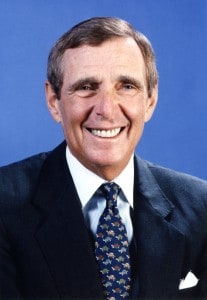

Canadian David Dreman was born in 1936 in Winnipeg, Manitoba. He had worked for companies such are Rauscher Pierce Refsnes Securities Corp., J&W Seligman, Value Line Investment Service, The Journal of Psychology and Financial Markets, International Foundation for Research in Experimental Economics (IFREE), and Dreman Value Management, L.L.C. His name is mostly known for his classic book “Contrarian Investment Strategy: The Psychology of Stock Market Success,” published in 1980. It is a book about investment, and every investor during the ’80s and forwards who are known for any success has probably read the “Contrarian Investment Strategy.”

Canadian David Dreman was born in 1936 in Winnipeg, Manitoba. He had worked for companies such are Rauscher Pierce Refsnes Securities Corp., J&W Seligman, Value Line Investment Service, The Journal of Psychology and Financial Markets, International Foundation for Research in Experimental Economics (IFREE), and Dreman Value Management, L.L.C. His name is mostly known for his classic book “Contrarian Investment Strategy: The Psychology of Stock Market Success,” published in 1980. It is a book about investment, and every investor during the ’80s and forwards who are known for any success has probably read the “Contrarian Investment Strategy.”

David Dreman has written numerous articles in different scholarly investment articles infamous economic journals such are the “Financial Journal,” Journal of Investing and “The Journal of Financial Behavior.” Readers of Forbes magazine have known him for his columns that he has written for more than two decades. In 1958, he graduated from the University of Manitoba in Canada, after which he became a research director at Rauscher Pierce. Later he worked for Seligman as a senior investment officer. After that, in 1977, at the Value Line Investment Service, he became a senior editor. That was when he was working for others and when he decided to found his own investment company where he acted as the president and the chairman of the company. That was Dreman Value Management, Inc. Dreman’s method of investing is contrarian investing. But he saw many hard times coming to that.

David Dreman stock picks a contrarian investment strategy.

Contrarian investing capitalizes on the emotional, knee-jerk reactions that make unpopular stocks underpriced so an investor is poised to benefit from upside should a business meet or exceed expectations.

Step 1: Find undervalued companies. The stock needs to be in the bottom 20 percent of the market for at least two of the below four ratios.

Step 2: Company stock must be among the 1,500 largest companies in the market because Dreman believed that larger firms are more in the public eye.

Step 3: Company stock needs to be in a rising trend in earnings, so our model requires earnings in the most recent quarter to exceed those of the prior quarter.

Step 4: Current company ratio that is either higher than 2.0 or higher than the industry average.

Step 5: The payout ratio of stock needs to be: Current payout ratios need to be lower, on average, than in the past.

Step 6: Return-on-equity needs to be above 27 percent.

Step 7: Pre-tax profit margins: need to be at least 8 percent because that can be indicated as a strong business.

Step 8: Yield of at least 1 percentage point higher than that of the Dow Jones Industrial Average.

Step 9: Stock needs to have a debt-equity ratio of less than 20 percent.

This is the idea of how we can use the Contrarian investment strategy by David Dreman to pick stocks.

When he was a junior analyst back in 1969, Dreman was only following a majority of investors as the stocks with minimal earnings turned over and became worthy. He lost three-quarters of his net worth by following the majority, which taught him to psychoanalyze investor behavior after becoming a contrarian investor. For him, the most important factor in the market is psychology. He is strict with his discipline, and that is a part of his success. He explains that he buys stocks when they are battered. He buys stocks that have a low ratio of costs-earnings. The analysis shows that buying stocks with low selling value in the long term is better. Patience is, for him, the main asset in terms of investing and dealing with your stocks. His famous “If you have good stocks and you really know them, you’ll make money if you’re patient over three years or more” quote is what his style of investment is determined by. He is well known for his publications. The “Contrarian Investment Strategy: The Psychology of Stock Market Success” published in 1980 gained huge success and is a part of every investor’s elementary literature. “The New Contrarian Investment Strategy” and “Contrarian Investment Strategies: The Next Generation” are also the titles that gain popularity in the world of investing.

David Dreman Quotes:

Patience is a crucial but rare investment commodity.

Graham’s observations that investors pay too much for trendy, fashionable stocks and too little for companies that are out-of-favor, was on the money… Why does this profitability discrepancy persist? Because emotion favors the premium-priced stocks. They are fashionable. They are hot. They make great cocktail party chatter. There is an impressive and growing body of evidence demonstrating that investors and speculators don’t necessarily learn from experience. Emotion overrides logic time after time.

When advisors go one way, markets go the other.

Ingesting large amounts of investment information can lead to worse rather than better decisions.

Volatility is no risk. Avoid investment advice based on volatility.

I buy stocks when they are really battered.

If contrarian strategies work so well, why aren’t they more widely followed?… It is not enough to have winning methods, we must be able to use them. It sounds almost simplistic, but it isn’t.

Positive and negative surprises affect ‘best’ and ‘worst’ stocks in a diametrically opposite manner.

It’s very hard to go against the crowd. Even if you’ve done it most of your life, it still jolts you.

Favored stocks underperform the market, while out-of-favor companies outperform the market, but the reappraisal often happens slowly, even glacially.

Getting in near the bottom and out near the top is not as easy as market timers or asset allocators would have you believe.

It is one thing to have a powerful strategy; it’s another to execute it.

David Dreman Books:

Psychology and the Stock Market: Investment Strategy Beyond Random Walk. 1977. American Management Association. ISBN 0-814-45429-1.

Contrarian Investment Strategy: The Psychology of Stock Market Success. 1980. Random House. ISBN 0-394-42390-9.

The New Contrarian Investment Strategy. 1982. Random House. ISBN 0-394-52364-4.

Contrarian Investment Strategies: The Next Generation. 1998. Simon & Schuster. ISBN 0-684-81350-5.

Contrarian Investment Strategies: The Psychological Edge. 2012. Free Press. ISBN 0-743-29796-2.