Table of Contents

Bonds and stocks are all securities, the difference being stockholders or owners of a company, while bondholders are deemed lenders.

A government bond is a debt security issued by a government to support government spending and obligations. Bonds play a critical role in balancing portfolios and general economies. Investors are thus encouraged to take on bonds and stocks concurrently. Bond returns may be lower than stocks, but they are safer, protected ways of investing in securities. The level of its duration can quantify the interest rate of bonds.

Moody’s Investors Service provides international financial research on commercial and government-issued bonds. Moody’s, along with Standard & Poor’s and Fitch Group, is considered one of the Big Three credit rating agencies.

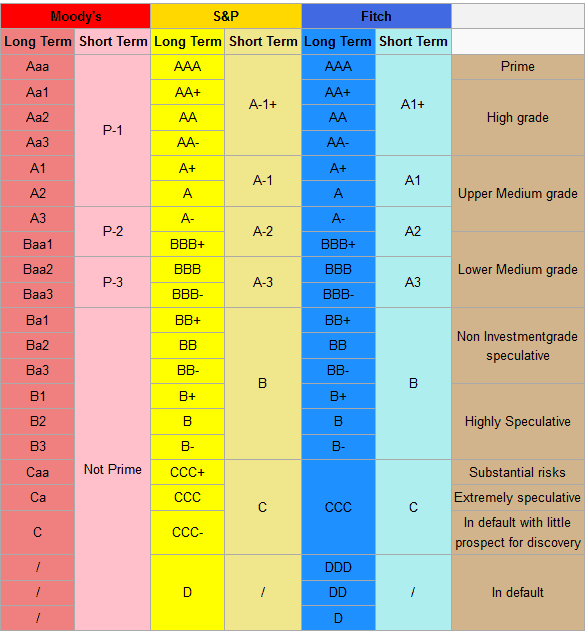

See List of government bonds rated by Moody’s and S&P and Fitch :

According to Moody’s, the purpose of its ratings is to “provide investors with a simple system of gradation by which future relative creditworthiness of securities may be gauged.” To each of its ratings from Aa through Caa, Moody’s appends numerical modifiers 1, 2, and 3; the lower the number, the higher the rating.

Government bonds are debt securities issued by governments to finance governmental spending. Credit rating agencies often evaluate these bonds’ creditworthiness, with Moody’s, Standard & Poor’s (S&P), and Fitch being three of the most prominent. These agencies assess the risk associated with the bonds and assign ratings that influence the interest rates on these bonds. Here’s a detailed explanation of how each agency rates government bonds:

1. Moody’s

- Rating System: Moody’s uses a letter-based rating system ranging from ‘Aaa’ (highest quality) to ‘C’ (lowest quality).

- Criteria: The ratings are based on the government’s financial strength, economic profile, and susceptibility to event risks.

- Impact on Rates: Higher-rated bonds (e.g., ‘Aaa’) are considered lower risk and typically have lower interest rates. Lower-rated bonds (e.g., ‘Ba1’, ‘C’) are considered higher risk and offer higher interest rates to attract investors.

2. Standard & Poor’s (S&P)

- Rating System: S&P’s ratings range from AAA (powerful capacity to meet financial commitments) to D (default).

- Criteria: S&P evaluates economic and fiscal metrics, including GDP growth, debt burden, and fiscal flexibility.

- Impact on Rates: Similar to Moody’s, higher S&P ratings correlate with lower interest rates, reflecting lower perceived risk.

3. Fitch

- Rating System: Fitch’s rating scale is similar to S&P’s, ranging from ‘AAA’ to ‘D.’

- Criteria: Fitch focuses on the country’s debt structure, economic growth, inflation, and political risk.

- Impact on Rates: As with the other agencies, higher ratings from Fitch generally mean lower interest rates.

Common Aspects

- Influence on Markets: The ratings these agencies give significantly impact investor confidence and the government’s borrowing costs.

- Dynamic Nature: Ratings are not static and can change in response to a country’s fiscal, political, and economic developments.

- Global Comparison: These ratings allow for comparison across different countries, providing investors with a benchmark to assess risk and return.

Importance

- Investor Guidance: They provide a guideline for investors regarding the safety and risk associated with investing in a country’s bonds.

- Borrowing Costs for Governments: A lower rating can increase a government’s cost of borrowing by requiring higher interest rates to attract investors.

Criticism and Limitations

- Subjectivity: Despite being based on quantitative data, the rating process has subjective elements and can be influenced by the agencies’ perceptions and methodologies.

- Past Controversies: These agencies have faced criticism, especially after the 2008 financial crisis, for their ratings on mortgage-backed securities.