Table of Contents

The concept of ROI can be applied to many areas of finance and trading, such as stocks and commodities. Investors calculate their ROI by taking the amount they have earned from an investment minus the cost of investing (including taxes), divided by the initial amount invested. The result is then expressed as a percentage. In other words, it is a measure used to determine how much money has been made compared to what was spent.

It is important to remember that although higher returns usually indicate better investments, there are no guarantees regarding trading. Risk assessments should always be undertaken before any investments are made, and diversification measures should also be taken to minimize losses when possible.

In addition to calculating profits and losses resulting from specific investments, traders may also use ROI as part of their strategy for how much capital they will allocate in different areas at any given time. By understanding their ROI over extended periods and other factors such as risk appetite and market conditions, traders can optimize their portfolio allocation for optimal returns on their investments without taking on more risk than desired.

Understanding ROI

The financial world is riddled with jargon and multiple confusing words. Without understanding these, surviving in a world filled with bankers, investors, and complex corporate environments may not be easy.

What is ROI?

Return on Investment or ROI represents an investment’s benefit (or return) divided by the investment cost. ROI, as a financial ratio, evaluates the profitability of an investment. Return on Investment can be expressed as a ratio or percentage—for example, the more significant the percentage, the better the investment.

It provides an easily usable formula that has many practical uses. For example, one can compare the Return on Investment from a range of not generally compared assets. Therefore, one could compare the stock market’s performance with a new niche start-up by merely plugging the correct financials into the Return on Investment equation.

What is ROI in trading?

ROI in trading represents the amount of money gained or lost on an investment relative to the amount invested. If the trader invested $1000 in his account, he made a $400 profit, then the return on investment in trading would be $400/$1000=0.4 or 40%.

Return on investment (ROI) in trading is an essential concept, as it helps traders assess the effectiveness of their assets. It is a metric that measures the total amount of money gained or lost on an investment relative to the amount initially invested. For example, if you invest $1000 into a trading account and make a $400 profit, your return on investment in trading would be $400/$1000=0.4 or 40%.

Return on investment equation

To calculate this, the amount earned is divided by the cost of the investment. The result is expressed as the Return on Investment ratio. Mathematically, the Return on Investment equation goes as follows:

ROI = (earnings from the investment – the cost of acquisition) / cost of investment

Sample investment return: Next, one must consider calculating a Return on Investment practically. To this end, a return on investment example should suffice: John invested $1000 in Nice Shoe Inc in 2010. Today, he wishes to sell those shares, and he sells them for a total of $1400. If he wanted to know his return on investment, John would first have to calculate his profits. This can be done by subtracting investment value and the cost of investment: $1400 – $1000 = $400. Next, the gain is divided to get the investment of $400/$1000 = 40%. Therefore, John’s return on investment is 40%.

These equations may be made much simpler using online return on investment calculators. This can make life simpler when comparing multiple investment opportunities simultaneously, allowing for a more straightforward path to seeing the opportunity costs associated with a respective business path.

Forex ROI calculator:

How to calculate the rate of return on investment in excel?

We can calculate return on investment in an excel sheet if we put the equation as a formula. You can download the return on investment (ROI) excel template.

What is a reasonable average rate of return on investments?

The reasonable average return rate on investment differs from industry to industry. Globally, an excellent average rate of return on assets is above 50%.

Generally, any value that comes out of the Return on Investment equation as positive is considered a good return. Nonetheless, the importance remains on evaluating all options so that the investment chosen outweighs its associated opportunity cost. The opportunity cost is the next best option forgone with the purchase of any good, service, or asset.

Consider this: John (from the example earlier) had the opportunity of purchasing shares in Nice Shirts Inc. For the same $1000 in investment, his Return on Investment would have equated to 50% over the same period. Therefore, John’s opportunity cost was higher than his profit from buying shares in Nice Shoes, Inc.

From this, one can see that opportunity cost plays a vital role in decision-making. A comprehensive Return of Investment analysis may help dramatically aid this because, as stated earlier, the equation provides a reasonable basis for numerical comparison.

What is a good return on investment in forex trading?

The excellent return on investment in forex trading is 20% annually. Active investor in stocks or forex is usually happy with a 15-20% annual return.

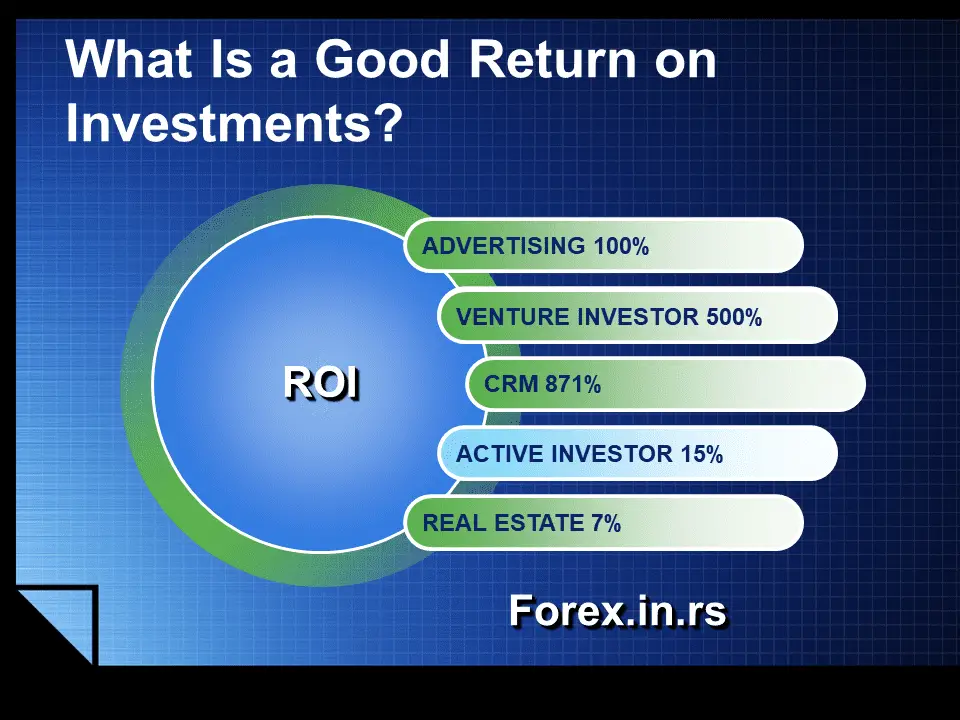

What has been considered a good return on investment is hard to tell. Each industry has its average ROI. For example, marketing and advertising for every $1 invested will bring you at least $2. On another side, real estate and stocks can get you a cumulative high profit, but ROI is much smaller. See the image below:

Share this Image about Good Return on investment On Your Site.

Limitations of the Return on Investment Analysis

Return on Investment is a profitability ratio. This means it is supposed to aid in any investment opportunity’s decision-making. However, to play a proper role in that situation, it is critical to establish that it has limits. The equation does not consider the time between the initial investment and the profit received. So, it may put assets that have different Rates of Return in the same category.

For example, the Return on Investment equation will say two 20% Returns on Investments are the same even though the first investment may have achieved this in 6 months and the second in 2 years. Therefore, the Return on Investment analysis is insufficient and must be used alongside other crucial profitability measures. Such measures provide a better basis with which to make an investment decision.

Examples of such calculations include the Present Net Value (NPV) and the Internal Rate of Return (IRR). These are not comprehensive, and further research is suggested before making critical decisions.

Furthermore, the Return on Investment analysis only provides historical data. This means that it cannot be a predictor of what an investment may do in the future. However, specific implications may be drawn from this.

Criticisms of evaluating performance based on ROI include:

- Reject investment opportunities that are profitable for the company but negatively impact a manager’s ROI.

- Be put in charge of a business segment that includes committed costs over which a manager has no control.

- Take actions that increase ROI in the short run at the expense of long-term performance.

In every country, ROI is the most commonly used financial performance measure. Return on investment calculation allows managers of one organization to compare performance with that of other organizations. To increase the return on investment (ROI), the company must increase sales, decrease operating expenses, or increase unit sales.

Which investment offers the best combination of low risk and high return?

Investments like preferred stocks, utility stocks, fixed annuities, and brokered CFDs offer the best combination of low risk and high return.

Stocks are typically high risk and high return, while bonds (especially government-secured bonds) are low risk and low return.

Stocks are typically high risk and high return; as an investment, bonds are less risky than stocks but generally have a lower rate of return. On the other side, one of the benefits of mutual funds is that their diversification reduces risk. The answer is: both can be risky, but average stock investing is more complex than average mutual fund investment. Most mutual funds can achieve a 5-7% ROI annually.

How to Calculate an Annual Return With Stock Prices

As same as we calculate ROI for any other business, ROI = (gain from the investment – the cost of acquisition) / cost of investment.

Simple Return = (Current Price-Purchase Price) / Purchase Price

Annual Return = (Simple Return +1) ^ (1 / Years Held)-1

or if you have dividends:

Simple Dividend-Adjusted Return = (Current Stock Price-Dividend-Adjusted Stock Purchase Price) / Dividend-Adjusted Stock Purchase Price.

Annual Dividend-Adjusted Return = (Simple Dividend-Adjusted Return +1) ^ (1 / Years Held)-1

The Future of ROI in Trading

This is a question we have when we talk about investing and ROI. Risk increases if the loss exceeds the amount invested, even if the probability remains unchanged. SO higher risk corresponds to higher returns, and lower risk equals lower returns. Return on investment can not be the only thing we are looking for when we invest our money—ROI and risk need to study together.

Recent times have seen the advent of the Social Return on Investments, a measurement system that considers the Triple Bottom Line: social, environmental, and economic factors. SROI helps the management of companies understand the scope of their decisions in a broader sense than just monetary policy.

Moreover, the Return on Investment analysis can act as an alarm bell, as the equation’s harmful products should see the immediate withdrawal of capital from the investment.

Overall, Return on Investment (ROI) in trading can provide valuable insights into how effective trades have been over time and help inform future strategies for capital deployment across different asset classes. By understanding its principles, investors can make smarter decisions when deciding where to allocate their capital to maximize returns while minimizing risk exposure.