Table of Contents

Position size in trading is one of the most important things. Unfortunately, beginner traders very often neglect this segment of trading.

1,000 Units = 0.01 Lot.

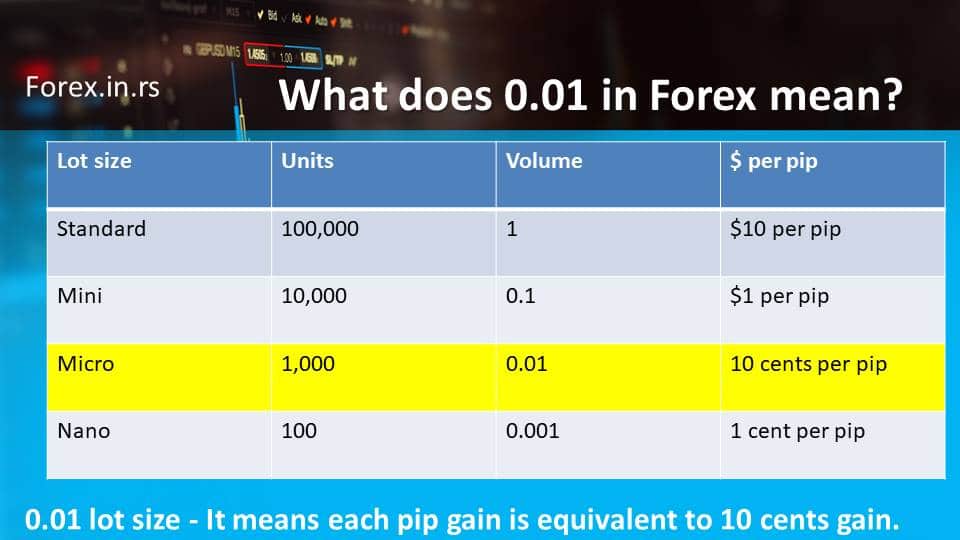

What does 0.01 in forex mean?

0.01 lot size in forex or micro lot equals 1.000 units of any given currency. So, a position size of 0.01 lot for EURUSD currency pair, for every ten pips gain, will provide a $1 profit (10 cents per pip). So for EURUSD, ten pips for 0.01 lot size profit are $1.

0.01 lot size or 1000 units or micro lot is the smallest position size for standard forex accounts.

How Much is 0.01 Lot Size in Dollars?

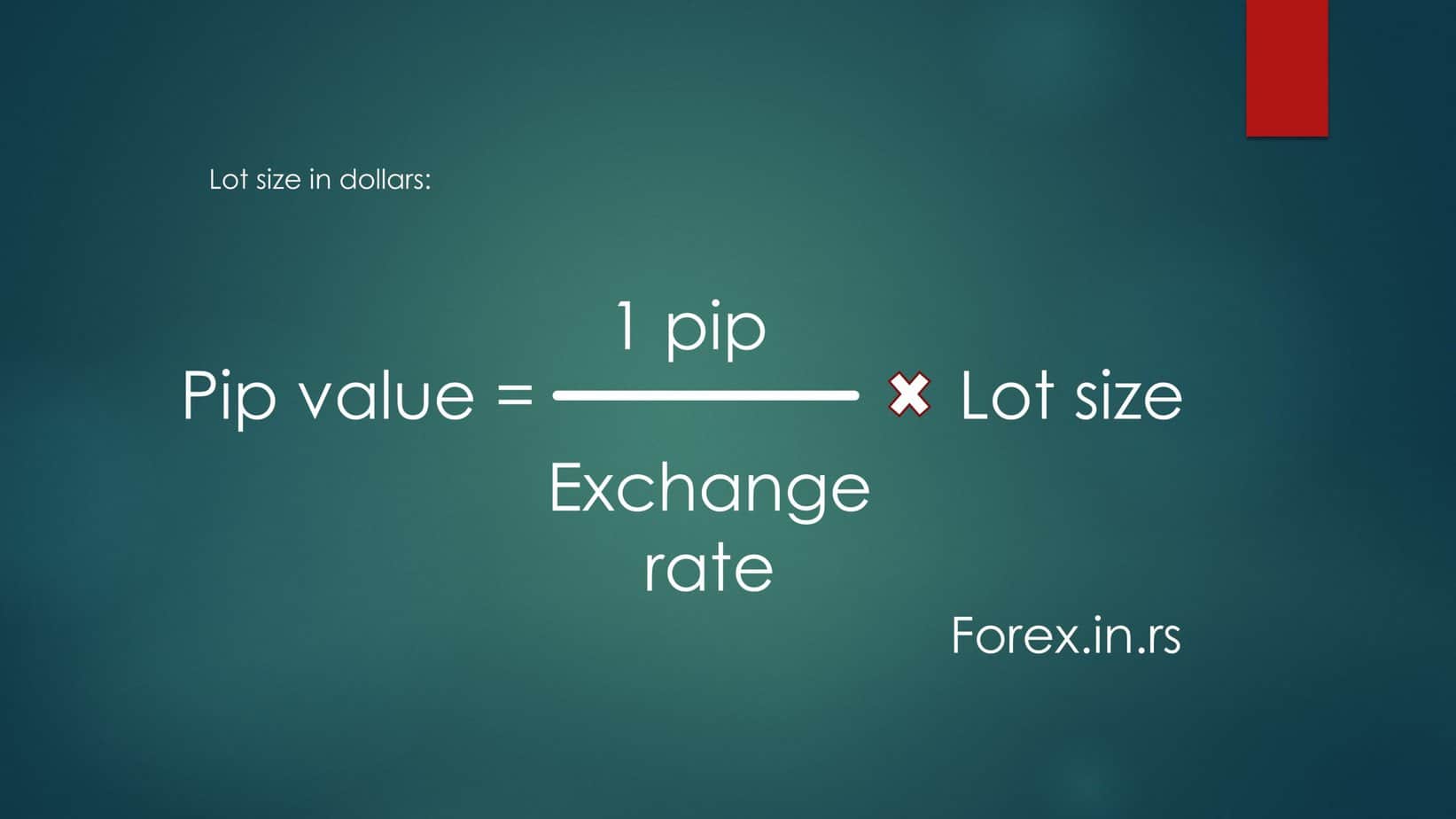

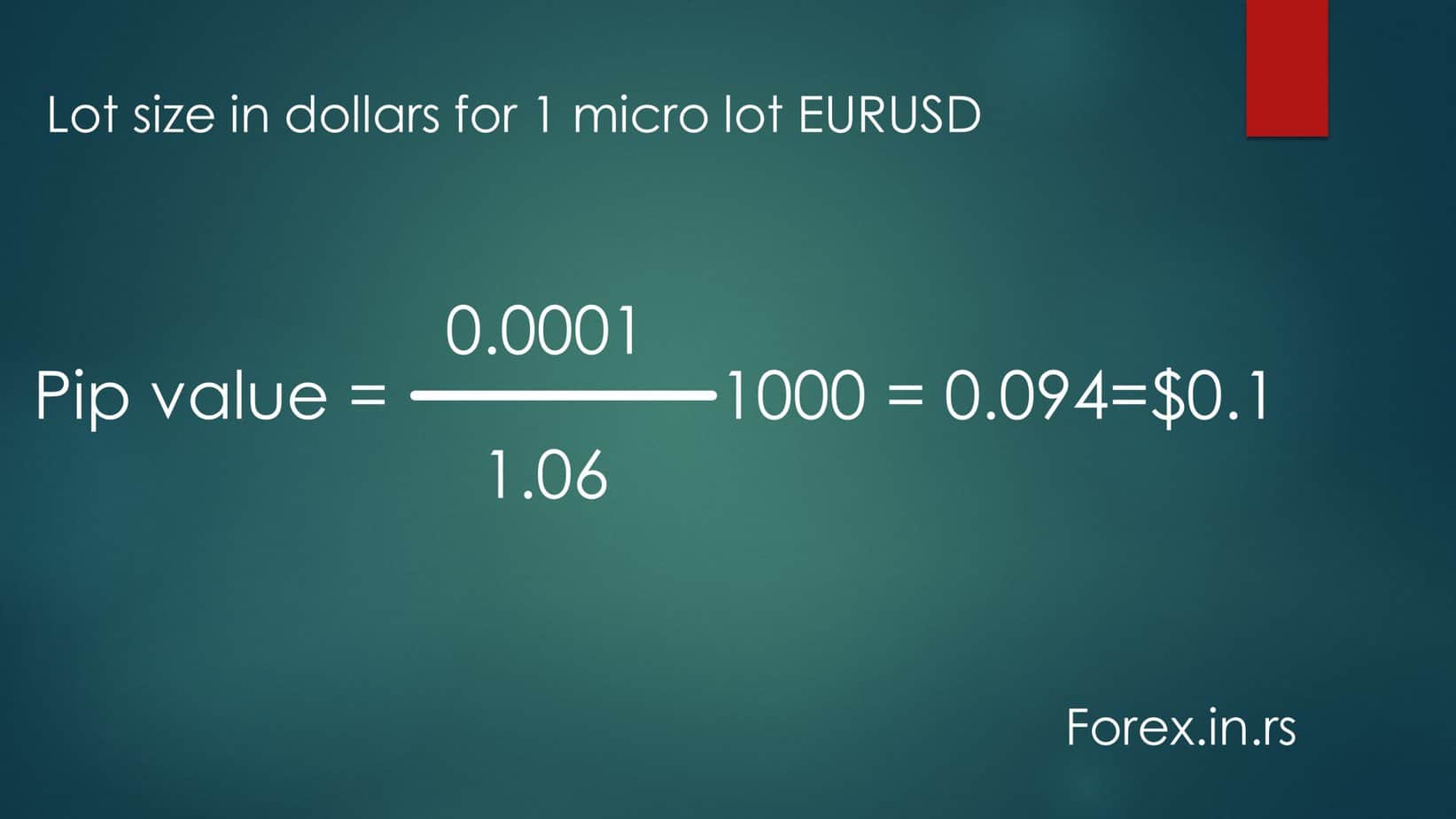

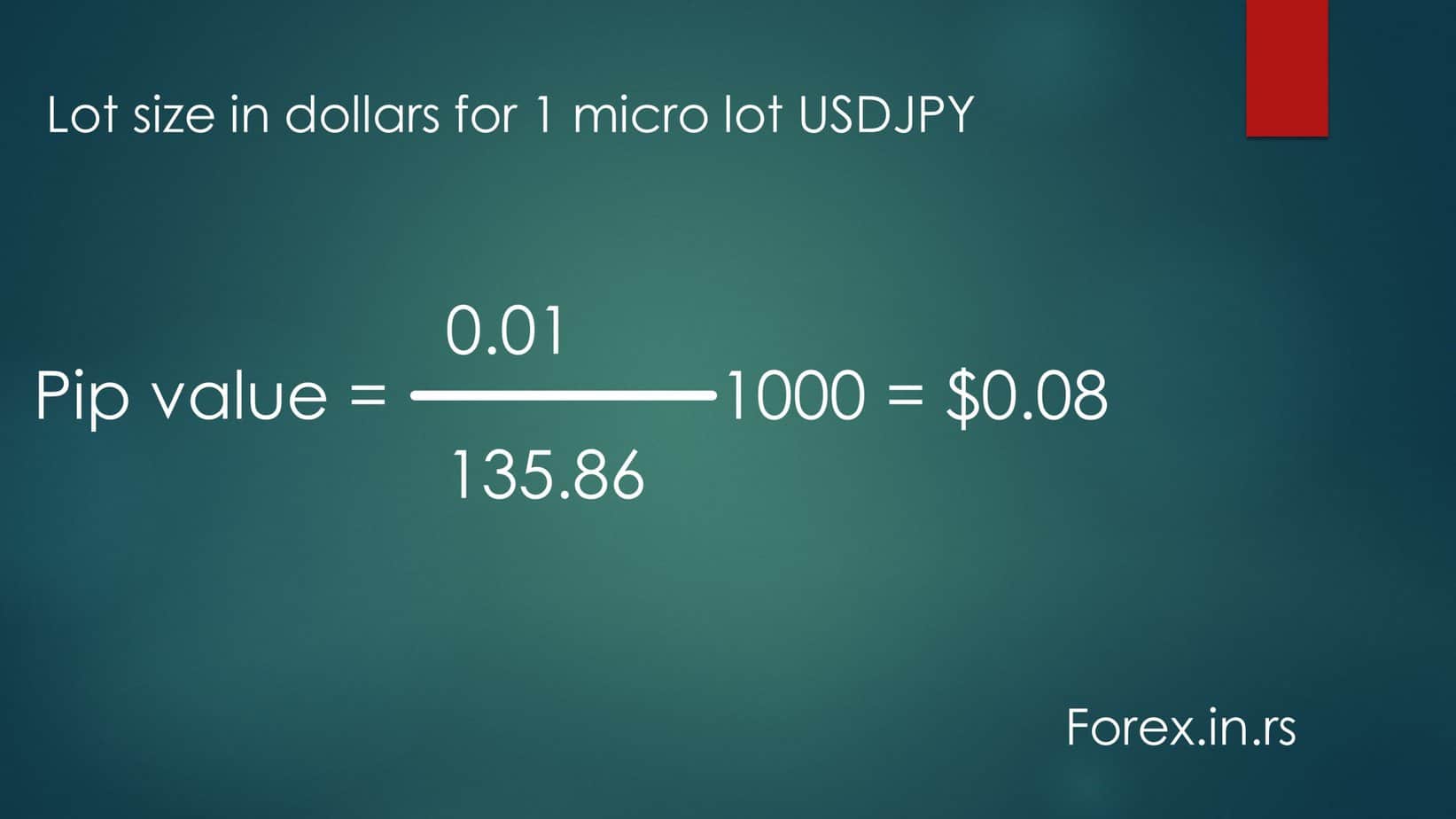

The 0.01 lot size for a currency pair where the secondary currency is USD is always $0.1. However, to calculate other currency pairs’ lot sizes in dollars, you must use the formula (1 pip/exchange rate)* lot size. In this case, the 0.01 lot size for EURUSD is $0.1, while for EURGBP, it is $0.12, and for USDJPY, it is $0.08.

The standard lot size forex is one lot, equal to 100,000 units or $10 per pip gain.

How Much is 0.1 Lot Size in Dollars?

The 0.1 lot size for a currency pair where the secondary currency is USD is always $1. However, to calculate other currency pairs’ lot sizes in dollars, you must use the formula (1 pip/exchange rate)* lot size. In this case, the 0.01 lot size for EURUSD is $1, while for EURGBP, it is $1.2, and for USDJPY, it is $0.8.

Please read my article on how to calculate 0.1 lot size in dollars.

How Much is 1 Lot Size in Dollars?

One lot size for a currency pair where the secondary currency is USD is always $10. However, to calculate other currency pairs’ lot sizes in dollars, you must use the formula (1 pip/exchange rate)* loone size. In this case, one lot of EURUSD is $ile for EURGBP, and for USDJPY, it is $8.

Below, you can see a Table of 3 types of position sizes:

Types of lot size:

- Standard Lot

- Mini-Lot

- Micro-Lot

Lot size chart forex

The lot size chart in Forex represents lot size, units, and $ per pip. As we can see, a below-standard lot has 100,000 units, a mini lot 10,000, a micro-lot 1000, and a nano-lot 100 units. These values are valid only if the secondary currency pair is USD.

Lot size value when secondary currency is USD (image above)

In the video below is a detailed explanation from our FXIGOR YouTube channel:

This methodology can be extended further.

For example, what is a 1.00 lot in forex?

1.00 lot is a measurement of currency units that traders will buy or sell during trading, and the standard size for a lot is For000 units. So, for example, if trada ten-pipse EURUSD, ten pips gain for one lot size can generate a profit of $100.

Micro lot forex

Micro lot forex size represents 1000 trading units or 0.01 lot size and the smallest block of currency a forex trader can trade. In that case, the 0.01 lot size profit is $1 for every 10 pips moving toward a trading position, and the seconForrrency is USD. For example, if a trader trades 1 micro lot (0.01 lot) and buys EURUSD at 1.2340, if the price hits the target of 1.2350, the profit will be $1.

For example, when a trader trades one micro lot, 0.01 of a standard lot, and buys EURUSD at 1.2340, they essentially trade 1,000 units of the Euro. If the price moves favorably and reaches a target of 1.2350, this 10 pip movement translates into a profit of $1. This profit calculation assumes that for every 10 pip movement towards the trader’s position, with the secondary currency being USD, the profit or loss is $1 per micro lot.

This mechanism of profit calculation makes trading with micro lots particularly appealing for those looking to gain forex trading experience without exposing themselves to the higher risks associated with larger lot sizes. It allows traders to fine-tune their risk management strategies, maximizing their potential returns while minimizing losses. Trading in micro-lots helps manage financial risk and provides a practical learning curve for understanding market movements and how different factors influence currency prices.

Mini lot forex

The mini lot forex size represents 10.000 trading units or 0.1 lot size, and it is the most common lot size in forex mini accounts that beginner traders usually use. In that case, 0.1 lot size profit is $10 for every 10 pips moving toward a trading position when the secondaForency is USD. For example, if a trader trades 1 mini lot (0.1 lot) and buys EURUSD at 1.2340, if the price hits the target of 1.2350, the profit will be $10.

Take, for instance, a scenario where a trader buys EURUSD at 1.2340 with a 1 mini lot position. If the trader’s market prediction is accurate and the price moves to 1.2350, achieving the targeted 10 pip increase, the result is a tidy $10 profit. This straightforward calculation allows efficient strategizing around specific pip movements and potential profit targets.

Standard lot forex

Standard lot forex size represents 100.000 trading units or 1 lot size, and it is the standard size in forex trading accounts that professional traders use. In that case, the 1 lot size profit is $100 for every 10 pips moving toward a trading position, and the seconForrrency is USD. For example, if a trader trades 1 lot and buys EURUSD at 1.2340, if the price hits the target of 1.2350, the profit will be $100.

Now, the most critical question:

What lot size to use in forex?

You must use a properly defined lot size based on your available portfolio balance, risk preference, and past performance. Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and stop loss and a dollar per pip. In the last step, a trader must determine the lot size (number of units) for currency pairs.

Read more in our article: How do you calculate lot size in forex?