Table of Contents

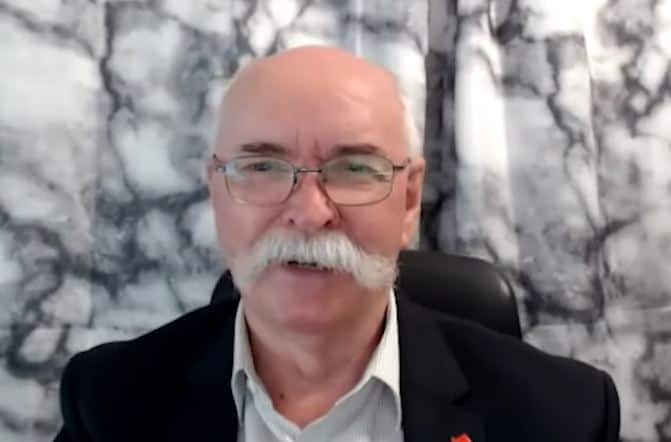

In this interview, we sit down with Daryl Guppy, a seasoned trader with nearly three decades of experience in equities, derivatives, and market psychology. Having navigated through multiple market cycles, Guppy shares invaluable insights about his trading journey, challenges, and triumphs. In a candid conversation, he discusses how market conditions have evolved and why adaptability is key for any trader aiming for long-term success.

In this post, readers will dive into Daryl Guppy’s approach to trading, where he reveals his thoughts on market psychology, the importance of understanding price patterns, and why some trading principles still apply despite technological advancements like high-frequency trading. Guppy emphasizes the need for precision in recognizing high-probability setups and explains why focusing on a handful of reliable chart patterns, like the triangle and cup-and-handle formations, can be a game-changer for traders.

Daryl Guppy Playbook & Strategy: How He Actually Trades

Identifying High-Probability Trading Setups

One of Daryl Guppy’s key strategies revolves around recognizing high-probability chart patterns. By spotting these patterns early, he positions himself for profitable moves. The key to his success isn’t just about following patterns, but understanding the psychology behind them.

- Look for established chart patterns: Guppy emphasizes using simple, reliable patterns like triangles and cup-and-handle formations. These patterns represent key psychological moments in the market.

- Focus on the breakout: Guppy prefers trading breakouts. He identifies when price action is likely to break out of a resistance level or trendline, signaling a high-probability trade.

- Use the measured move strategy: Once a breakout happens, Guppy uses the base of the pattern (e.g., the triangle) to set a target price. This allows for calculated and strategic trade entries with clearly defined exit points.

These rules help traders focus on setups that align with clear, predictable price movements. By using chart patterns to anticipate price action, you can target opportunities with a higher probability of success.

Adapting to Market Changes

Daryl Guppy highlights the importance of adapting to changing market conditions. The strategies that worked in one market environment might not be effective in another. He advocates for staying flexible and adjusting trading tactics to match the evolving market landscape.

- Understand market cycles: Markets move through different phases—bull, bear, and consolidation. Guppy’s approach changes based on the market cycle. For example, in a bullish market, trend-following strategies work well, but in a bear market, you may need to adjust your tactics.

- Don’t be afraid to change your approach: Just because a strategy worked in the past doesn’t mean it’s right for today’s market. Always reassess and modify your strategies as market conditions evolve.

- Focus on volatility: Guppy uses volatility to gauge market behavior. He adjusts his stop losses and position sizes based on how much the price is expected to move.

By staying flexible and continually adapting to the market, you increase your chances of staying profitable, even in uncertain conditions.

Psychology and Market Behavior

Daryl Guppy places a strong emphasis on understanding the psychology behind price action. He believes that the market isn’t just about numbers—it’s driven by human emotion and behavior. Recognizing how other traders think and act can give you an edge.

- Follow the crowd, but think independently: While patterns represent collective market behavior, it’s important not to follow the herd mindlessly. Guppy looks for patterns where many traders are likely thinking the same thing, but he uses his own judgment to decide if the pattern is worth trading.

- Track the “footprints” of other traders: Guppy watches for clues in price action that tell him how other market participants are reacting. He sees patterns as footprints that reveal the collective mindset of traders.

- Use the right indicators: Guppy focuses on a few core indicators that track market sentiment, such as the Guppy Multiple Moving Average (GMMA). These indicators help him read market psychology and anticipate trends.

By understanding the psychology of the market, you can better predict price movements and make smarter trades that align with the broader market consensus.

Managing Risk with the 2% Rule

Risk management is crucial to Daryl Guppy’s strategy. He believes in protecting capital and making sure that no single trade wipes out a large portion of your portfolio. This is where his strict adherence to the 2% rule comes in.

- Limit risk to 2% of total capital: Guppy ensures that no trade risks more than 2% of his total trading capital. This means if a trade goes wrong, the loss is manageable and doesn’t significantly affect the overall portfolio.

- Adjust position sizes: Based on volatility, Guppy adjusts the size of his positions. If a trade has more potential for movement, he’ll reduce his position size to stay within the 2% risk rule.

- Use volatility-based stop losses: Instead of relying on a fixed dollar amount for stop losses, Guppy uses volatility indicators to set stop-loss levels. This ensures that stop losses are placed in line with the natural fluctuations of the market, avoiding premature exits.

By sticking to the 2% rule, Guppy ensures long-term survival and minimizes the risk of significant losses, allowing him to stay in the game and trade profitably.

Avoiding Over-Trading

One of Daryl Guppy’s most practical rules is knowing when to trade and when to stay out of the market. Over-trading, especially during unfavorable market conditions, is a sure way to erode your capital. Guppy advocates for patience and precision.

- Wait for ideal conditions: Guppy believes that independent traders have the advantage of waiting for the perfect setup. Unlike institutional traders who must trade every day, individual traders can afford to be patient and trade only when the market aligns with their strategy.

- Don’t force trades: If the market isn’t presenting the right conditions for your strategy, it’s better to sit on the sidelines. Guppy’s method involves waiting for the market to come to him rather than chasing trades.

- Use smaller trades for experimentation: When trying out new strategies, Guppy recommends using smaller trades to test them out, minimizing the risk of a larger loss while learning what works.

This approach keeps traders from being swayed by short-term market noise and helps them focus on high-quality trades that fit their strategy.

Using Technical Indicators Strategically

While many traders rely on dozens of indicators, Daryl Guppy prefers to keep things simple. He uses just a few key tools that he knows well and can rely on to make accurate predictions.

- Stick with a handful of indicators: Guppy uses the Guppy Multiple Moving Average (GMMA) to understand market sentiment. He also uses a volatility-based stop loss to track price fluctuations. Sticking to a small set of reliable indicators reduces confusion and increases the clarity of trading decisions.

- Don’t rely on just one indicator: Guppy emphasizes that there is no single “magic” indicator. It’s not about finding a perfect tool but about knowing how to use the tools you have effectively.

- Adapt indicators to changing conditions: As market conditions evolve, so should your approach to using indicators. Guppy modifies his indicators to suit the specific environment, ensuring his strategies remain relevant.

Mastering High-Probability Trade Setups with Simple Chart Patterns

Daryl Guppy has spent decades honing his ability to spot high-probability trade setups, and a big part of his strategy revolves around understanding and utilizing simple chart patterns. He believes that certain patterns, like triangles and cup-and-handle formations, hold the key to predicting where the price might go next. For Guppy, it’s not about using complex, hard-to-understand indicators, but about focusing on the clear patterns that show how traders are reacting to the market’s psychology. By reading these patterns, he’s able to anticipate breakouts with higher accuracy, increasing his chances of success.

Guppy’s approach to pattern recognition is about much more than just identifying shapes on a chart—it’s about interpreting the market’s collective behavior. For instance, the triangle pattern often signals an impending breakout when price consolidates and builds pressure. Guppy uses these patterns to determine entry points and set clear price targets based on the measured move principle. This strategy allows traders to execute trades with a higher probability of success while minimizing the guesswork often involved in trading. By focusing on patterns that reflect market psychology, Guppy teaches traders how to trade with more confidence and precision.

Adapting Your Strategy to Changing Market Cycles and Volatility

Daryl Guppy emphasizes the importance of adapting your trading strategy to fit the market cycle you’re in. According to Guppy, markets are not static, and the approach that works in a bullish market can fail in a bear market or during periods of consolidation. He believes that successful traders need to recognize when the market is shifting and adjust their tactics accordingly. This adaptability is what has allowed him to stay relevant in the markets for over 30 years, even as technology and market structures evolve.

For Guppy, understanding volatility is key to navigating different market environments. In volatile markets, he recommends adjusting position sizes and using tighter stop losses to manage risk. In more stable, trending markets, he might allow for larger positions and looser stops. Guppy also stresses the importance of recognizing when market conditions are unfavorable for your trading strategy and having the discipline to step back. By staying flexible and assessing volatility, Guppy’s approach ensures that traders can continue to profit, no matter what market phase they’re in.

Risk Management 101: The Power of the 2% Rule

Daryl Guppy’s approach to risk management is grounded in a strict but essential rule: never risk more than 2% of your total capital on a single trade. This simple yet powerful rule is at the core of his long-term trading success. Guppy emphasizes that while winning trades are important, it’s the ability to control your losses that determines whether you can survive in the market. By limiting risk to just 2% per trade, he ensures that even a series of losses won’t significantly impact his overall capital.

The 2% rule isn’t just about how much to risk; it’s also about managing position sizes and setting appropriate stop-loss levels. Guppy carefully calculates the dollar value he’s willing to lose, then adjusts his position size to stay within that limit. This ensures that no matter how large or small a trade may be, the risk remains consistent and manageable. By sticking to the 2% rule, Guppy creates a solid foundation for his trading, allowing him to weather inevitable drawdowns without risking his overall portfolio.

Trading with Psychology: How to Read the Market’s Collective Mind

Daryl Guppy places a strong emphasis on understanding the psychology of the market, which he believes is just as important as technical analysis. He views price patterns as reflections of market sentiment—the collective mindset of all the traders involved. For Guppy, it’s not just about interpreting price movements, but about reading the underlying emotions that drive those movements. By understanding the psychology behind these patterns, traders can predict the next market move with greater certainty.

Guppy uses chart patterns like triangles and cup-and-handle formations to gauge how other market participants are likely to react. He believes these patterns form because of the collective decisions of all traders, which then reveal the market’s mindset. By paying attention to these psychological clues, Guppy can anticipate whether a trend is likely to continue or reverse. This approach allows him to trade with confidence, knowing that he’s not just guessing what will happen next, but rather predicting the outcome based on human behavior.

Don’t Overtrade: Waiting for the Perfect Market Conditions

Daryl Guppy advocates for a patient and disciplined approach to trading, stressing that overtrading is one of the quickest ways to lose money. He believes that successful traders don’t trade every day; instead, they wait for the right market conditions that align with their strategy. By being selective and waiting for high-probability setups, Guppy ensures that his trades have the best chance of success, rather than forcing trades in unfavorable conditions. This selective approach helps minimize risk and maximizes potential rewards.

For Guppy, the key to this strategy is understanding that not every market moment is worth capitalizing on. He doesn’t feel pressured to trade simply for the sake of being active. Instead, he’s focused on finding opportunities that fit his specific trading style and risk tolerance. Guppy’s method teaches traders the importance of patience, allowing them to only take trades that truly align with their strategy, thereby increasing the chances of profitable outcomes over time.

Daryl Guppy’s approach to trading is built on a foundation of patience, precision, and a deep understanding of market psychology. He stresses the importance of adapting your strategy to changing market conditions, making sure that your approach evolves with the market rather than staying static. His rule of limiting risk to just 2% per trade is a cornerstone of his success, ensuring that he can survive drawdowns without significant damage to his capital.

Guppy also emphasizes the power of chart patterns to predict market movements, teaching traders to use simple yet effective patterns like triangles and cup-and-handle formations to spot high-probability setups. By focusing on the collective psychology behind these patterns, Guppy helps traders understand not only where the price is likely to go, but why it’s moving in that direction. His approach is further reinforced by the discipline to avoid overtrading—waiting for the perfect conditions to strike rather than forcing trades in uncertain markets.

In essence, Daryl Guppy’s strategy is about building a method that works consistently over time by focusing on risk management, understanding market psychology, and waiting for the right opportunities. His approach is proof that success in trading isn’t about taking every opportunity, but about waiting for the ones that fit your strategy and managing risk with precision.