instruments and enhances the diversity of trading strategies available to market participants.

CFDs Offer High Leverage

A critical key characteristic of CFD trading is leverage, which enables traders to have a more prominent market position with a relatively higher initial investment. Leveraged trading allows traders to amplify potential profits and losses as they gain exposure to the total value of the position while only committing a fraction of the total capital upfront as argon. For instance, traders can access significant market exposure with a fraction of the total position value deposited as margin.

However, it’s imperative to acknowledge that while leverage magnifies potential gains, it also increases the risk of substantial losses. Profits or losses are calculated based on the position’s full size, not just the initial margin. Therefore, effective risk management strategies are essential to mitigate the risks associated with leveraged CFD trading.

For example, CFD leverage can be up to 1:1000, higher than 1:3 in the stock industry.

CFDs Market Mimicry

CFD trading closely mirrors the behavior of its underlying market, aligning with its third distinctive characteristic. CFD prices are intricately linked to the movements of the underlying assets, ensuring that traders experience price changes that closely resemble those of the actual market. This characteristic enhances the efficiency of CFD trading, as it allows traders to capitalize on market movements without needing to own the underlying asset. Whether trading stocks, commodities, currencies, or indices, CFD prices faithfully reflect the dynamics of their respective market. CFD trading platforms may also apply spreads or commissions depending on the traded market. This mirroring effect ensures that CFD traders can effectively analyze market trends, execute trading strategies, and confidently manage risk, leveraging the underlying markets’ familiarity and dynamic sets.

CFDs Do Not Expire

Contracts for Difference (CFDs) offer traders a unique advantage. They typically do not have an expiry date on most markets, allowing positions to be held open indefinitely as long as the trader wishes to maintain their position. This characteristic distinguishes CFDs from futures and options contracts, which typically have fixed expiry dates.

Here’s a detailed explanation of why CFD positions don’t have expiry dates on most markets and how overnight funding fees come into play:

- Continuous Trading: Unlike futures and options contracts with predefined expiry dates, CFDs are designed for continuous trading. This means that traders can open and close positions at any time during regular market hours without being constrained by expiration dates. This flexibility enables traders to implement a wide range of trading strategies and hold positions for as long as necessary based on market conditions and their investment objectives.

- Underlying Assets: CFDs derive their value from underlying assets such as stocks, indices, commodities, or currencies. Since these underlying assets do not have expiration dates in the spot market, CFD positions based on them also do not have expiration dates. As long as the underlying asset continues to exist and trade in the market, traders can maintain their CFD positions without worrying about expiration.

- Overnight Funding Fees: While CFD positions can be held indefinitely, traders must be aware of overnight funding fees, also known as financing charges or swaps. These fees are incurred when a spot position (i.e., a position based on the current market price of the underlying asset) is held open beyond a specific time, typically after 10 pm UK time. The time may vary depending on the broker and the market being traded. These fees are charged because CFD positions are leveraged products, and traders borrow funds from the broker to maintain their positions overnight. The overnight funding fee compensates the broker for the cost of providing this leverage.

- Calculation of Overnight Funding Fees: Overnight funding fees are calculated based on the notional value of the CFD position and the applicable interest rates. The fees can be debited or credited to the trader’s account depending on the position’s direction (long or short) and prevailing interest rates. Generally, long positions incur financing charges, while short positions may receive financing credits.

- Managing Overnight Positions: Traders should factor overnight funding fees into their trading strategy when holding CFD positions overnight. Depending on market conditions and the cost of financing, it may be more cost-effective to close out positions before the end of the trading day to avoid incurring overnight funding fees. Additionally, traders should regularly review their positions and adjust their strategies to optimize their trading performance and minimize costs.

A typical Forex Broker is a CFD broker.

A typical forex broker often operates as a CFDs broker, offering a range of financial instruments beyond just forex pairs. Here’s an explanation of how a typical forex broker functions as a CFDs broker:

- Trading Platform: Forex brokers typically provide an online platform allowing clients to access various financial markets, including forex, stocks, indices, commodities, and cryptocurrencies. These platforms are user-friendly and equipped with trading tools and features to assist traders in executing their strategies effectively.

- Access to Multiple Markets: As a CFDs broker, the forex broker enables clients to trade various instruments through Contracts for Difference (CFDs). These instruments include stocks from global exchanges, stock indices, commodities like gold, silver, oil, and other assets such as bonds or ETFs. This expanded offering allows traders to diversify their portfolios and capitalize on opportunities across different asset classes.

- Leverage and Margin Trading: Similar to forex trading, CFD trading involves leverage, allowing traders to control more prominent positions with less capital. Forex brokers offer leverage on CFD trades, enabling clients to amplify their potential profits (as well as losses). Margin requirements are set by the broker and vary depending on the asset being traded and the regulatory environment in which the broker operates.

- Long and Short Positions: CFD trading through a forex broker allows traders to take long (buy) and short (sell) positions on various financial instruments. Traders can speculate on price movements in either direction, profiting from rising and falling markets. This flexibility is one of the critical advantages of CFD trading and attracts traders seeking to capitalize on diverse market conditions.

- No Expiry Dates (Except for Futures): Most CFD positions offered by forex brokers do not have expiry dates, enabling traders to hold positions open for as long as they choose. This differs from futures contracts, which have fixed expiration dates. However, traders should be aware of overnight funding fees incurred for holding spot positions overnight, as mentioned earlier.

- Risk Management Tools: Forex brokers typically provide tools to help traders manage their positions effectively. These tools may include stop-loss orders, take-profit orders, and guaranteed stop-loss orders (GSLOs) to limit potential losses and protect profits. Additionally, brokers may offer risk management features like negative balance protection to prevent traders from losing more than their initial investment.

- Regulation and Compliance: Reputable forex brokers operating as CFDs brokers adhere to strict regulatory requirements imposed by financial authorities in their jurisdiction. Regulatory oversight ensures brokers maintain high transparency, fairness, and client protection standards. Traders should verify that their chosen broker is regulated by a recognized regulatory body to safeguard their funds and ensure a trustworthy trading environment.

In summary, a typical forex broker extends its services to include CFD trading, offering clients access to various financial markets, leverage, long and short positions, risk management tools, and regulatory oversight. This comprehensive offering caters to traders seeking exposure to various asset classes beyond the forex market.

CFDs vs. ETF

In our article, we analyze CFDs vs. ETFs.

Contract for Differences (CFDs) and Exchange-Traded Funds (ETFs) are two types of financial instruments catering to diverse investment strategies and risk appetites. Here’s a detailed explanation based on the points you’ve provided:

Ownership

- CFDs: When you trade CFDs, you’re engaging in a contract with another party to exchange the difference in the price of an asset from when the contract is opened to when it is closed. You do not own the underlying asset. This means you can speculate on price movements without having the burden or benefits of physical ownership.

- ETFs: Trading ETFs means buying shares of a fund that owns the underlying assets. ETFs track the performance of a particular index, sector, commodity, or other asset class. When you purchase an ETF, you have a stake in its underlying assets, making you a partial owner of a diversified portfolio.

Asset Type

- CFDs can represent a wide range of assets, including but not limited to currencies (like EUR/USD, GBP/USD), commodities (like gold), stocks, or even indices. This versatility allows traders to speculate on the price movements of various assets without owning them.

- ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds. It generally operates with an arbitrage mechanism designed to keep them trading close to their net asset value, though deviations can occasionally occur. ETFs provide exposure to a broad portfolio or a specific sector, such as technology, healthcare, or commodities.

Purpose

- CFDs are primarily used for speculation. Traders use CFDs to predict the future direction of asset prices. If they anticipate that the underlying asset’s price will rise, they will buy (go long on) a CFD. Conversely, if they believe the price will fall, they will sell (go short on) a CFD. This allows for profit opportunities in both rising and falling markets.

- ETFs are investment tools that allow investors to diversify their portfolios without buying all the ETF components individually. They track the performance of a specific index or basket of assets, providing a more passive investment strategy than active trading.

Risk and Term

- CFDs are considered high-risk financial instruments due to their leverage, margin requirements, and the speed at which profits or losses can occur. They are often used for short-term trading strategies, and their value can fluctuate significantly quickly.

- ETFs are generally viewed as lower-risk investments than CFDs because they offer diversified exposure to various assets, sectors, or indices. ETFs are suitable for both short-term trading and long-term investment strategies, but they are commonly used by individuals looking for long-term growth through a diversified portfolio.

In summary, choosing CFDs and ETFs depends on an individual’s investment strategy, risk tolerance, and financial goals. CFDs offer a way to speculate on price movements with potentially high returns (and high risk) without needing physical ownership of the underlying asset. On the other hand, ETFs provide an opportunity for diversified, longer-term investments in a range of assets with typically lower risk than CFDs.

Read more about Equity Swap vs CFD.